- Introduction

- At the Outset : The Lead up to Institutional Adoption

- Bitcoin’s Potential for Portfolio Participation

- Pension Funds and Family Offices on Crypto ETFs

- Portfolio Benefits of Crypto ETFs

- Conclusion

Introduction

As the crypto bull run has allowed multiple existing and newly launched cryptocurrencies to gain strong, often lasting traction, crypto-assets are increasingly being recognized as a legitimate financial asset class. The market has experienced significant growth, with a market capitalization of approximately $2.4 trillion as of 2024, indicating that the rising acceptance and usage is headed into a favorable zone, carried on the backs of the strongly performing Bitcoin ETFs and the Ether ETF updates. Since their debut in January, Bitcoin ETFs have attracted tens of Billions of dollars of investment. In a positive addition to the same, U.S. regulators have now given final approval for spot exchange-traded funds that hold Ethereum’s ether (ETH), giving Americans access to a second major cryptocurrency via the easy-to-trade vehicles.

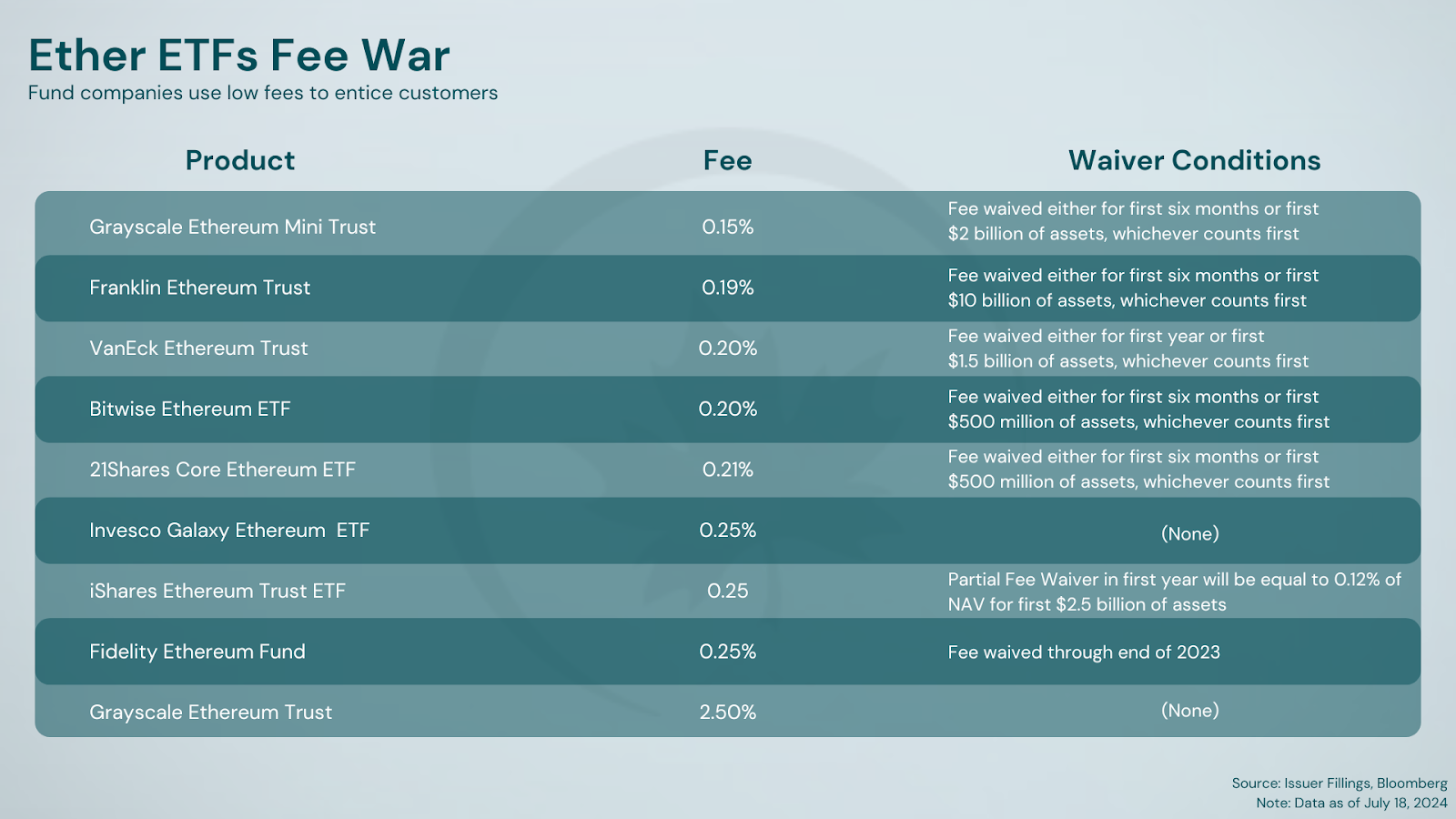

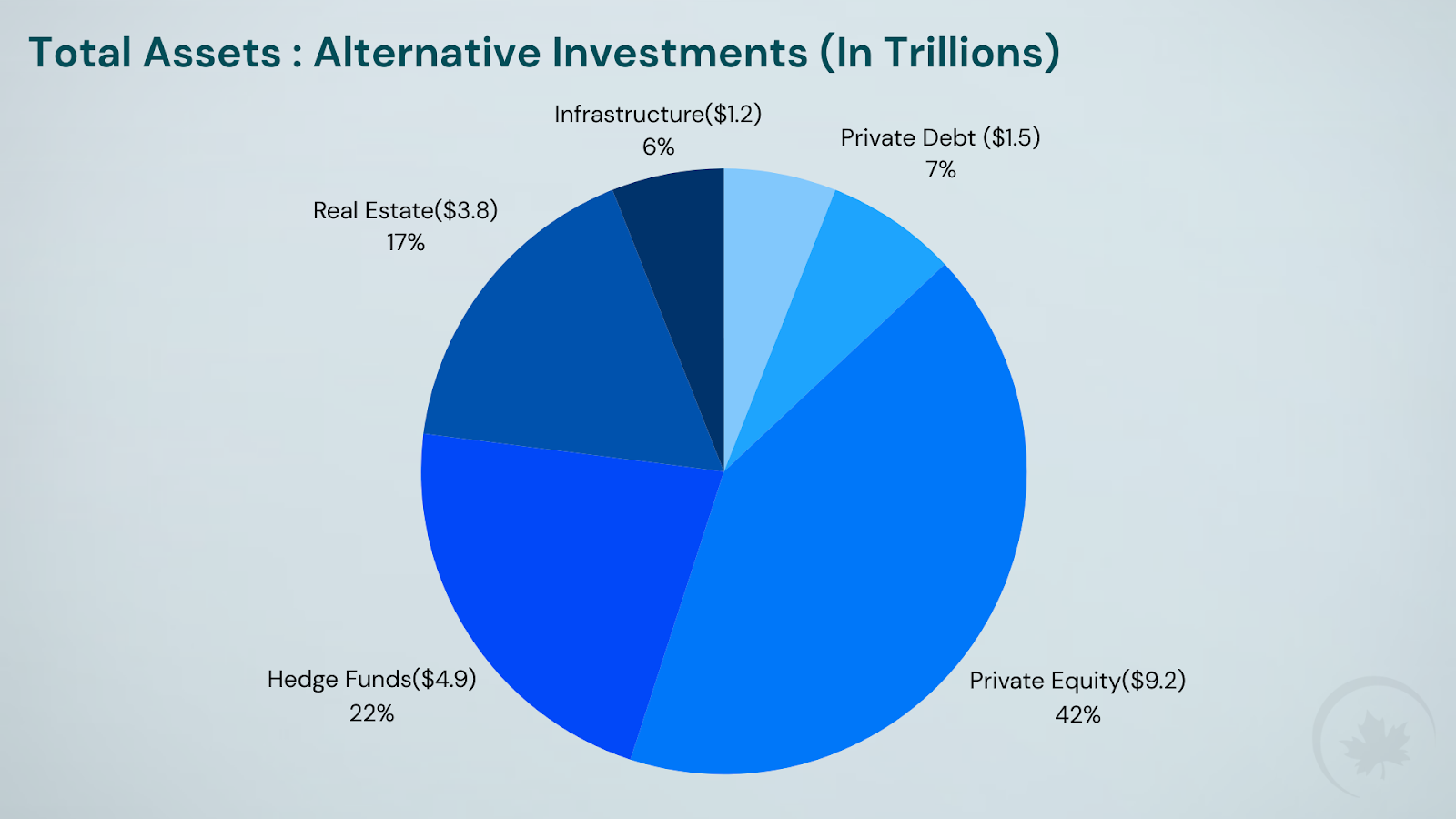

The Ether ETF approval comes roughly six months after the SEC greenlit 11 spot Bitcoin ETFs, indicating a significant regulatory shift.The first US ETFs that invest directly in Ether made strong debuts, with some seeing relatively high trading volumes for their opening sessions, with over $1 Billion worth traded between the nine exchange-traded funds. The Grayscale Ethereum Trust (ETHE) generated nearly half of the $1 Billion total volume. Other notable performers included BlackRock’s iShares Ethereum Trust and the Fidelity Ethereum Fund, which recorded $266 million and $204 million in inflows, respectively. The first day of trading for U.S. spot Ethereum ETFs saw them draw in a respectable $107 million in net inflows—a figure that was dragged down by the $484 million in outflows from Grayscale’s Ethereum Trust, repeating a pattern familiar from the launch of spot Bitcoin ETFs earlier in the year. The impact of Bitcoin ETFs on market dynamics has been profound, with estimates suggesting net inflows of $33.1 Billion by mid-2024. This surge in investment has not only driven up the price of Bitcoin but has also enhanced its legitimacy as a financial asset. Institutional investors, in particular, have shown a keen interest in Bitcoin ETFs, recognizing their potential for diversification and risk management within traditional portfolios – and the interest is wide-arrayed and has it’s own competitive diversity. Institutional market data provider Kaiko has released a report, projecting that Ethereum will outpace Bitcoin following the launch of spot Ether ETFs. The investable technology underpinning the crypto-economy is catalyzing innovation and creating entirely new investable markets. Digital assets are firmly in the alternative investment category for allocators, which is generally a catch-all for assets that are very different and less liquid than public equities and fixed income exposure. Of the projected $146.8 Trillion in investable assets by 2025 (PwC), roughly $22 Trillion of this represents alternative investments (CAIA), made up of predominantly private equity, venture capital, infrastructure, real estate and hedge funds.

At the Outset : The Lead up to Institutional Adoption

Spot Bitcoin ETFs give mainstream investors a regulated way to invest in Bitcoin through their brokerage accounts. Unlike a Bitcoin futures ETF, a spot Bitcoin ETF invests directly in bitcoins as the underlying asset. This exposure is more intuitive for investors, making spot Bitcoin ETFs more straightforward for those investing in Bitcoin. The Securities and Exchange Commission (SEC) approved the first Bitcoin spot ETFs in January 2024—three years after the first Bitcoin futures ETFs were approved. Facilitated by spot Bitcoin ETFs, enhanced liquidity could lead to more stable prices and easier price discovery in the Bitcoin market. And while spot Bitcoin ETFs could have greater expenses than other funds due to the costs associated with securing and trading cryptocurrency, they offer a host of diversification and return benefits that can prove them as being an instrumental addition to investment portfolios, not just for retail investors, but for institutional investors – pension funds, hedge funds, investment banks, asset management firms and more. The great promise of Bitcoin ETFs is that they can open the door for professional investors to buy bitcoin en masse, dramatically increasing the pool of capital investing in the asset. But a great opportunity for expansion still lies ahead because : as a percentage of total capital invested in Bitcoin ETFs, professional investors currently own just 7-10% of all assets.

The 13F filings in May of this year have revealed some very interesting trends. For example, more than 50 firms held shares in Cathie Wood’s ARK 21Shares Bitcoin ETF (ARKB) by April 2024 itself. Holders spanned far and wide from Hong Kong-based Yong Rong HK Asset Management to Sydney-based Regal Partners and Canada’s Bank of Montreal. At present, there are some very well established financial market participants that are buying Bitcoin ETFs en masse, some of which include :

Hightower Advisors, which is the second-ranked RIA firm in the U.S. according to Barron’s, managing $122 Billion in assets. Another interesting holder is Bracebridge Capital, which is a Boston-based hedge fund that manages money for Ivy League universities Yale and Princeton, among others, which reported a stake of more than $307 million in Ark’s fund and around $100 million worth of BlackRock’s iShares Bitcoin Trust (IBIT). They hold $434 Million of Bitcoin ETFs, and are at the top of this pyramid. Similarly, Brown Advisory is a $96 Billion firm based in San Francisco which currently owns $4 Million of bitcoin ETFs.

In a recent report, Goldman Sachs says institutional investors are poised to benefit from the recent approval of spot Bitcoin ETFs. There are a number of ways in which the advantages of Cryptocurrency ETFs play out for institutional investors. One key advantage of spot Bitcoin ETFs is their cost-effectiveness compared to other investment vehicles such as closed-end funds and trusts. This cost advantage stems from reduced management fees and a smaller tracking error – the discrepancy between the ETF’s performance and that of its underlying asset. Another benefit is the enhanced liquidity offered by ETFs in contrast to private funds, which often impose limitations on share transactions. This liquidity enables institutional investors to adjust their positions with greater ease and flexibility – entering and exiting positions quickly and as needed. Moreover, ETFs operate within established regulatory frameworks and adhere to standardized reporting procedures. This provides investors with an additional safeguard that isn’t available when holding Bitcoin directly: a belief that has only been expounded by blowouts like the Terra Luna and FTX mishaps.

Bitcoin’s Potential for Portfolio Participation

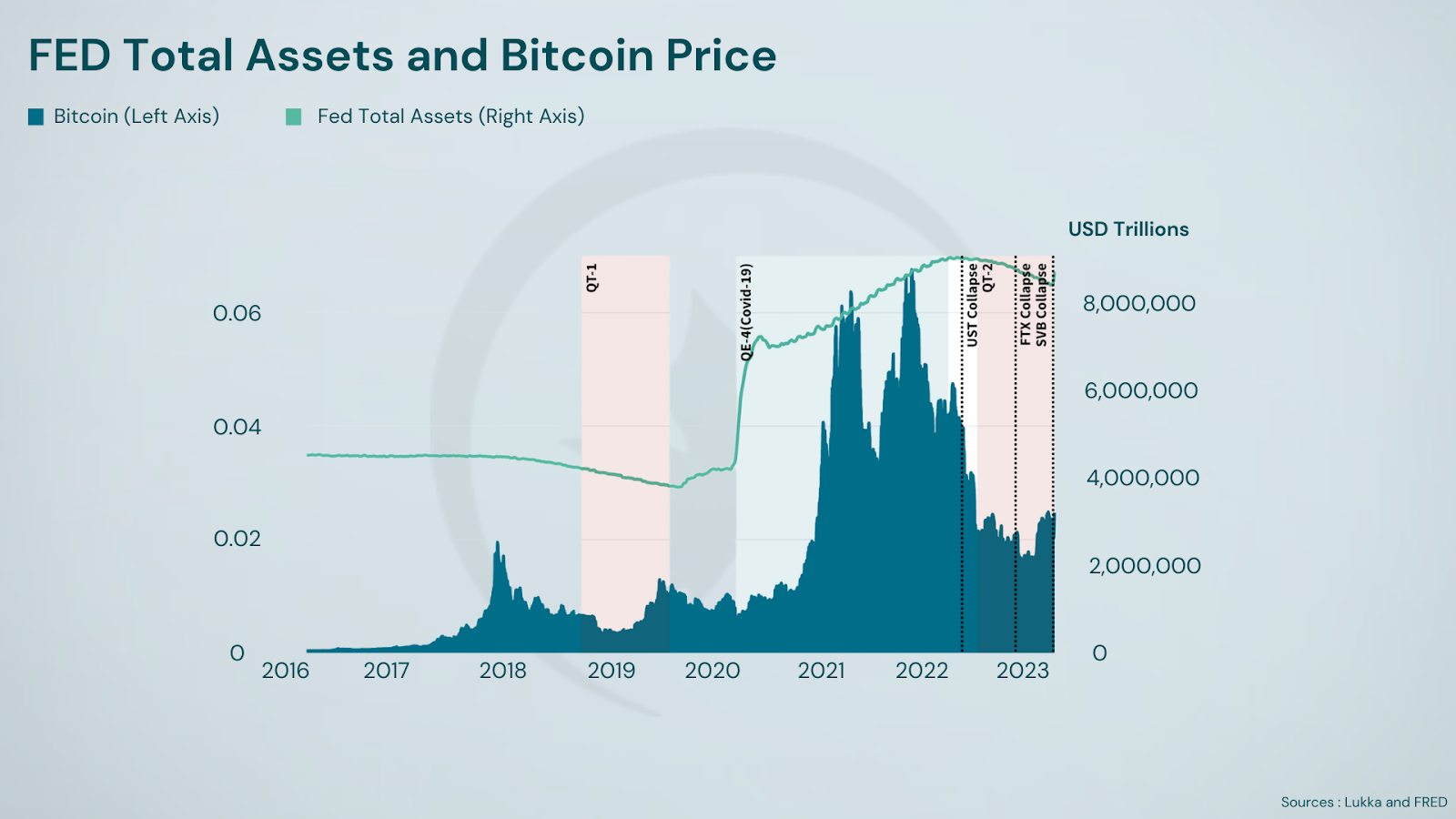

The Covid-19 pandemic saw Bitcoin’s value skyrocket by 300% in 2020, as market speculation suggested investors were flocking to the digital currency amidst low interest rates. This upward trend was partially driven by financial market participants who recognized Bitcoin’s potential as a hedge against pandemic-induced inflation, despite relatively stable inflation rates in countries like the U.S.

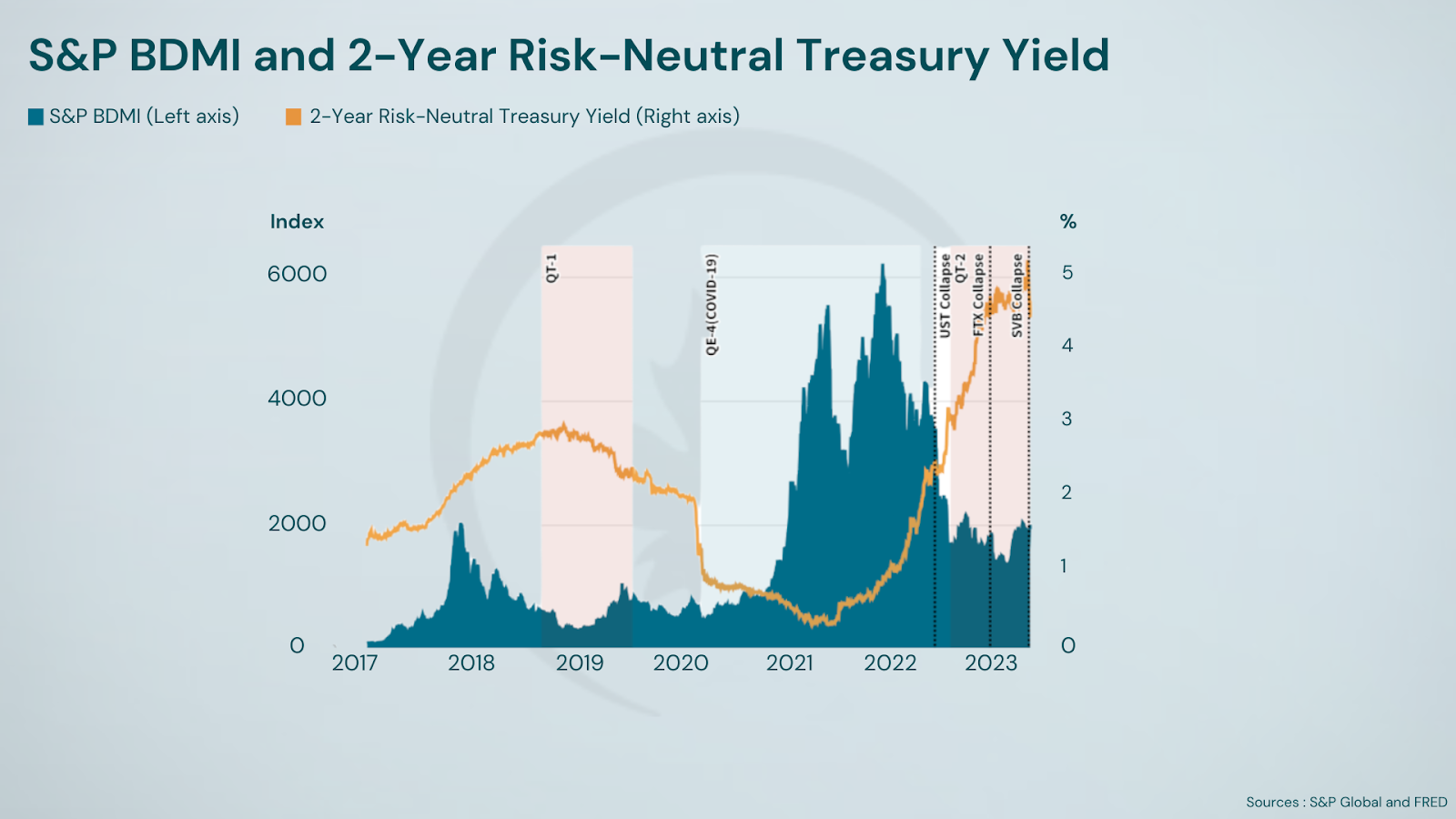

A longstanding argument posits that central banks’ money printing leads to inflation or currency devaluation over time. In contrast, cryptocurrencies like Bitcoin, with its capped supply of 21 Million coins, are designed to resist inflationary pressures. The Covid-19 pandemic, which prompted many countries to inject Trillions in stimulus packages to stabilize their economies, provided an ideal testing ground for this theory. And interesting results were borne out of the same. One of the convincing measures of proof regarding this hypothetical test’s results is the correlation (or lack thereof) between Bitcoin’s Price, and the Total Assets owned by the US Federal Reserve, and the more objective measure that is the lack of correlated trends between the S&P BDMI and the 2-Year Risk-Neutral US Treasury Yield – which is a measure of short-term confidence in macroeconomic output.

Bitcoin’s average monthly volatility exceeded that of gold, though Bitcoin’s lowest monthly volatility remained below gold’s. This heightened bullish volatility was attributed to cryptocurrencies’ perceived safe-haven status during the pandemic’s uncertain times. Consequently, investors, especially institutional investors may consider cryptocurrencies as a means to diversify their portfolio assets.

Pension Funds and Family Offices on Crypto ETFs

The narrative around bitcoin in pension funds has been largely speculative, and historically so. The history of pension funds’ investments in cryptocurrencies starts with the Fairfax County Police Officers Retirement System and the Fairfax County Employees’ Retirement System investment in Bitcoin in 2019, becoming the first public pension funds to invest in Bitcoin through a blockchain-dedicated fund. Their foray has resulted in more than a tenfold return in just under five years, but the nature and ultimate purpose of pension funds investments is such that safeguarding the deposits and minimising the downside to the greatest extent possible is not just a public opinion or even just a fiduciary principle, it is ensured by a stronghold of relevant laws to ensure the desired investor experience and outcome. In that light, pension fund managers, tasked with protecting their beneficiaries’ financial futures, have traditionally viewed the volatile cryptocurrency market with caution, seeing it as potentially incompatible with their fiduciary duties. Even though Bitcoin’s impressive climb to nearly $73,000 did catch the eye of institutional investors of this class, it is the introduction of Bitcoin ETFs really, that can be the key to unlocking pension fund participation in this market. These ETFs provide the regulatory framework and operational familiarity that pension funds require, offering a more accessible and less risky entry point into the high-potential cryptocurrency space. Through Bitcoin ETFs, pension funds can potentially benefit from cryptocurrency’s advantages, such as high returns and inflation protection, while minimizing the risks associated with direct cryptocurrency ownership. This also helps smoothen the legal and oversight wrinkles associated with the holding of cryptocurrency assets. This development could pave the way for Bitcoin to be considered a legitimate asset class within pension fund portfolios, potentially taking its place alongside established options like gold.

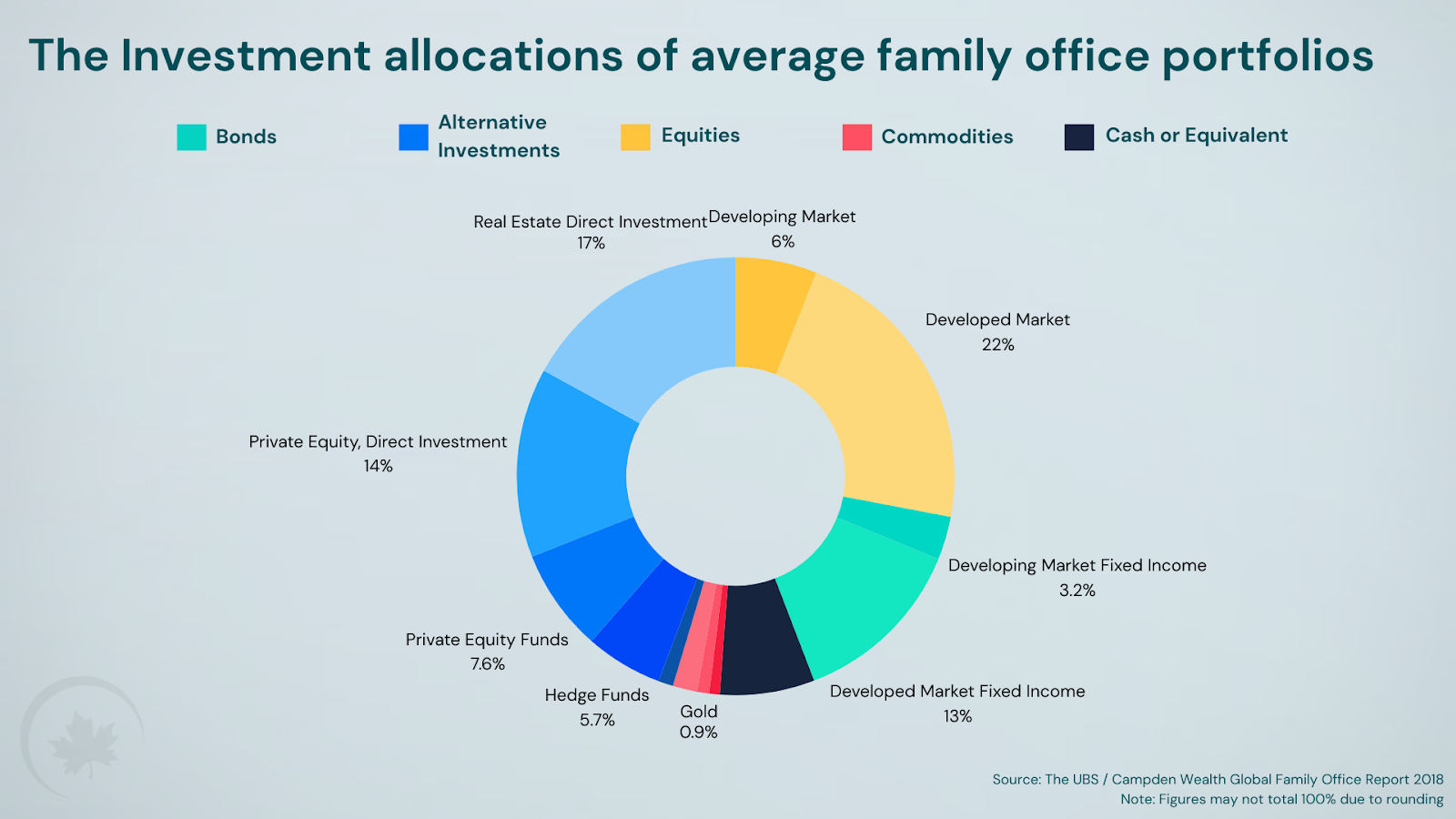

The High Net-Worth Individuals (HNIs), who have historically preferred a combination of real-estate, stock portfolios, and increasingly, ownership in other private businesses aka private equity, are also looking for opportunities to engage with the cryptocurrency markets. The interest is expanding from crypto “whales”, the vast majority of whom are Millennials, and even beyond the influential cohort of the Winklevoss twins, Mike Novogratz and Mark Cuban, to now include a lot of veteran figures on Wall Street, and the financial districts of multiple finance hubs worldwide. A lot of wealthy individuals and families who do not come from the financial business background are now more open-minded about letting these institutions invest some of their money in the leading cryptocurrency ETFs. And family offices are an ideal structure to deploy the same – throughout the years, the growth rate of the family office industry has been unprecedented due to a constant influx of newly minted Millionaires and Billionaires. Today, there are more than 10,000 operational family offices globally. Although family offices have traditionally prioritized wealth preservation via conservative investment strategies, a 2020 UBS Global Family Office Report indicates that 57% of family offices believe blockchain will transform investing strategies and behaviors in the future. The 2024 BNY Mellon Wealth Management Study reveals approximately 39% of the surveyed family offices are either actively investing in cryptocurrencies or considering them, highlighting a keen interest in this asset class. They also found that among those exploring or investing in cryptocurrencies, there is a noticeable preference for public market ETFs that include cryptocurrencies. Some family offices are making venture-style investments themselves in businesses which are developing the infrastructure around digital assets or new decentralized protocols; for example, in digital asset service providers, including exchanges, or software companies building products and services on the blockchain. Arts and antiquities happen to occupy a major chunk of the HNI and family office investment portfolio – an industry that NFTs and Tokenization of RWAs is looking to disrupt. While it is true that there will be HNIs looking to exploit the nascent stage of regulation for purposes of controversial personal benefits, the overarching effect of Bitcoin and Ether ETFs is expected to actually add more stability to this reality, as opposed to empowering miscreants – because with the vast amounts and international-scale interests coming into this ecosystem, there can now be worldwide convergence to create avenues like prudent policy and overwatch, enhance the standards and scope of forensic and AML (anti-money laundering) research and practice, and set up a global initiative to aid uniform and universal regulation standards. Leading Indian cryptocurrency exchange CoinDCX has recently launched CoinDCX Prime, which offers a personalized investment experience for High-Net-Worth Individuals (HNIs), Family Offices, and Institutional Investors with a minimum investment portfolio of INR 50 Lakhs. CoinDCX is aiming for the Prime platform to have $100 Million AUM by 2025.

Portfolio Benefits of Crypto ETFs

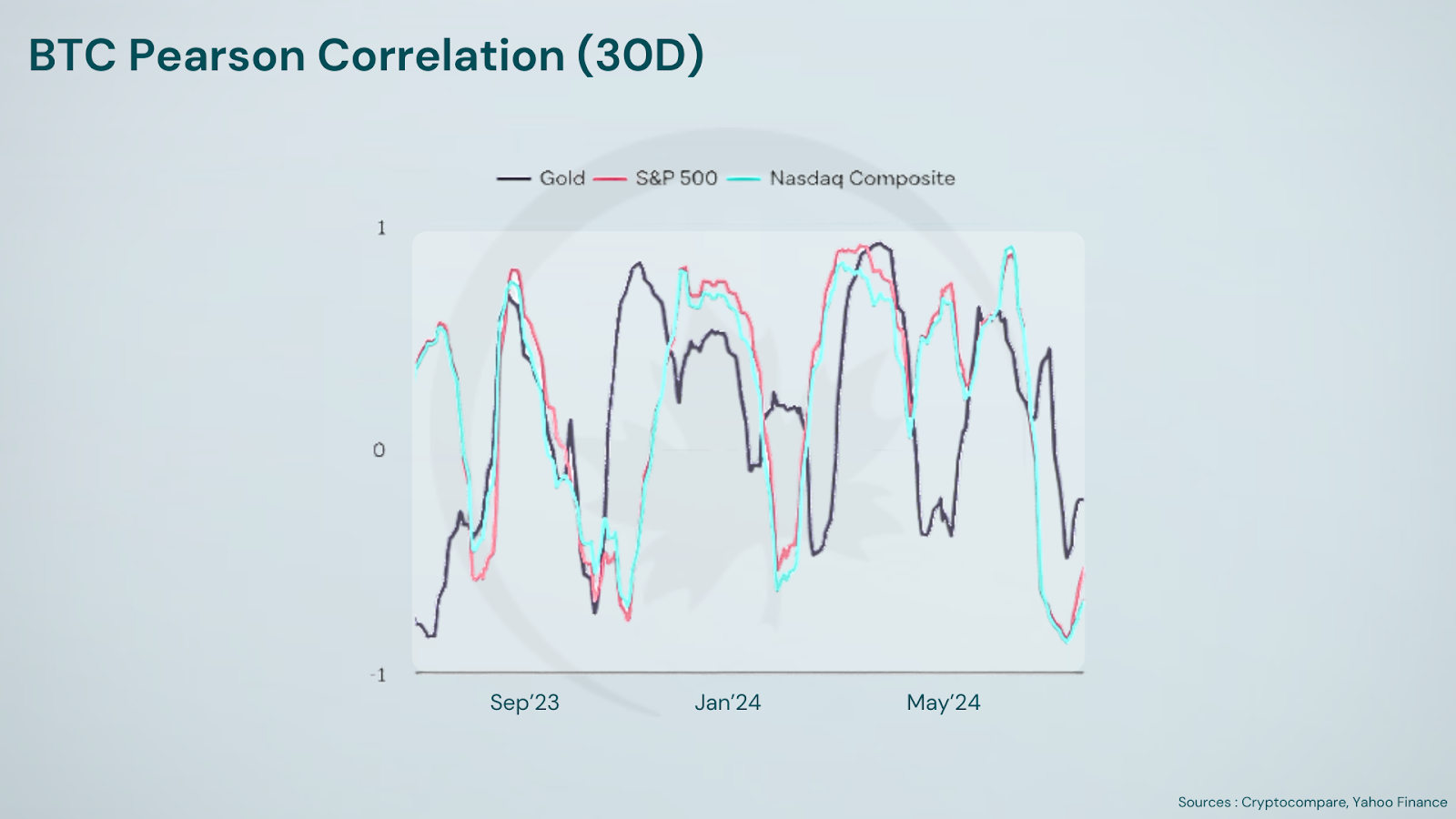

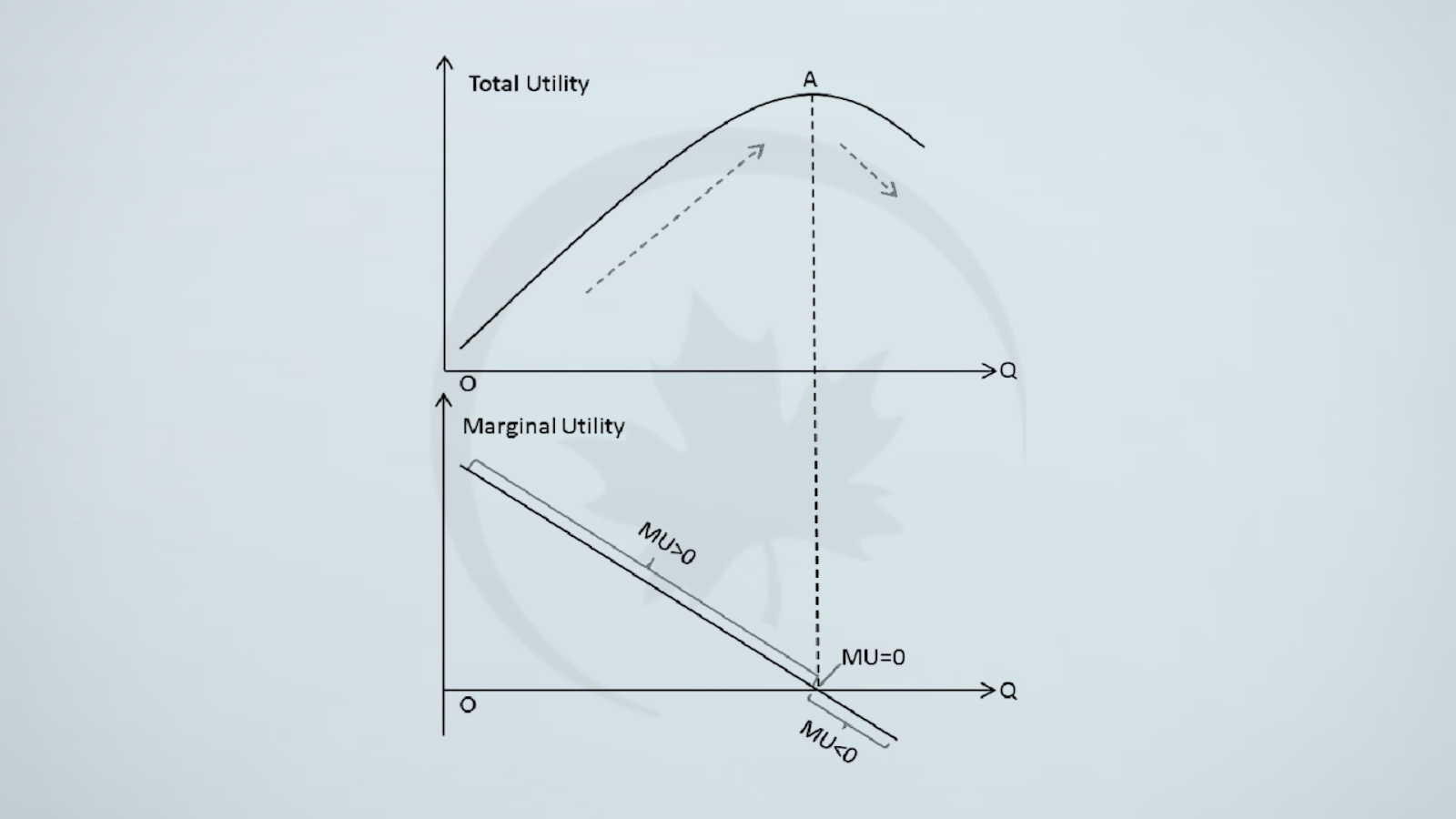

A study by Brière, Oosterlinck, and Szafarz (2015) published in the Journal of Asset Management was one of the early academic works to explore Bitcoin’s potential as a portfolio diversifier. They found that Bitcoin had low correlation with traditional assets and could potentially improve the risk-return trade-off of diversified portfolios. They did also express concerns about the volatility of Bitcoin compared to traditional assets – which is something that ETFs are poised to repair as participation inflates. And because professional investors still own a very small chunk of the Bitcoin ETFs available in the market, we can expect the trend of stabilization to catch on faster than some historical precedents might signal. It is hinged on the simple idea of ‘marginal and total utility’, and the fact that the transition from the Early Adopter Stage → Early Majority Stage will yield outsized benefits for the ‘mass-market’ dynamics of ETFs.

A more recent study by Kajtazi and Moro (2019) in the International Review of Financial Analysis examined the impact of adding Bitcoin to a diversified portfolio of stocks, bonds, and cash. Their findings suggested that including Bitcoin could improve portfolio performance, primarily due to Bitcoin’s high returns rather than its diversification benefits. Some pioneering research work in the Operations Research world (Annals of Operations Research) has noted that Bitcoin could be particularly useful for risk reduction when combined with gold, suggesting a potential complementary relationship between these two assets often considered as alternative investments, because historical data reveals that while gold can be an effective hedge for stock market movements, Bitcoin’s hedging abilities are limited and time-varying. From a financial theory perspective, research has found that including cryptocurrencies in a portfolio could potentially improve its efficiency frontier, offering better risk-adjusted returns : studies indicate that a small allocation to Bitcoin—such as 1% to 5%—can significantly improve the risk-adjusted returns of a traditional diversified portfolio. Cryptocurrencies, particularly Bitcoin, can serve as a hedge against heightened economic policy uncertainty (EPU). During periods of high EPU, cryptocurrencies tend to have positive returns, making them valuable diversifiers in times of uncertainty.

Conclusion

With the introduction of Bitcoin and ETH ETFs, the floodgates have opened for more crypto exchange-traded products, including the potential for a Solana-based ETF in 2024 itself. This surge in Crypto ETFs marks a shift in perception, transitioning crypto from being perceived solely as a speculative asset to becoming a foundational element of investment portfolios. Investors can now access more than 70% of the liquid crypto asset market through low-cost ETFs. According to media sources, Van Eck, a global fund manager, expressed optimism regarding the future potential of Ethereum Layer-2 networks. The firm forecasts that these networks could achieve a valuation exceeding $1 Trillion by the year 2030. This role of institutional capital infusion cannot be underplayed in VanEck’s optimism in Layer-2’s viability, or atleast in the extent of its huge projection numbers. This is where Crypto-ETFs are benefitting the industry the most : by bringing in global attention, expertise, structure and capital into the “decentralized” world, they are allowing unprecedented opportunities for the development and innovation in raw, effective, frontier blockchain technologies based off of the value proposition gained by the heightened token prices and retail and institutional interest. Put simply, it means that Crypto-ETFs add a sizeable amount of centralisation to the outermost consumer-facing product, which is the crypto-token itself, while generating heaps of benefits for the industry in terms of talent, connections and reputation that allow for real value-addition into and via cryptocurrency engineering and the boost to Layer-2, Layer-3 projects, DeFi platforms, NFT marketplaces and more. One of the most fundamental signals of this can also be received from VC Funding trends in Crypto in 2024 : VC investment in crypto startups reached $2.5 billion during the first quarter of 2024, a 32% increase from the last quarter and roughly even with the same period last year. The recovery in publicly traded tokens and continued rise in institutional adoption will further drive increased VC funding for the next few quarters, spawning quality projects with long-term and widespread benefits and aiding implications. Crypto-ETFs are doing more for the cryptocurrency world than the current prices are able to capture, and it is only a matter of time until these undercurrents make cryptocurrency a faction of technology to be reckoned with – exactly like Social Media, or SaaS is today.