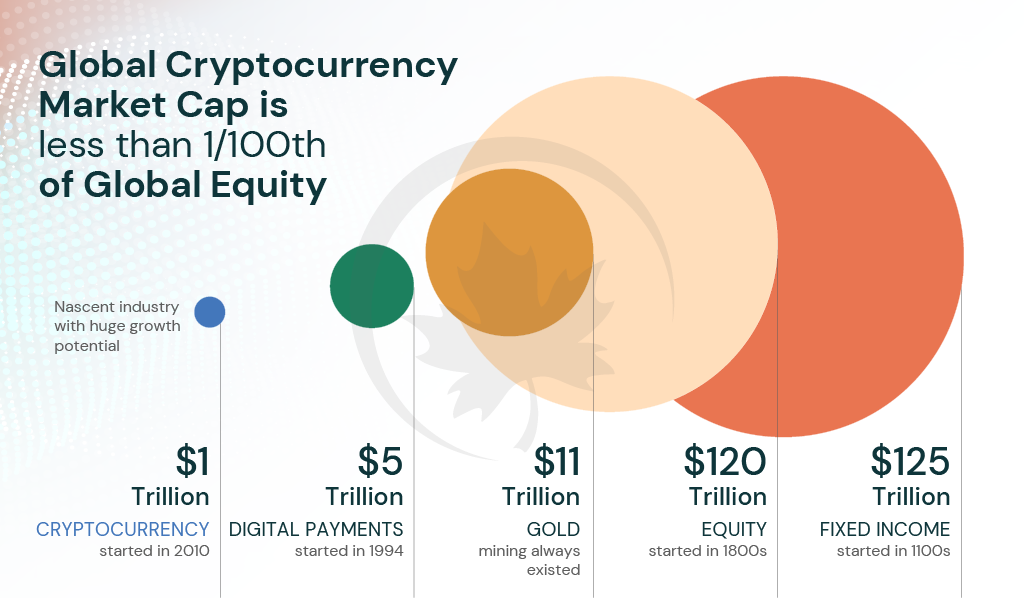

Cryptocurrencies have become a distinct factor in the global financial market, with the ecosystem growing from just a conceptualization in 2008 to a $3 trillion+ valuation in 2021. The growth of this asset class is a result of its underlying technology – Blockchain. We believe blockchain technology is the birthplace of the next stage of development in the internet age. Driven by our belief in this technology, since 2016, Mapleblock has invested in over 250 blockchain applications and layers, establishing ourselves as a strong value-add VC.

Introduction

In what might be one of the most influential papers the global economy has witnessed, Satoshi Nakamoto first proposed Bitcoin, a peer-to-peer Electronic Cash System, in 2008. Utilizing pre-existing elements of Blockchain technology and the Proof-of-Work algorithm, Nakamoto created a global payments structure that provided user anonymity and transaction transparency while eliminating the need for trust between involved parties. Bitcoin, a cryptocurrency backed by a breakthrough mechanism, emerged, setting the framework for many more. Launched in 2015, Vitalik Buterin’s Ethereum brought forth another major advancement with its smart contract functionality, enabling the development of an entire ecosystem around cryptocurrencies, essentially initiating the transition to the next generation of the internet, Web3. Cryptocurrencies have emerged as a prominent asset class, and assets have historically ascertained their values depending on supply and demand dynamics which can be erratic at times. During the 16th century, rare colored tulips became a status symbol for wealthy Dutch businessmen pushing tulip prices to new heights daily. The tulip prices later crashed, bursting the bubble and eventually being called “Tulipmania.” Multiple instances of hyperinflation and dubious financial products have been observed across the globe. This begs the question of the reliability of different stores of value and investment vehicles. Against the prevalent perception, the utility provided cryptocurrencies and the encompassing Web3 ecosystem is real.

Data as of 12/31/2021

Why Do We Believe in Web3?

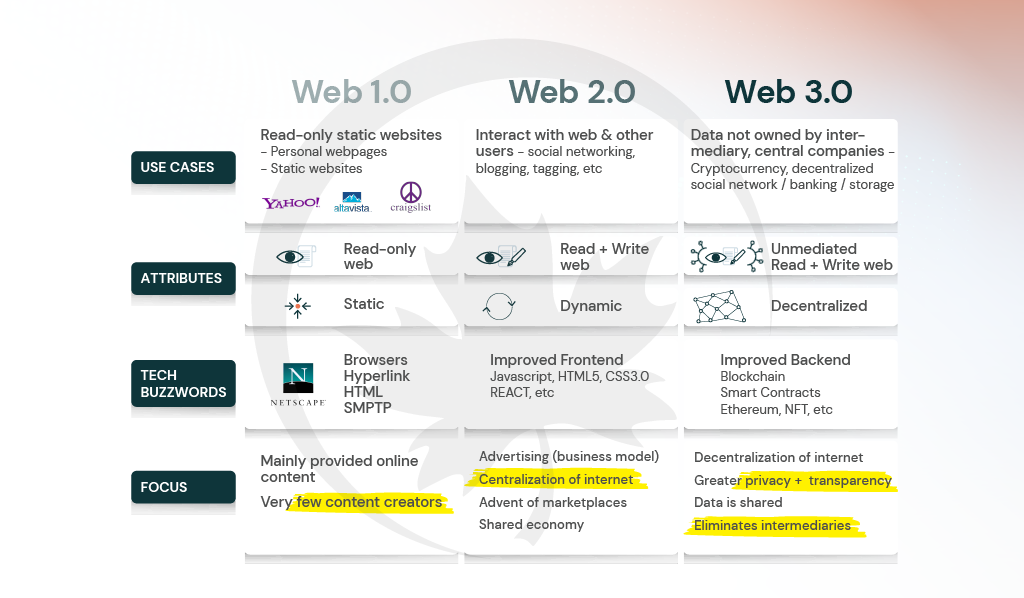

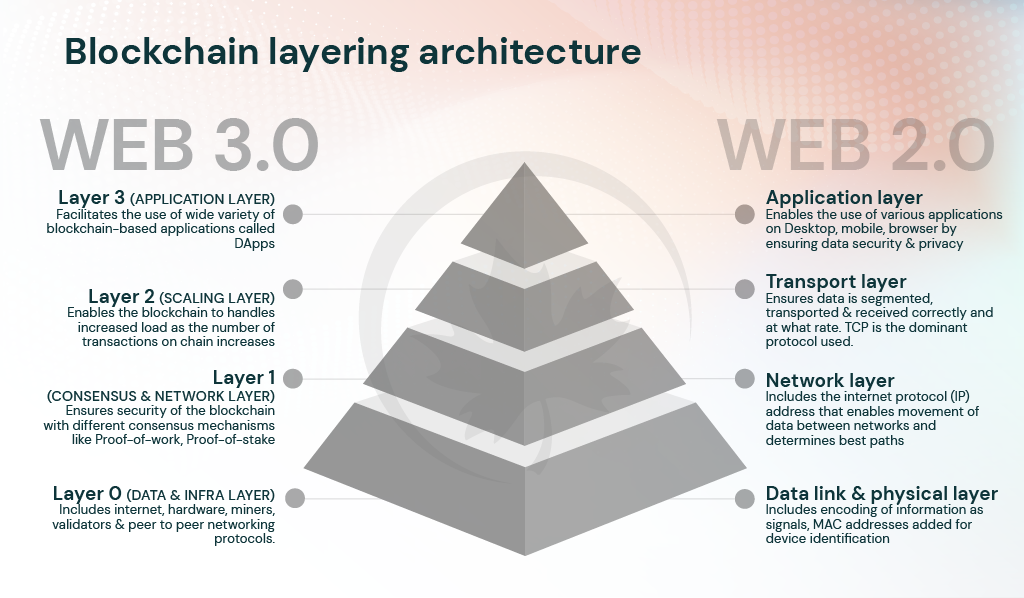

Built around cryptocurrencies, Web3 is the idea for the next iteration of the World Wide Web, and Blockchain, as the backbone of Web3, redefines the data structures the Internet is built on. It introduces a governance layer that runs on top of the current Internet, which allows for two people who do not know or trust each other to reach and settle agreements over the Web. Since the inception of the internet, we have been transitioning from different stages, starting from read-only Web 1.0 to read, write, and own Web3.

The necessity-based transition of the web

Data as of 12/31/2021

The ongoing revolution for the decentralization of the Web can be dated back to the origins of the Internet in the 1960s when the US military research department, Advanced Research Projects Agency (ARPA), aimed to establish a connected yet distributed communication network (ARPANET) impervious to a Soviet nuclear attack. ARPANET eventually evolved from a military program to an academic one connecting several national universities with connections to the Defense Department. Soon enough, several independent networks emerged, which served as the precursor to the development of TCP/IP protocols, a groundbreaking technology proposed by the future “father of the internet,” Vint Cerf, that standardized inter-network communication enabling the Internet. TCP/IP protocols induced scalability as the number of hosts on the Internet grew immensely.

Initial commercialization prospects of the Internet in the early 1980s suffered from the unavailability of information and training as vendors disregarded the TCP/IP technology. This perception was changed only after years of conferences, workshops, and tutorials. Eventually, the Internet touched everyone from schools to businesses as Tim Berners Lee’s World Wide Web, a global hypertext system, arrived, meliorating the most basic operations people could think of. Societal expectations grew immensely, instilling a euphoric attitude toward the Internet, but in the latter half of the 1990s, these expectations became unrealistic.

Riding the bull run of 1995, people invested in exorbitantly overvalued internet companies with weak constitutions resulting in the Dot-com bubble burst in 2000. The Dot-com crash was devastating. Retail investors had lost over $5 Trillion in the stock market. Many young workers were left unemployed. The image was grim, but while the internet investment mania disappeared, the Internet didn’t. It was the same promising technology, and companies built upon it still harbored great potential. In fact, the infrastructural and human resource development during the bull run enabled the Internet to mature, easing the deployment of novel ideas. A new breed of internet companies arrived, describing the Web as a platform emphasizing user interactivity. The terms “Web2.0” and “Social Media” were popularized as Facebook surfaced in 2004 and paved the way for a host of social platforms, such as YouTube, Reddit, and Twitter in the following years, called Mobile pocket.

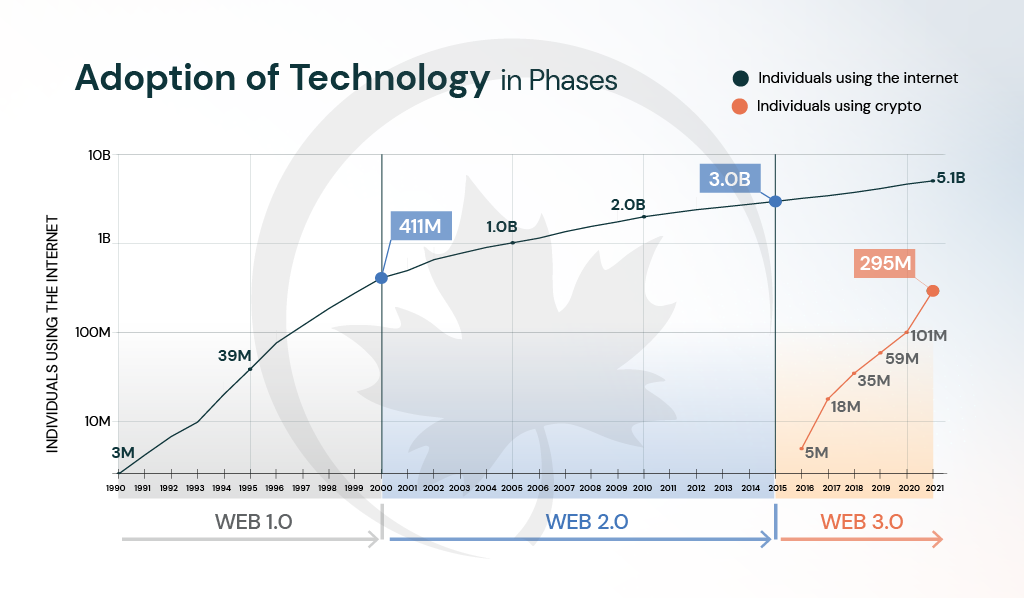

Web1 was misconstrued and unfamiliar for many initially. It then went through a period of overt financial and social exuberance followed by an equitably great plunge returning to a state of relative normalcy and eventually evolving into Web2. Web3 brings with it an equally disruptive technology, and its course so far resembles Web1’s. Every new technology, specifically Web3’s growth and future, can be modeled into three stages.

- Rejection: Incumbents associated with the existing infrastructure reject the advances of the growing technology. This is generally a stage of fear or unawareness.

- Agitation: A stage filled with confusion where some prominent institutes adopt the growing technology while others try to understand it or actively reject it. This is generally a stage of being on the sidelines.

- Acceptance: Technology becomes a part of daily life as mass adoption begins and all institutions come to embrace or get accustomed to the new norm. This is generally a stage where technology overpowers fear and confusion, and people start adopting it in their businesses and organizations while conducting a normal course of operations in a more efficient manner.

Several governments and institutions across the world banned or placed heavy restrictions on cryptocurrencies in Web3’s rejection phase. As cryptocurrencies and the Web3 ecosystem became more sophisticated, user adoption increased tremendously, and institution adoption followed suit but only in a fragmented fashion. Web3 is currently in the agitation phase, and the acceptance stage is only a few years away as crypto users multiply at a remarkable rate.

Data as of 12/31/2021

Every once in a while, there’s a technology that comes and changes everything, but it takes a few years to understand its potential. We are at the precipice of Web3 adoption, where ingenious applications capable of revolutionizing various aspects of the societal structure are being built daily.

Why Do We Believe in Web3?

1. Web3 – The Global Democracy

A plain etymological analysis of the word “democracy” implies the term’s meaning as the power to the people. It refers to a societal structure where the authority is vested equitably in its constituents, providing them freedom over their actions while emphasizing their possession without discrimination. Web2 has fallen considerably short of what one might call an ideal democracy. The ability to influence the digital ecosystem is heavily concentrated in a few corporations in the existing global scenario. A handful of winners in every technology-driven industry get away with charging unreasonable take rates or fees, as addressed publicly in the recent Apple Vs. Epic debacle. Corporate control over social media also translates into disproportionate influence over people’s digital experiences, making such platforms vulnerable to external interference, primarily from the Government. According to the Meta Transparency Center, authorities submitted 4,25,832 requests to access user data and demanded content restrictions on 7,46,000 Facebook posts in 2021. Recent years have also witnessed a stark increase in data privacy concerns as tech giants used data without user consent to perform targeted advertising and anti-competitive market practices. In the pursuit of the betterment of the state of global democracy, Web3 is the way ahead.

The new age internet – Web3 initiated a movement enabling a global-scale constitution governed by code instead of people eliminating human bias. It is built upon the shortcomings of the traditional web, and it achieves this through its five pillars:

- Identity

A person’s identity is built on the basis of privacy and authenticity. Web3 enables portability of reputation across different aspects like loan approvals, Credit ratings, etc. - Governance

The new web functions by the people, and each new upgrade is accepted as a proposal which is then voted on by the users of the network. Each member of the network has the right to participate and vote in the decision-making process. - Build

Every brick of the infrastructure is built, financed, and serviced by the members of the network. A collective architecture is built with collaboration with a common interest in mind. - Own

Each asset owned by a user comes with an in-built certification of ownership. This allows users to prove the ownership of that asset and get access to associated benefits. - Monetize

New monetization opportunities with the open web income, where you get paid for your contribution to your topics of interest. The new web functions as an open economy, rewarding users for their belief in the network.

Why Do We Believe in Web3?

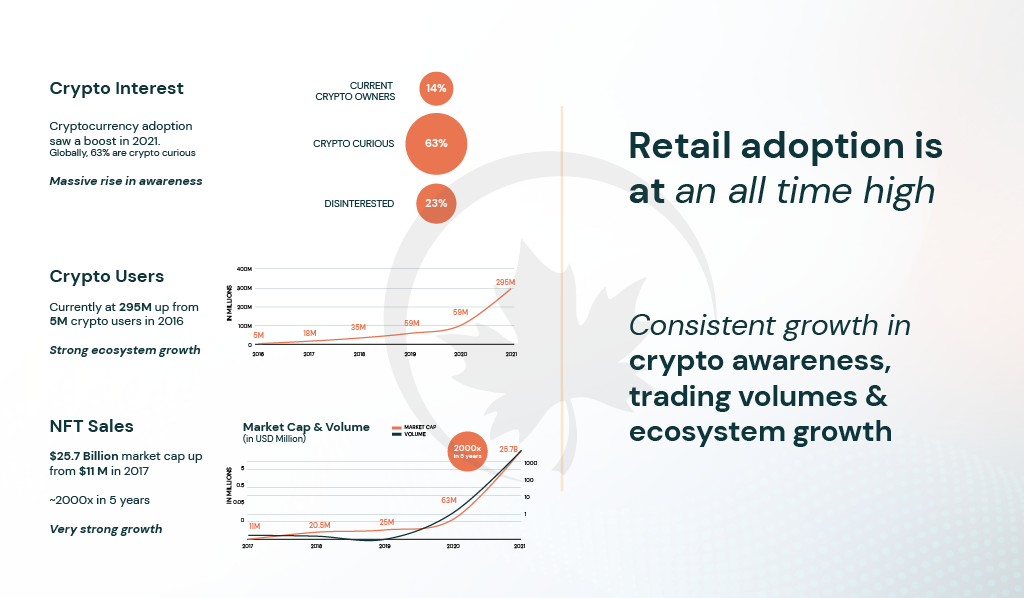

2. Retail Adoption

A technology’s use case and impact can only be observed by the increasing number of people adopting it. With average YoY growth of 43.2% observed from 2016 to June 2021, Web3 has experienced spectacular growth.

Data as of 12/31/2021

Why Do We Believe in Web3?

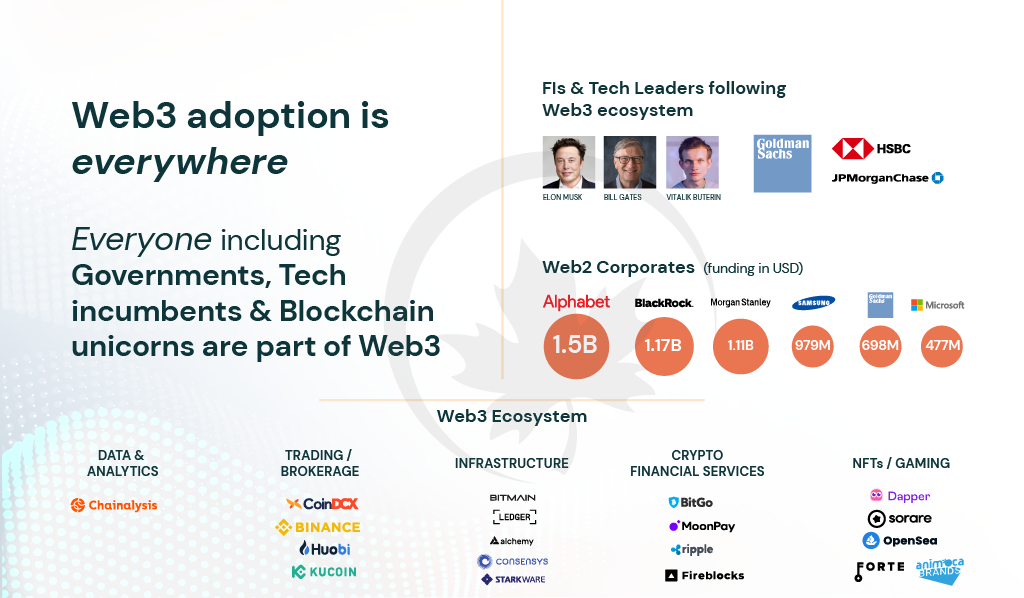

3. Enterprise Adoption

Established institutions, from multinational corporations to sovereign governments, have affirmed the benefits of blockchain technology and have brought forth incredible efforts to incorporate it into their operations.

Data as of 12/31/2021

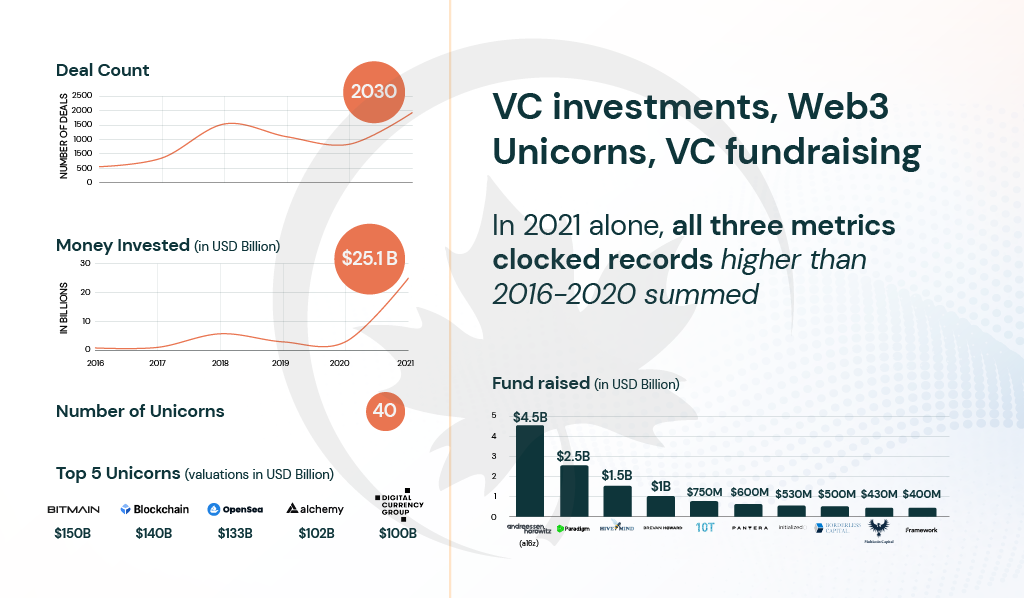

Many traditional VCs have also increased their research into cryptocurrencies and created new funds targeting the Web3 space. Previously sitting on the sidelines, industry bigwigs such as Tiger Global and Sequoia are also dabbling in the Web3 space. According to Pitchbook, VCs deployed ~$30bn across 1250+ projects in the Web3 domain during 2021. Out of these, 65+ startups reached a valuation of $1bn, and ~50 crypto startups raised $100mn+ in funding during 2021.

Data as of 12/31/2021

Why Do We Believe in Web3?

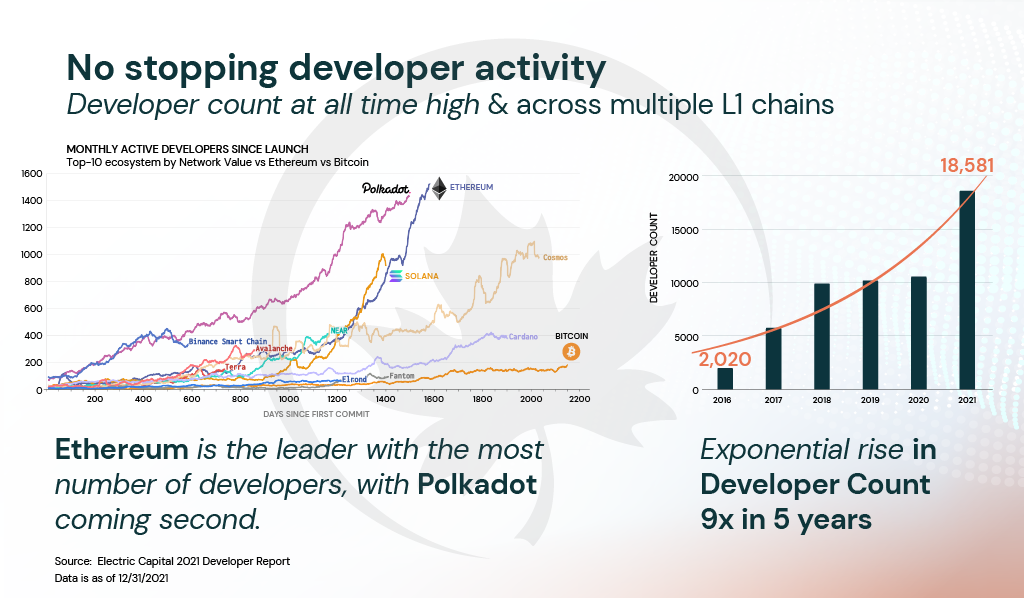

4. Developer Activity

While the current Web3 developer ecosystem is notably minuscule compared to Web2, it has still registered incredible growth in recent years. The promise of Web3, along with excellent incentives and growth opportunities, has initiated the dev migration. A stack overflow survey states among developers who know what Web3 is, over 40% believe that it is the future of the Internet. Multiple robust networks have made it simpler for devs to procure grants to build and actualize their vision through protocols, decreasing the barrier for providing services and developing products. This creative liberty is unique to Web3 and has allowed prolific devs to achieve extraordinary feats. According to the Electric Capital 2021 report, less than 1,000 full-time developers are responsible for billions of dollars in DeFi TVL.

Ingredients of Web3

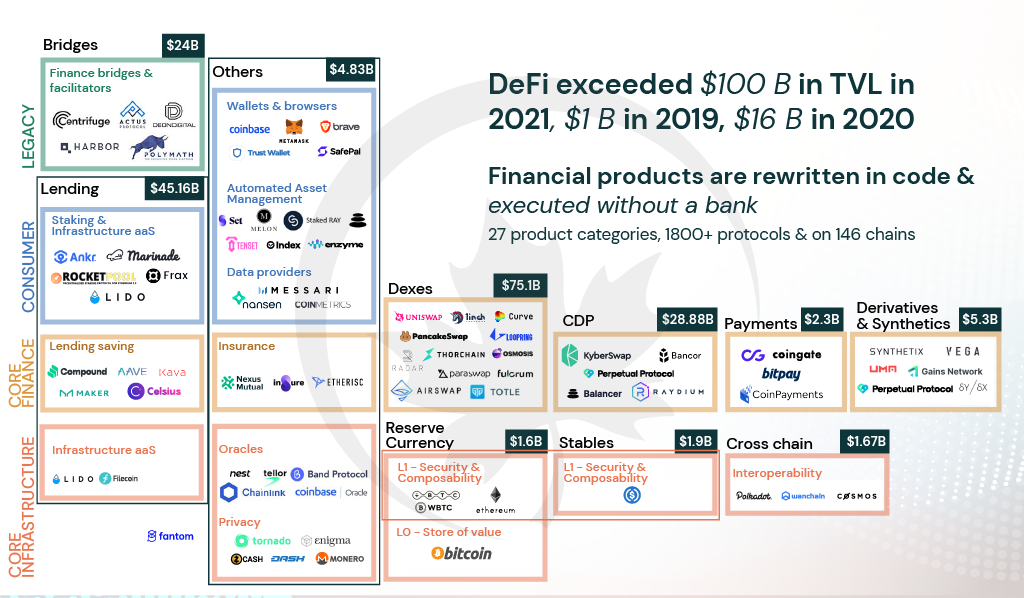

1. DeFi

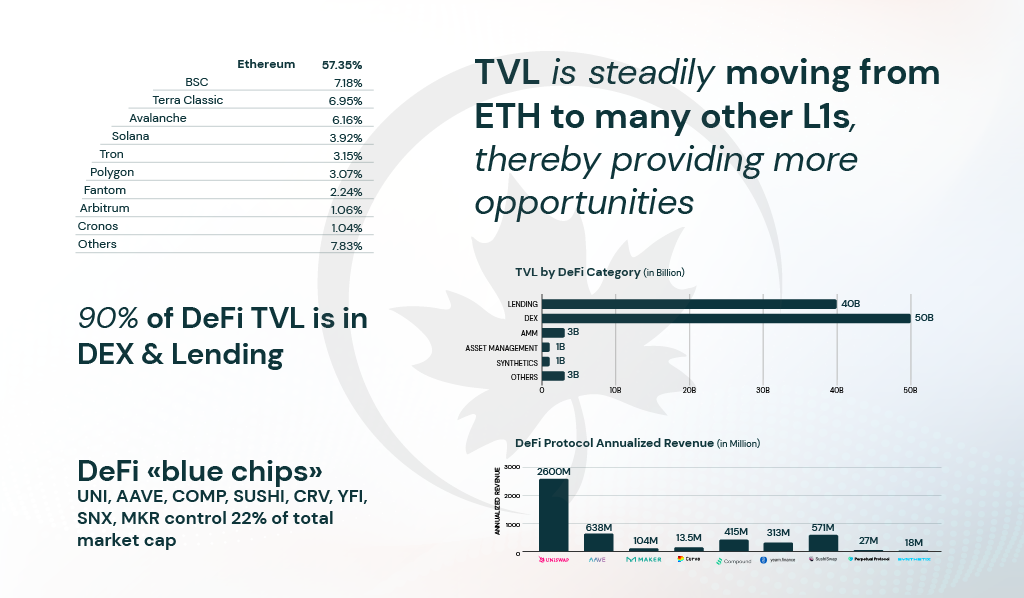

Defi can be considered as the primary use case of blockchain technology. It aims to reshape the multi-trillion dollar global banking industry to create a modern internet-native financial ecosystem with greater reach and minimal friction. DeFi has introduced several ingenious products revolutionizing fundamental aspects of the financial services industry, including but not limited to exchanges, credit, and insurance, and has witnessed meteoric growth in various financial services sub-domains within a few years.

Data as of 12/31/2021

While Ethereum continues to maintain its dominant position, which has been the case since the very conception of DeFi, multiple blockchain networks have emerged within the space. The proponents of DeFi now envision a multi-chain future, a stark contrast to the pre-existing zero-sum game outlook. This transition has also brought forth several different Layer 0, 1, 2, and middle-ware chains, some of which are focused on DeFi. Several core infrastructural solutions with diverse architectures based on multiple programming languages have emerged, attracting a wider audience and augmenting DeFi functionality, usability, and scalability.

To optimize the full use of multi-chain functionality and provide a one-stop solution to users, equally robust cross-chain solutions are required. To achieve this, a blockchain network should be able to communicate with other blockchains to promote information sharing and ease asset transfer across the different ecosystems. It allows users to safeguard their assets as and where they desire. This will also allow users to maximize their yields at a convenient cost and almost in a matter of no time. A wide array of technologies, such as relay-based bridging protocols and P2P networks for secure atomic swaps, each with different positions in the interoperability trilemma, have emerged in cross-chain space where the degree of sophistication grows every day. The growth of the sub-domain also has fueled interest in cross-chain staking enabling DeFi enthusiasts to reap the rewards from multiple networks. As new protocols are being developed every day, we will witness much better security and efficiency in years to come.

Data as of 12/31/2021

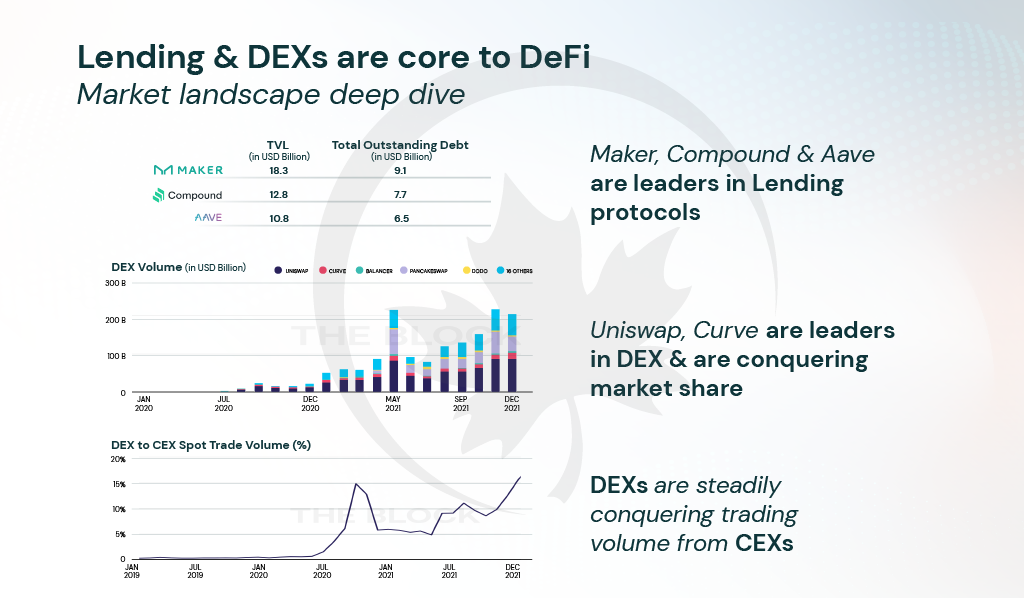

a. DEXs and Lending Protocols

At the forefront of DeFi adoption, DEXs, and Lending protocols are the powerhouses behind DeFi’s incredible growth. Revolutionizing the basic tenets of the financial services industry, these protocols are fundamentally different from their TradFi counterparts. While banks determine the interest rate charged to borrowers after assessing creditworthiness and extract revenue from the spread between interest rates paid and received from lenders and borrowers, DeFi credit protocols work on an entirely different principle where interest rates are primarily determined by the ratio of supplied or borrowed tokens in a particular market, eliminating intermediaries’ fees and widening the spectrum of people who can leverage these services. Another testament to the constant innovation DeFi brings to the financial sector is the development of liquidity pools and Automated Market Makers (AMMs) as the underlying mechanism for exchanges as opposed to the traditional order book method. DEX industry leader Uniswap has already surpassed $1 trillion in cumulative trading volume.

Data as of 12/31/2021

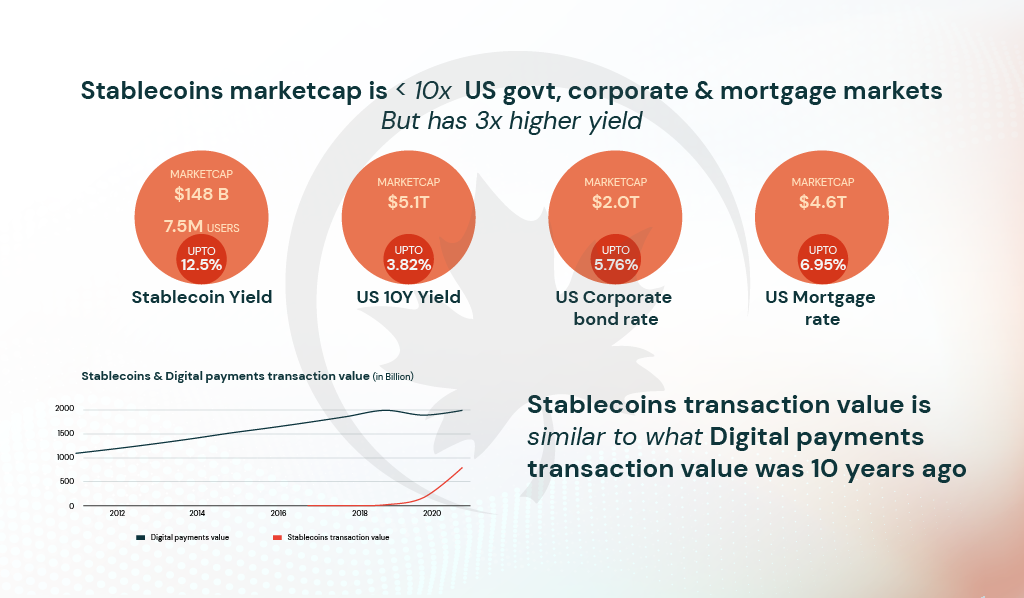

b. Stablecoins

Arguably the most important invention in the Web3 ecosystem, Stablecoins are specialized cryptocurrencies that are expected to be pegged to fiat currencies. First, Stablecoin emerged in 2014 as BitUSD, which was issued on the BitShares Network, collateralized by the BitShares token, $BTS. The crypto-backed stablecoin was unpegged in 2018, but it successfully popularized the field. Tether, in 2015, introduced the first stablecoin collateralized by fiat and other money market assets, and the project took off, becoming one of the most recognizable names in the industry. Subsequent years also witnessed the growth of algorithmic and fractional stablecoins. While still minuscule compared to the fiat in circulation, the USD-pegged stablecoin supply has increased rapidly in recent years. Currently, Tether USD ($USDT) and USDC Coin are the largest stablecoins in circulation, but these stablecoins are centralized as they are issued by a single authority and thus require approval from respective regulatory authorities as the ecosystem expands. The fourth-largest stablecoin by circulation, DAI Token issued by MakerDAO is the most prominent asset-backed decentralized stablecoin at the moment.

It’s difficult to ignore the promise of stablecoins as a secure, low-cost, and globally accepted payment infrastructure, and this is valid for small businesses and large corporate institutions alike. According to a 2021 Deloitte retail executives survey, 87% of respondents stated that accepting digital currencies provides a competitive advantage in the market, and nearly 75% plan to accept stablecoin payments in the next 24 months. International bodies such as the Committee on Payment and Market Infrastructures (CPMI) and the Financial Stability Board (FSB) are entertaining the possibility of using Stablecoin arrangements to facilitate cross-border transactions. A very promising trajectory lies ahead for stablecoin adoption.

Existing and new Stablecoins to come are prone to regulatory approvals, as the case may be. Also, Stablecoins that are not pegged to real fiat currency are developing a more robust technology and environment to avoid risks that users faced during the Terra (Luna) crash.

Data as of 12/31/2021

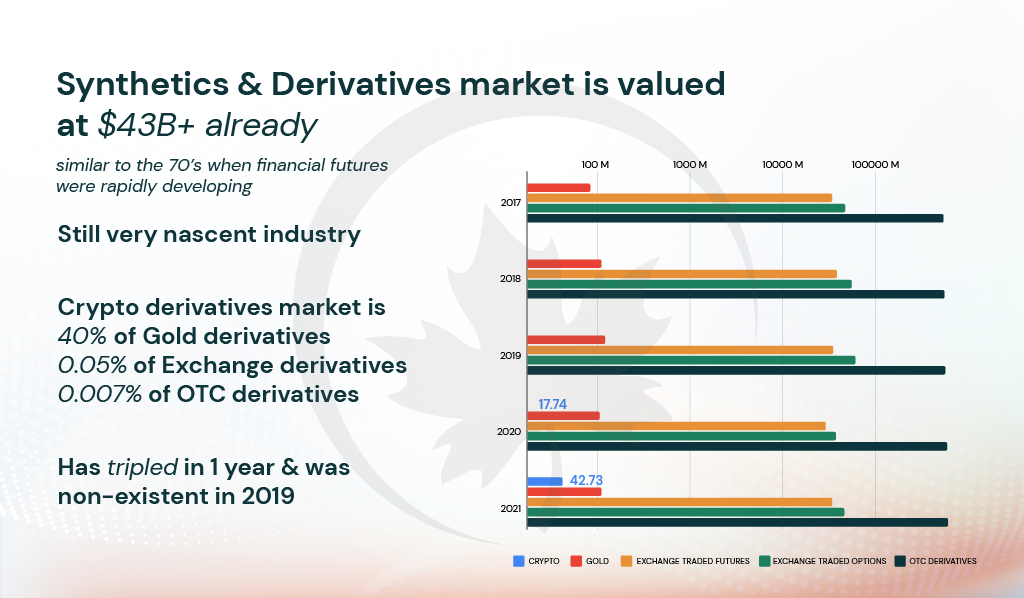

c. Derivatives and Synthetics

DeFi is still nascent, but with time and efforts in financial engineering, advanced products could bring a significant upsurge in retail and institutional acceptance. Derivatives and Synthetics are two fledging fields within DeFi with immense potential to accomplish the same.

Derivatives are sophisticated financial products based on securities, commodities, and real-life results or outcomes. Analogous to the TradFi world, crypto derivatives provide a means for users to modulate exposure to certain digital assets for hedging or speculation, also enabling them to conduct leveraged trades. Synthetics are an exciting subset of crypto derivatives involving the fusion of traditional financial securities such as equity or forex with DeFi to create more agnostic products. Synthetic assets are essentially tokenized derivatives that mimic the price movement of underlying assets, allowing users to transmit exposure to any asset in the world from within the crypto ecosystem through oracles.

DeFi derivatives can be very attractive for large trading firms already dabbling in complex financial products. CME, the world’s largest derivatives exchange, has been aggressively expanding its profile of crypto derivatives offerings which now include futures and options for Bitcoin and Ethereum. Industry Titans such as Blackrock have already incorporated such products into their promising assets list. As the DeFi ecosystem develops, more institutions will soon approach native crypto platforms to access derivatives.

Data as of 12/31/2021

As per a Grayscale report on DeFi, the Global Financial sector is valued at $8 Trillion, but the DeFi market capitalization share only amounted to around 1.6% as of 2021. The overall DeFi TVL is worth around 1% of US Commercial Bank deposits. There are more than 200 million crypto users worldwide, an impressive figure, but only 3.45 million users utilize DeFi services, which is negligible compared to the legacy financial services user base. DeFi is currently insignificant compared to the conventional financial services industry, but this may not be the case after a few years. DeFi has witnessed tremendous growth, and the factors that have enabled this are still in play. DeFi is still evolving rapidly as developers constantly push the boundaries experimenting with new business models, governance mechanisms, and combinations of existing protocols.

Ingredients of Web3

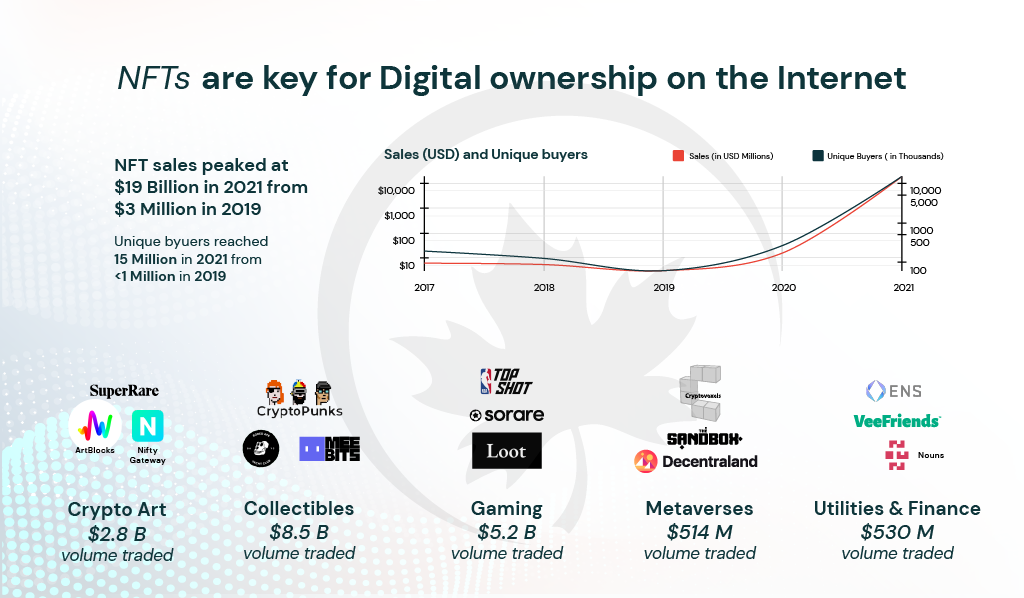

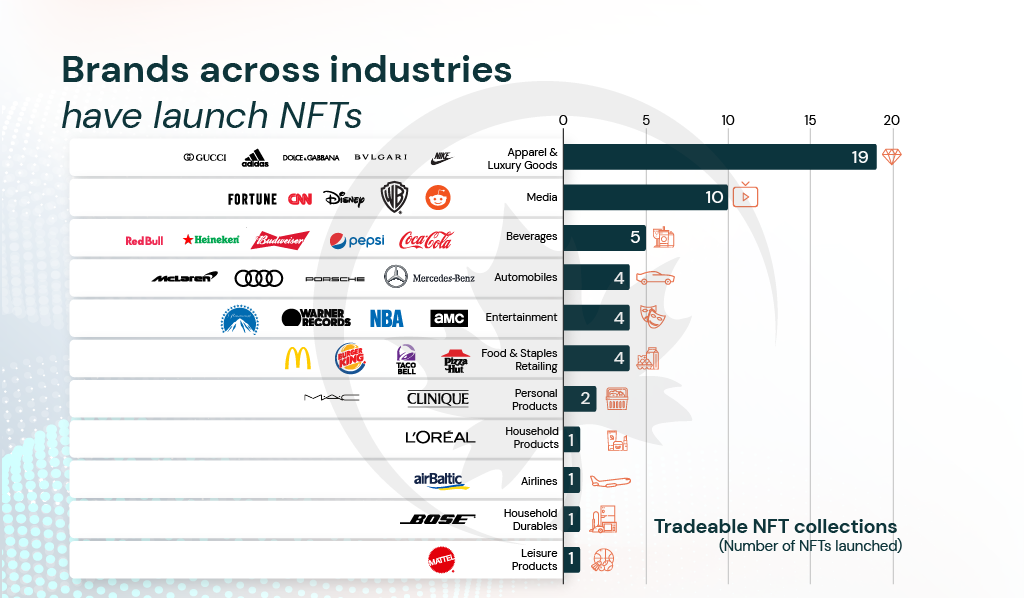

2. NFTs

Non-fungible tokens, or NFTs, are blockchain-based cryptographic assets with unique identification codes. A simple definition, but it couldn’t begin to cover the extent of effect NFTs will have on multiple industries across the global economy. Anything digital could be an NFT, music clips, art, games, or GIFs, and metadata contained by an NFT is permanent yet programmable. NFTs have evolved from static images to something which can be described as tokenized software or multimedia entities. These digital assets denoting a particular piece of data are, after all, codes running on a blockchain, providing a unique mechanism allowing the integration of various characteristics associated with the data into the assets. Another ingenious implementation of blockchain technology, NFTs have the potential to reform how the entertainment industry and numerous sub-domains within it function.

Data as of 12/31/2021

Through NFTs, music and digital artists can conveniently extract royalties from every secondary sale, while specialized tokens can enable the development of enhanced fan engagement programs. Retaining the few properties of cryptocurrencies, NFTs also place immense emphasis on ownership, granting users true control of their digital holdings. Digital collectibles and the online gaming assets market are ripe for NFT technology adoption.

Data as of 12/31/2021

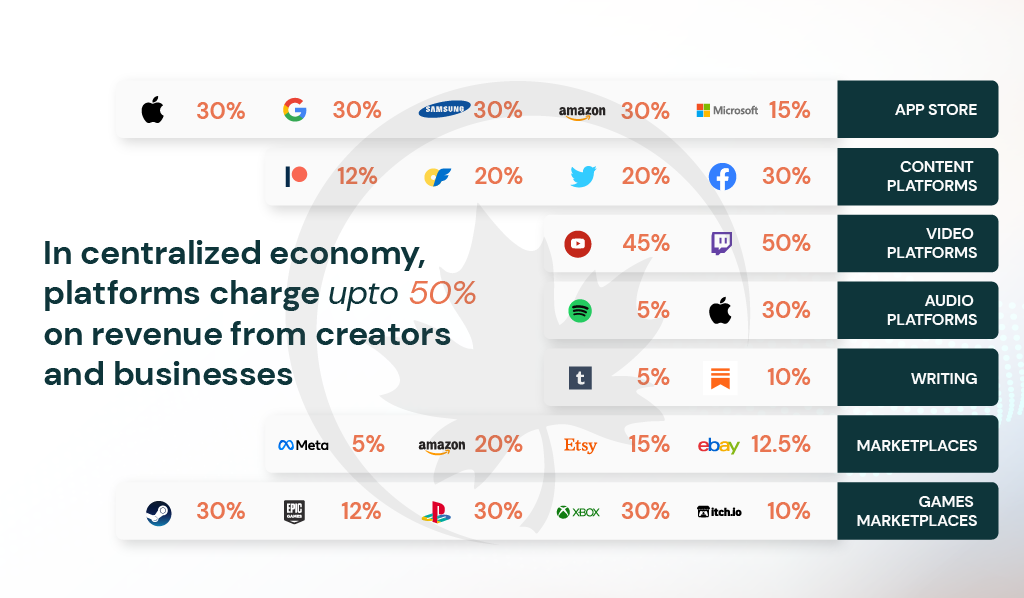

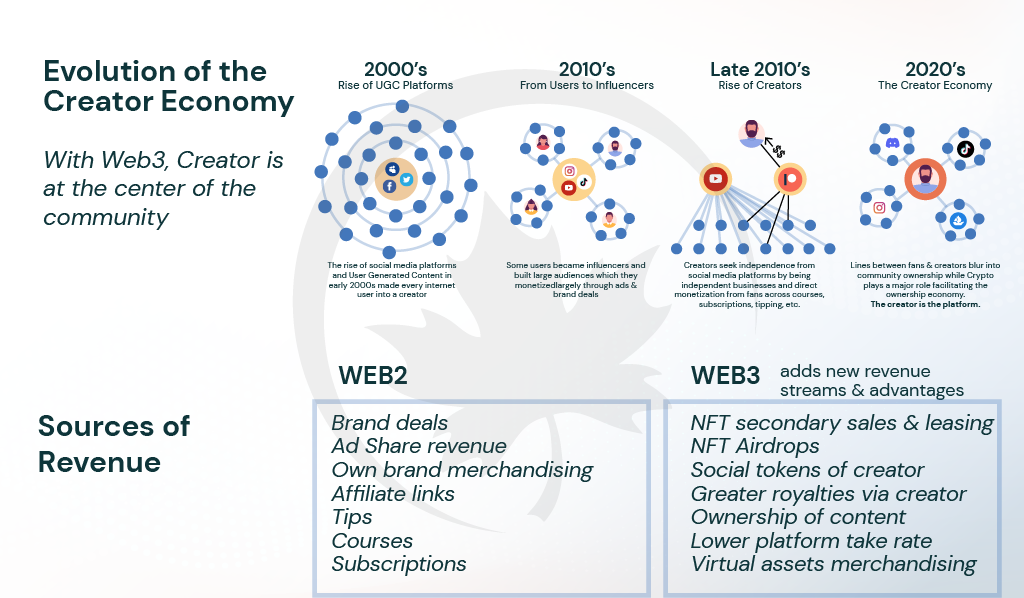

a. Creator Economy

The most profound effects of NFTs are associated with the Creator Economy. Sustained only by advertisement, merchandise, and sponsorship revenue, NFTs provide creators with a completely new array of monetization opportunities. The Creator economy already stands at an incredible $100 billion valuation, with an extremely promising trajectory ahead as more among the GenZ pursue unconventional opportunities with a greater degree of freedom as opposed to conventional 9 to 5 jobs and emphasize the shift of power dynamics away from monopolies. Web2 constructs allowed companies to charge exorbitant fees, with platforms such as YouTube, Twitch taking over half of the associated revenue. NFTs and the greater Web3 economy directly connect artists with their audience, eliminating the intermediaries and the value they take away.

Data as of 12/31/2021

While Web3 does harbor the potential to fundamentally alter the creator economy’s functioning, mass adoption still faces some challenges. Mainstream NFT marketplaces such as OpenSea still suffer from high gas fees due to Ethereum’s dominance in the domain which can be discouraging for new users. The notoriety associated with NFTs, in general, can also be problematic.

Ingredients of Web3

3. GameFi

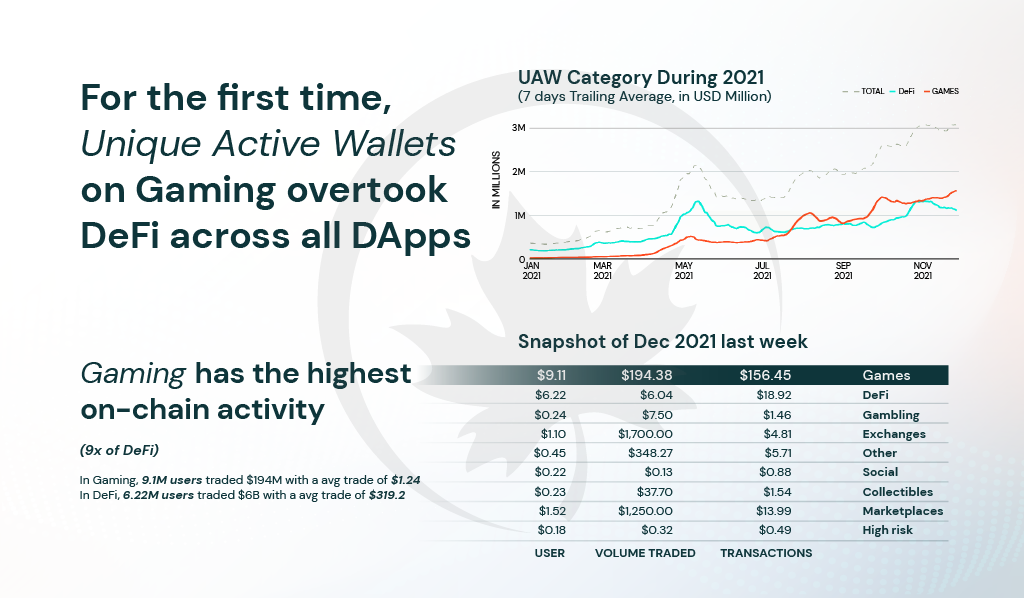

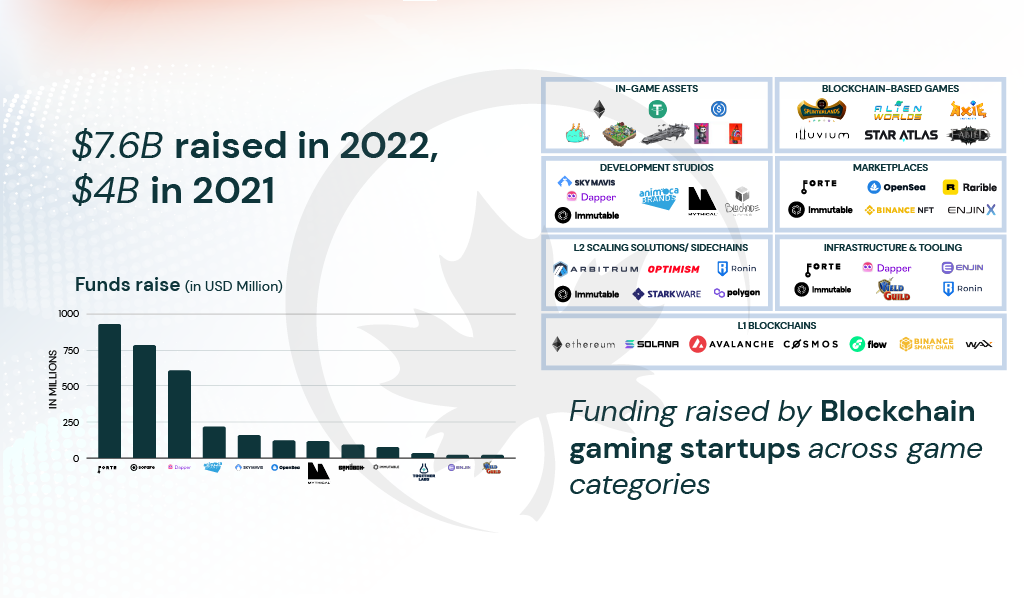

GameFi, as the name suggests, combines elements of decentralized finance with games and refers to blockchain-based games. The GameFi ecosystem, laying at the center of several emerging technologies and Web3 constructs, takes a dynamic approach to offer gamers something they have never experienced before, as users get to collect, trade, or mint NFTs as they progress through the game.

In Web2, Gamers have few means to monetize the time and efforts they invest, such as esports tournaments and streaming, but this is also limited to a few individuals. Within the Web3 ecosystem, any user can earn income through prevalent play-to-earn (P2E) models and staking and trading in-game NFT assets.

Data as of 12/31/2021

The gaming industry has witnessed tremendous growth over the years, with 2022 global revenue clocking in at over $190 billion, and GameFi could be very well seen as the future of this burgeoning industry. Currently, the GameFi ecosystem struggles with the creation of games with sustainable tokenomics and engaging mechanics as developers tend to over-fixate on the monetization aspect to attract more users. As the ecosystem matures, the involvement of experienced gaming studios will significantly elevate game development standards, opening GameFi to a greater gaming community.

Data as of 12/31/2021

Ingredients of Web3

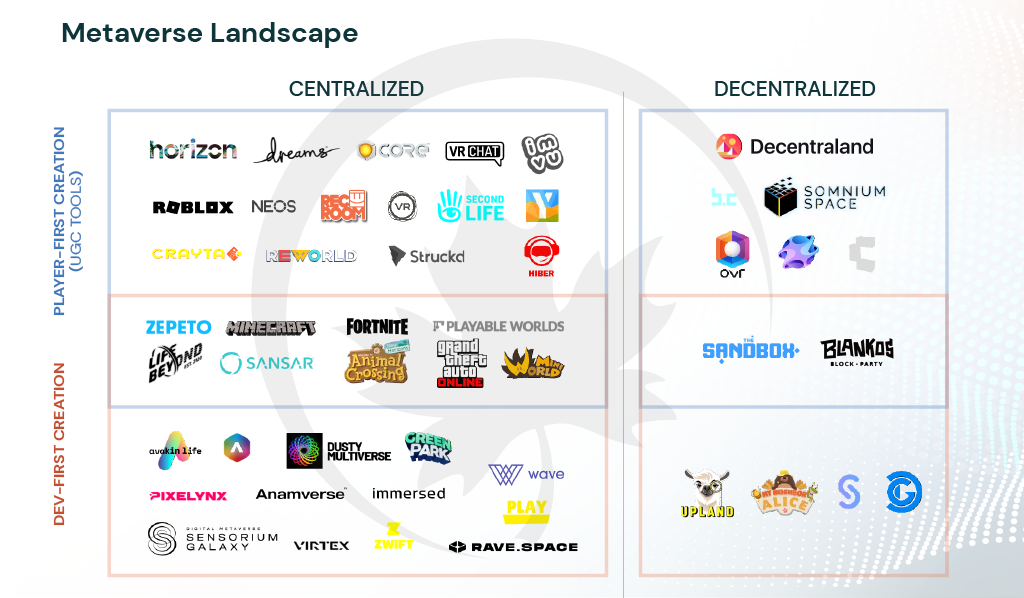

4. Metaverse

An immersive virtual space with the potential to change how the world functions, Metaverse, along with Web3, will drive the future of the Internet. Web3 and Metaverse form a symbiotic relationship as NFTs augment the infrastructure behind Metaverse, tying all objects within the virtual world to unique ownership and facilitating their transfer and exchange.

Data as of 12/31/2021

The promise of Metaverse has attracted immense institutional interest from multiple sectors, especially the entertainment and fashion industry.

Data as of 12/31/2021

Metaverse could enable entire digital economies and disrupt multiple industries, particularly the gaming industry along with GameFi, but while blockchain-based Metaverse projects such as Decentraland and Sandbox have garnered much attention in 2021 and posted exceptional growth statistics, mass adoption is still far away. A significant degree of technological advancement is still necessary to enable the seamless functioning of massive digital worlds. Simultaneously, developing cost-efficient AR/VR products is also essential to fully actualize the promise of Metaverse.

Ingredients of Web3

5. DAOs

“Law written in code followed by majority like a democracy”, this perfectly describes a DAO.

DAOs are collectives of developers, investors, and users with shared goals and interests. They function as a governing body giving the community the right to vote on any proposal. DAOs provide the necessary structure to protocols and install governance mechanisms to ensure seamless operation. Down the road, the DAO-based framework is primed to be adopted by Web2 firms, especially within the financial sector.

Data as of 12/31/2021

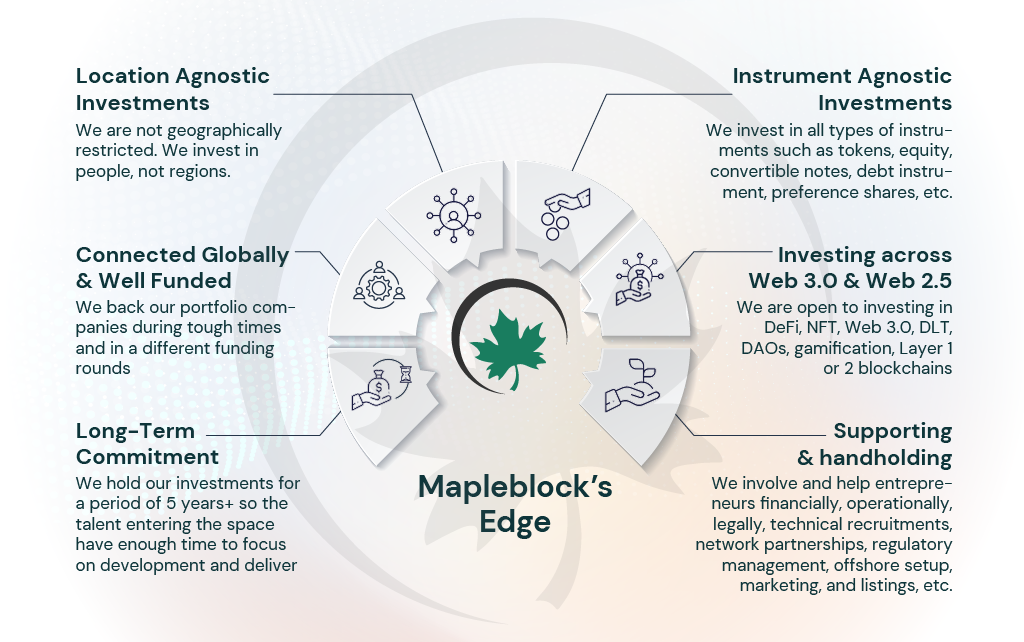

Mapleblock’s Edge and Value proposition

Six core proposition makes Mapleblock uniquely positioned to augment Web3’s next big protocol.

We have been through multiple Bull Runs and Bear Markets, giving us ample time to test our philosophy, and with each new cycle, we have seen sovereign institutions, policymakers, and major corporations changing their mindset for the positive impact on the growth of Web3.

Download the full pdf below, or preview our Thesis here: