- Introduction

- The Year of CBDC exploration and adoption

- The Bitcoin Craze

- Recovering Market Cap

- Artificial Intelligence and Crypto

- The Resurgence of GameFi

- State of DeFi

- Crypto hacks

Introduction

The cryptocurrency journey has been quite eventful over the past few years, and 2023 was no different. The most recent crypto winter was triggered by 2022’s massive losses from Luna, TerraUSD, and FTX, which extended into 2023 with the failure of crypto banks Silvergate Bank and Signature Bank in March. Despite these losses, regulatory uncertainties, and global economic turmoil, Bitcoin saw an increase of over 65% since January 2023. The performance of Bitcoin moving forward will likely depend on several key factors, such as the direction of monetary policy and the progress of cryptocurrency regulation. This post provides some highlights of the 2023 crypto year.

The Year of CBDC exploration and adoption

There is a wide global agreement on the potential benefits of the Central Bank Digital Currencies (CBDC). The International Monetary Fund (IMF) is developing a universal CBDC platform to prevent the disjoint national approach and to foster financial inclusion. Almost every country with a functioning economy is making efforts to integrate either cryptocurrency, a Central Bank Digital Currency (CBDC), or both. Key global standard-setters such as the Financial Stability Board, the Basel Committee on Banking Supervision, and the Financial Action Task Force are continuing their efforts to develop a coherent approach for international adoption.

130 countries and currency unions are exploring CBDC. 11 countries have fully launched their digital currency. In May 2020, only 35 countries were considering CBDC, now we have 130 countries and 64 of them are in advanced exploration phases like pilot or launch. The 130 countries exploring CBDC represent more than 98% of Global GDP. The Russian attack on Ukraine has fueled the CBDC development and it has since doubled. The European Central Bank (ECB) launched a preparation phase in November 2023. This will be used to finalize the rulebook and create a robust platform for infrastructure and development. There are over 15 cross border CBDC in progress.

The Bitcoin Craze

The upward trend in Bitcoin was fueled by the speculation regarding the approval of Bitcoin spot ETFs early in 2024. With Blackrock proposing a Bitcoin Spot ETF and Grayscale court win over SEC to convert the Grayscale Bitcoin Trust into an ETF, the approval of Bitcoin ETF becomes more apparent. It is yet to be approved, but we might see the ETF soon in 2024 since Blackrock has almost 100% ETF filing conversion. All this has led to more traditional investors eyeing into the crypto ecosystem and booking some gains. Bitcoin has also managed to outperform many key assets and indices. Bitcoin halving in April 2024 will affirm the narrative of bitcoin as the digital gold.

Recovering Market Cap

The macroeconomic conditions were tough in 2023 and varied drastically. With the war in Ukraine and the Middle East, the global economy saw geopolitical suffering. The western banks tightened the regulatory monetary policy looking to curb the inflation. Despite the challenging macroeconomic conditions, the total cryptocurrency market capitalization increased in 2023 to $1.4 trillion (+70.7% YoY growth). The growth was fueled by the optimism surrounding the Bitcoin ETF approval in the later part of the year. The global cryptocurrency market reached its peak in November 2021, with a value close to $2.9 trillion. However, more than a year later, the market has not been able to recover even half of that peak value.

It’s interesting to see how the cryptocurrency market has been growing despite challenging macroeconomic conditions. The growth from 575 million crypto owners in November 2023 to an expected 700 – 900 million in 2024 indicates a strong trend in global cryptocurrency adoption. A significant factor contributing to the growth of the cryptocurrency market has been the rising interest from institutional investors. Major entities on Wall Street, hedge funds, and even conventional banks are beginning to recognize the potential of digital assets. This surge of institutional capital has likely played a crucial role in stabilizing the market and lending much-needed credibility to it.

Artificial Intelligence and Crypto

Generative AI took the center stage in 2023. The launch of ChatGPT and GPT-4 by OpenAI and then its acquisition by Microsoft. Google came in with Google Bard and ended the year with its most advanced Google Gemini. The Google Pixel has inherited many of the AI features. The momentum of the AI trend is still going forward into 2024. Generative AI and AI in general can have many profound applications in web3 too.

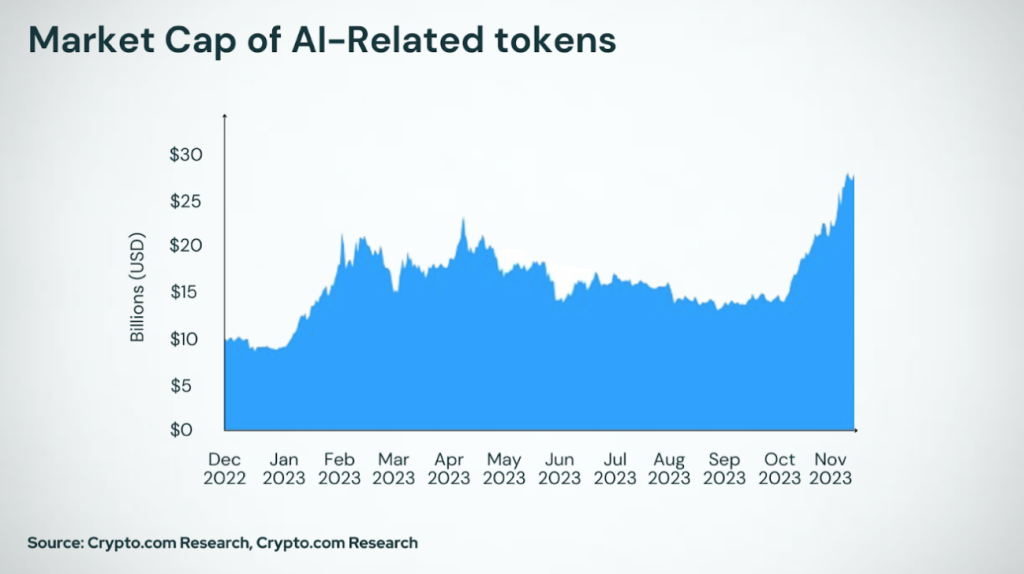

We have seen the rise of many web3 companies integrating web3 and AI which can help in DeFi and infrastructure projects. The integration of AI and Web3 has been a significant trend. Alethea AI, a research and development studio, is at the forefront of this integration. They are leveraging the transformative technologies of Generative AI and blockchain to enable decentralized ownership and democratic governance of AI. In terms of market capitalization, AI-related tokens have seen substantial growth. The market capitalization of AI-related tokens rose from just over $8 billion at the start of 2023 to nearly $28 billion. This growth underscores the increasing interest and investment in the intersection of AI and blockchain technologies.

The Resurgence of GameFi

The tech savvy population in the developing countries are growing rapidly. With access to better smartphones to more people. There is going to be a gaming market that would be penetrable to more people. As smartphone penetration and the internet connectivity increases in developing countries, we are going to see more and more users playing mobile games. The majority of users in the GameFi industry are not going to be the ones already playing the web 3.0 games but the ones that are exposed to the web 3.0 games from the beginning. Users will be more willing to choose the past time based on the efficiency.

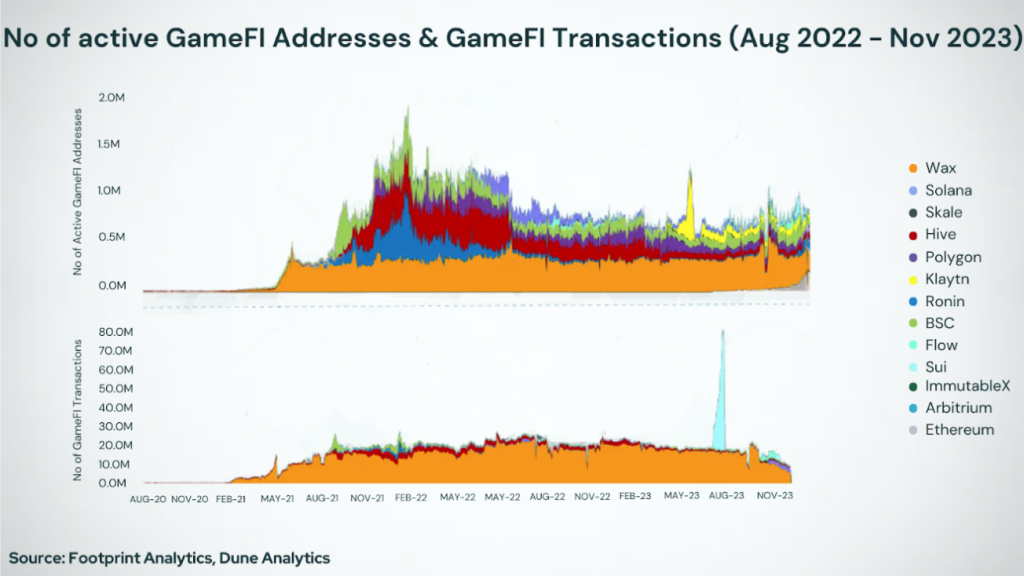

The GameFi sector has seen significant activity with a total of 8.7 million transactions across the top 13 gaming chains as of November 30, 2023. A large portion of these transactions, 57.9% to be precise, originate on the WAX blockchain, which is known for its gasless transactions. Most blockchain games today employ a hybrid architecture. In this setup, the gaming engine and most in-game actions or game states are not actually stored on-chain. Instead, on-chain transactions are primarily used for minting or upgrading Non-Fungible Tokens (NFTs) or tokens. These NFTs or tokens often have some form of in-game utility, enhancing the gaming experience and potentially adding value for the players. This approach combines the benefits of blockchain technology, such as transparency and security, with the efficiency and scalability of traditional gaming architectures.

State of DeFi

A significant trend in 2023 was the integration of real-world assets (RWA) into DeFi. Platforms like MakerDAO expanded their operations to include investments in US Treasuries and corporate bonds, demonstrating a growing intersection between traditional finance and DeFi. This trend is not just about liquidity; it represents a strategic move to bridge DeFi with the broader financial ecosystem, promising enhanced stability and utility for DeFi platforms.

Efforts were also made in 2023 to address DeFi’s scalability issues. Partnerships were formed and more efficient protocols were developed to handle increased transaction volumes. These developments indicate a promising future for the DeFi sector despite its challenges.

In 2023, the total value locked (TVL) in DeFi was $53 billion, which is modest compared to traditional finance and over 70% below its peak. This indicates that DeFi cannot easily absorb significant losses. The sector’s vulnerability to cyber threats was highlighted by sophisticated attacks, such as the $50 million Kyber Swap hack.

Crypto hacks

In 2023, the cryptocurrency community faced significant losses exceeding $1.8 billion due to over 450 instances of fraud and cybercrime. The FBI linked several of these incidents to the North Korean Lazarus Group, which has drawn attention from governments and multiple platforms following a series of attacks on DeFi protocols and cryptocurrency exchanges.

In response to these incidents, the US government-imposed sanctions on Sinbad, a cryptocurrency mixer, for its role in handling millions from exploits by North Korea-linked hackers, notably the Axie Infinity and Horizon Bridge heists, each ransacking hundreds of millions. In addition to these larger illicit operations, another minor type of scam preyed on numerous unsuspecting victims.