- Introduction

- Tokenization : A History

- The Architecture of Tokenized Treasury Securities

- The Fundamental Advantages and Frontier Attractions of Tokenized Treasury Securities

- Conclusion : A Vast, Tokenized World Awaits

Introduction

Tokenized Treasuries have become a significant and influential segment within the blockchain ecosystem in 2024. This innovative financial instrument represents a fusion of traditional government-issued bonds with blockchain technology, providing benefits such as improved efficiency, transparency, and liquidity. This month’s newsletter aims to provide a detailed overview of Tokenized Treasuries, including their definition, history, engineering architecture, development timeline, user engagement, market statistics, and their interrelation with Real-World Assets (RWAs) and Central Bank Digital Currencies (CBDCs).

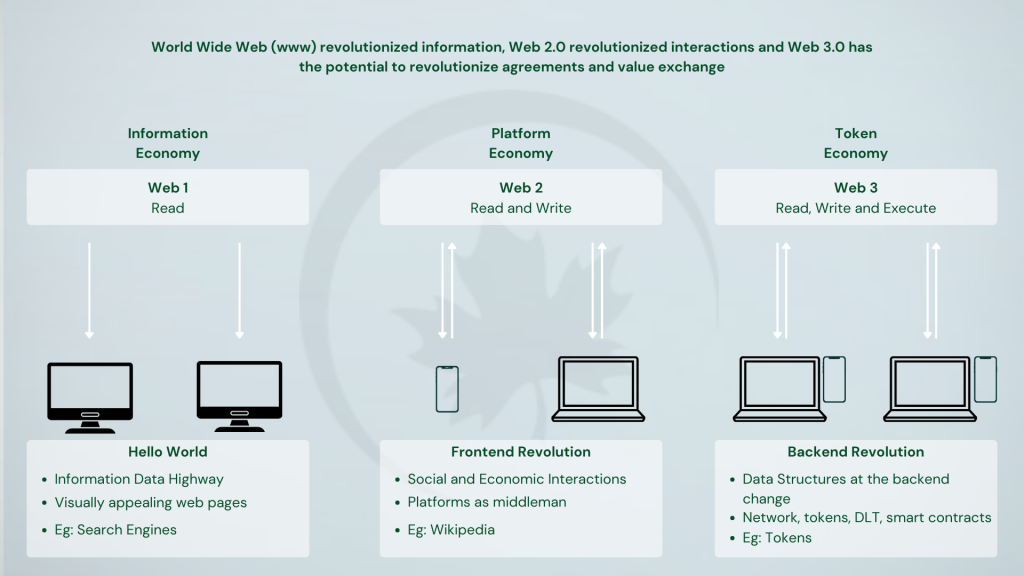

Tokenized Treasury Financial Instruments represent a revolutionary convergence of traditional finance and blockchain technology. These innovative financial products are digital representations of conventional treasury instruments, such as government bonds or Treasury bills, that have been converted into tokens on a blockchain network. This process, known as tokenization, allows these traditionally illiquid assets to be more easily traded, transferred, and fractionalized in the digital realm. They deploy the cornerstone advantages of blockchain technology, such as increased security, faster settlement times, and enhanced transparency, in an otherwise highly centralised industry.

Tokenization can lower barriers to entry for smaller investors, allowing for fractional ownership of treasury instruments. Unlike traditional markets, Tokenized assets can be traded around the clock, adding to increments in market efficiency.

The creation of Tokenized treasury instruments is part of a larger trend towards the tokenization of real-world assets (RWAs), which is expected to reach a market size of $16 trillion by 2030, according to the Boston Consulting Group. There is well rounded growth in the industry with exponential traction being added to investments like the Tokenized private credit loan market, which had reached a total active loan value of over $600 million back in October 2023, and has grown manifold since then. Tokenized instruments can be traded globally, 24/7, breaking down geographical and time-zone barriers that exist in traditional markets. Smart contracts enable the automation of various processes, including interest payments, redemptions, and compliance checks.

Tokenization : A History

The history of tokenization can be traced back to the 1990s, when early attempts were made to digitize physical assets, such as commodities and real estate, through the use of digital certificates and exchange-traded funds (ETFs). One of the pioneering projects in this era was the creation of the first real estate investment trust (REIT) ETF by Vanguard in 1996, which allowed investors to gain exposure to a diversified portfolio of commercial real estate. However, the introduction of blockchain technology in the 2010s marked a significant turning point, enabling the development of more sophisticated and decentralized tokenization models.

The concept of tokenizing traditional assets on the blockchain began to gain traction around 2017 with the rise of blockchain technology. Projects like Polymath and Harbor emerged, focusing on the tokenization of equity and real estate, respectively. These early initiatives provided proof of concept for the tokenization of more complex financial instruments like bonds. From 2017 to 2018, initial forays into asset tokenization were primarily experimental, with companies like Securitize and Tokensoft leading the way in tokenizing real estate and equities.

As the decentralized finance (DeFi) ecosystem began to flourish in 2019 and 2020, the tokenization of more traditional financial instruments, such as bonds, started to be explored. Projects like Cadence and Vertalo experimented with creating Tokenized bonds, although regulatory uncertainty hindered mass adoption during this period. Significant advancements in blockchain technology, particularly in Layer-2 solutions and cross-chain communication, set the stage for the tokenization of treasuries in 2023.

In 2024, Tokenized Treasuries saw increased adoption and significant capital allocation, with the market value exceeding $1.09 billion by April and $1.5 billion by June 2024. Several key players are leading the charge in the tokenization of treasury assets. BlackRock, with its BUIDL fund, manages a significant portion of the market, offering investors exposure to U.S. Treasury bonds in a Tokenized format . Similarly, Franklin Templeton has upgraded its $380 million Tokenized treasury fund to enable peer-to-peer transfers, highlighting the evolving nature of these financial products . Other notable contributors include the Swiss Central Bank, which made history by implementing its first Tokenized monetary policy.

BlackRock’s BUIDL fund, now the world’s largest Tokenized treasury fund, which has amassed $473 million in deposits, and initiatives by the U.S. Department of the Treasury to explore the potential of Tokenized government debt instruments. Two funds, BlackRock’s BUIDL and Matrixport’s Short-Term Treasury Bills, are dominating Tokenized U.S. Treasury products with around 88% market share. The co-existence of Tokenized Treasuries, RWAs, and blockchain ETFs could further lead to a more efficient, transparent, and accessible financial system. Tokenization can increase the liquidity of assets by making them more accessible and easier to trade. It can also improve efficiency by reducing the need for intermediaries and allowing for 24/7 trading. The global tokenization market is projected to reach $5.6 billion in 2026. It’s currently growing at a compound annual growth rate (CAGR) of 19%.

Amongst the chains, Ethereum surpasses $1 billion in Tokenized US Treasuries, with BlackRock’s BUIDL fund leading with the aforementioned $473 million. Ethereum is currently the largest network for Tokenized US treasuries, and had harnessed 48.4% of the total market Tokenized Treasuries cap, valued back then at $340.8 million, issued on it in October 2023. Stellar follows closely behind Ethereum with it’s October 2023 share amounting to 45.9% of the total market cap, valued then at $323.0 million. Franklin Templeton’s FOBXX fund is Tokenized on Stellar. Polygon is a second chain on which Franklin Templeton’s FOBXX fund is Tokenized. Aiding this growing ecosystem is Avalanche, on which U.S. Treasury notes have been tokenized as well.

The Architecture of Tokenized Treasury Securities

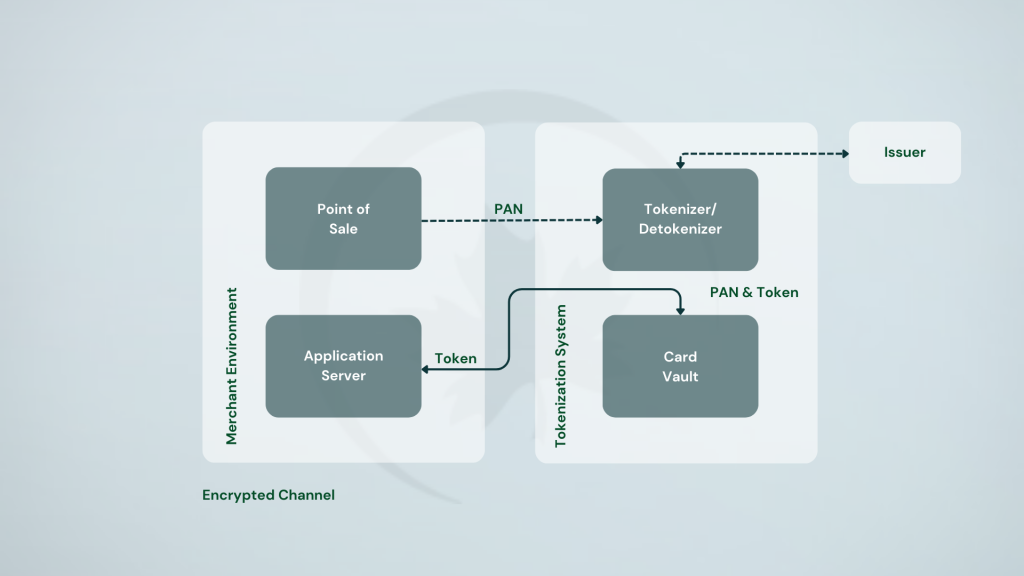

The architecture of Tokenized Treasuries involves several key components. At the core of this architecture are the smart contracts that encode the terms and conditions of the Tokenized Treasuries. Smart contracts are self-executing contracts with the terms of the agreement directly written into code that ensure that the Tokenized bonds behave according to predefined rules, including interest payments, maturity dates, and redemption. Due to required compliance processes, traditional finance has additional administrative overhead. Smart contracts, on the other hand, can be programmed to comply with regulations, ensuring that the transaction complies with local laws without the need for legal review. These contracts are deployed on blockchains such as Ethereum, Stellar, Polkadot, Polygon and Binance Smart Chain, which offer programmable functionality and the ability to create and manage digital assets. The smart contracts handle the minting and distribution of the tokens, as well as the automated payment of interest and principal to token holders.

To ensure the integrity of the Tokenized Treasuries, the token issuer must acquire the underlying U.S. Treasuries and deposit them in a custodial account with a regulated entity. This custodian is responsible for safeguarding the assets and verifying their existence, providing an additional layer of security and transparency. Custodial services bridge the gap between traditional finance and blockchain, ensuring that the underlying treasury bonds are securely held and managed. Oracles are third-party services that provide real-world data to the blockchain, such as bond prices and interest rates, ensuring that the smart contracts can react to real-time information.

The Tokenized Treasuries are then issued as ERC-20 tokens on the Ethereum blockchain, allowing them to be easily integrated with various DeFi protocols and traded on decentralized exchanges. The use of blockchain technology enables features such as fractional ownership, increased liquidity, and global accessibility, making these Tokenized assets more attractive to a wider range of investors. However, the blockchain architecture behind Tokenized Treasuries goes beyond just Ethereum.

There are three key challenges that must be overcome to provide utility to tokenized assets: the data and compliance problem, the liquidity problem, and the golden record/cross-chain synchronization problem. Tokenizing an asset is just the first step; for these tokenized assets to be truly useful, they need to be enriched with real-world information and data, have secure connectivity across the multi-chain ecosystem to unlock liquidity, and maintain synchronized and up-to-date data as they move across different blockchains. With its Data Feeds, Cross-Chain Interoperability Protocol (CCIP), Proof of Reserve, and other offerings, Chainlink is a frontrunner in enabling this new era, and Colin Cunningham, the Head of Tokenization & Alliances at Chainlink Labs, is at the forefront of this revolution. The platform has enabled over $10 trillion in value, with a large number of integrations across DeFi and collaborations with organizations such as SWIFT, DTCC, and ANZ Bank. To ensure cross-chain interoperability and seamless integration with other blockchain networks, projects like Chainlink have developed a suite of solutions, with further research underway in partnership with a host of stakeholders that enable the secure transfer and verified storage of Tokenized assets across different chains. This allows for greater liquidity and the creation of new financial products that leverage Tokenized Treasuries as building blocks. Projects like Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Axelar’s cross-chain infrastructure enable the secure transfer of Tokenized assets across different blockchain networks. They empower several mechanisms that power cross-chain token transfers, including burn-and-mint, lock-and-mint, and lock-and-unlock. These mechanisms ensure that the Tokenized Treasuries maintain their value and integrity as they move between chains, with the underlying assets being locked or burned on the source chain and minted or unlocked on the destination chain, to avoid bridging risks associated with wrapped assets. Depository Trust & Clearing Corporation (DTCC), a leading financial market infrastructure, in collaboration with Chainlink and several major financial institutions. The pilot, called Smart NAV, aimed to establish a standardized process for delivering and distributing Net Asset Value (NAV) data of mutual funds across virtually any blockchain network. The pilot found that by delivering structured data on-chain and creating standard roles and processes, foundational data could be embedded into a multitude of on-chain use cases, such as tokenized funds and “bulk consumer” smart contracts. This capability can support future industry exploration and power numerous downstream use cases, including brokerage portfolio applications. The pilot also highlighted the benefits of real-time, more automated data dissemination and built-in access to historical data.The Chainlink industry report, featuring contributions from BCG, 21Shares, Paxos, and Backed, provides a comprehensive overview of the growing tokenization market and is a valuable resource for those interested to delve deeper into strategic efforts of innovation in this industry. Regulatory frameworks and industry collaborations, such as Project Guardian, led by the Monetary Authority of Singapore, have further demonstrated the viability and benefits of tokenized assets. Tokenization, combined with such supportive infrastructure and alliance ecosystem, can create greater transparency, expose hidden leverage, provide indisputable ownership claims, and enable the automation of critical risk management strategies.

Major financial institutions, such as BNY Mellon, Citi, and Clearstream have collaborated with blockchain projects like Chainlink to demonstrate the feasibility of connecting traditional finance systems with public blockchains for the movement of Tokenized assets. This collaboration helps address challenges around data privacy, operational risk, and legal liability, paving the way for broader adoption of cross-chain Tokenized Treasuries.

One of the key advantages of this foray into enabling cross-chain interoperability is to empower Tokenized Treasuries with the ability of integration with decentralized finance (DeFi) protocols. By using Tokenized Treasuries as collateral or as part of yield farming strategies, investors can generate additional returns on their holdings. Moreover, the blockchain architecture behind Tokenized Treasuries enables features that are difficult to replicate in traditional financial systems. For example, the ability to earn yield on U.S. Treasuries in real-time, 24/7, is a unique proposition that is made possible by the automation and programmability of smart contracts. This feature is particularly attractive to crypto-native investors who are accustomed to the always-on nature of decentralized finance. Further successful efforts in this realm include the integration between Ondo Finance, a leading issuer of Tokenized secure notes and on-chain Treasuries, and Axelar, a Web3 interoperability platform. This integration, known as Ondo Bridge, enables the cross-chain transfer of Ondo’s USDY token, which is a Tokenized note secured by short-term U.S. Treasuries and bank deposits. The initial deployment relies on Squid, a cross-chain liquidity router built on Axelar, to transfer USDY between some chain pairs, including Mantle. Additionally, the integration will enable unified secondary market liquidity, allowing traders to capitalize on token price arbitrage across various decentralized exchanges, maintaining price stability. The bilateral effort at expanding the scope, utility and security of Tokenized Treasuries means that a wave of highly effective innovations is already underway and these are the front-runners at the moment. Further participants include Polymesh, a specialized blockchain platform focusing on security tokens, which provides a secure and compliant environment for Tokenized treasuries.

MakerDAO, a well-known DeFi platform, integrates various RWAs, including Tokenized treasuries, to back its stablecoin, DAI. Hedge funds and pension funds, in particular, have shown interest in this new set of integration frontiers. Companies like Jump Trading and Alameda Research play crucial roles in providing liquidity for Tokenized Treasuries, ensuring smooth trading and minimal price volatility. Platforms, mainly Coinbase and Binance, have started offering retail investors access to Tokenized Treasuries, democratizing access to government bonds. By listing tokenized T-bills on their platforms, exchanges attract a wider range of investors, both institutional and retail, to participate in the market. This increased trading volume and activity also helps to improve the overall liquidity of tokenized T-bills. With more participants trading tokenized T-bills on exchanges, price discovery becomes more efficient. The increased competition and transparency lead to more accurate and stable pricing, which is a key aspect of market liquidity. User engagement with Tokenized Treasuries is thus diverse, ranging from institutional investors seeking secure, yield-generating assets to retail traders looking for exposure to government bonds without traditional barriers. Matrixdock is another participant worth noticing in this converging ecosystem. By integrating the aforementioned technologies of Chainlink Data Feeds, CCIP, and Proof of Reserve, Matrixdock enhances the utility and liquidity of its Short-term Treasury Bill Token (STBT). STBT enables holders to earn yields from U.S. Treasury securities and reverse repos. The Short-Term Treasury Bill token (STBT) is fully backed by short-term Treasury bills and pegged 1:1 to the USD, providing qualified investors with on-chain risk-free returns from US Treasury securities. STBT grants users daily access to underlying asset data and is overseen by a transparent committee of industry leaders as a third-party supervisor to review STBT’s underlying asset reports. Additionally, Chainlink Proof of Reserve (PoR) provides real-time on-chain verification of collateral value, further enhancing the transparency of STBT across multiple dimensions. Tokenized Treasuries are part of the broader trend of tokenizing RWAs. This trend includes assets like real estate, corporate bonds, and even intellectual property. Centrifuge, a platform focused on bridging traditional finance with DeFi, has been instrumental in bringing RWAs, including Tokenized Treasuries, to the blockchain. Furthermore, Central Bank Digital Currencies (CBDCs)and Tokenized Treasuries can coexist and complement each other within the financial ecosystem. CBDCs are digital representations of fiat currencies issued by central banks, aiming to enhance payment systems and financial inclusion. When integrated with Tokenized Treasuries, they can provide a seamless and efficient financial environment where digital currencies can be used to purchase and trade Tokenized government bonds. McKinsey & Company predicts the crypto RWA market, including Tokenized Treasuries, could reach a capitalization of $2 trillion by 2030. Further expounding on this exponential growth trail, a report by Standard Chartered states that the market for tokenized real-world assets is projected to reach $30.1 trillion by 2034. As the market for tokenized assets expands, Standard Chartered expects demand to soar, with projections indicating that 69% of buy-side firms plan to invest in tokenized assets by 2024.

The Fundamental Advantages and Frontier Attractions of Tokenized Treasury Securities

One of the most compelling aspects of Tokenized Treasuries is the combination of security and yield. Traditional treasury bonds are seen as one of the safest investments, backed by the full faith and credit of the issuing government. By tokenizing these bonds, investors can enjoy the same level of security while benefiting from the efficiencies and innovations offered by blockchain technology. This includes faster settlement times, enhanced transparency, and increased liquidity. Tokenized Treasuries also offer fractional ownership, allowing smaller investors to purchase portions of a bond rather than needing the capital to buy an entire bond outright. This ability to divide Treasuries into smaller, more accessible units has been a key driver of the adoption of this class of financial instruments, as it allows retail investors and smaller players to participate in the government bond market, which was previously dominated by institutional investors. This democratizes access to these financial instruments, opening up opportunities for a broader range of investors. Moreover, the use of blockchain smart contracts ensures that the terms of the bond are automatically executed, reducing the need for intermediaries and lowering transaction costs. Another significant advantage is the potential for enhanced liquidity. Traditional bonds can be illiquid, with trades often taking days to settle. Tokenized Treasuries, on the other hand, can be traded on blockchain platforms 24/7, with transactions settling in minutes, with the lightning fast settlements stemming from blockchain’s by-and-large commitment to speed at scale. This increased liquidity makes it easier for investors to enter and exit positions, improving market efficiency. Tokenized Treasuries also benefit from the transparency of blockchain technology. This transparency can reduce the risk of fraud and increase trust among investors. Moreover, the involvement of government entities, such as the U.S. Department of the Treasury, and the development of regulatory frameworks for tokenized Treasuries have provided a layer of validation and stability, which has helped to increase investor confidence and drive broader adoption. The aforementioned Standard Chartered analysis emphasizes on the transformative impact of tokenizing the niche of trade finance assets, which are traditionally underinvested but offer strong risk-adjusted returns and low default rates and help to bridge the $2.5 trillion global trade finance gap.

The ability to seamlessly integrate tokenized Treasuries with DeFi applications, such as lending, borrowing, and yield farming, has opened up new investment opportunities and use cases, attracting crypto-savvy investors to this asset class. In terms of yield, Tokenized Treasuries can offer competitive returns compared to a number of other investment options. For example, in the DeFi space, yields can fluctuate significantly due to market conditions and the inherent risks of new technologies. Tokenized Treasuries, backed by the stability of government bonds, offer a more predictable and stable return, providing diversification and potentially mitigating overall investment risk for both new entrants and long-term participants in the market, making them an attractive option for risk-averse investors. Lastly, the integration of Tokenized Treasuries with other blockchain-based financial instruments can create new opportunities for portfolio diversification and risk management. For instance, investors can use Tokenized Treasuries as collateral in DeFi lending platforms, allowing them to borrow against their holdings without needing to sell them. This can provide liquidity while maintaining exposure to the bond’s yield. In line with the DeFi instruments’ liquidity enhancement, Tokenizing Treasuries also improve the liquidity of conventional Treasury financial instruments by enabling the aforementioned structure of fractional ownership in the Tokenized market and creating a more active secondary market, that is not only a reflection of the prices of Tokenized Treasuries, but also quite presently, a reliable proxy and influencer to the prices of conventional Treasury securities. This aids value-attestation of the holdings of traditional financial investors as well. Another obvious yet prominent benefit is realizing that Tokenized Treasuries can not just be traded globally, but can be traded 24/7 by everyone, in all time-zones. This is different from a stock market participant from a particular country who could utilize all 24 hours participating in the markets of different countries, and engaging with and exposing themselves into the peak influence of those particular sovereign markets, because now the participant can indeed utilize 24 hours participating in the Tokenized Treasury market, but they would get to see the time-dependent effects of peak influences of various continental and national trading vigors all happen in a same globalized pool of decentralized securities, and that creates a host of trading and arbitrage opportunities that both institutional investors and seasoned traders would be looking forward to capturing.

Conclusion : A Vast, Tokenized World Awaits

Tokenized Treasuries have emerged as a significant and influential subset within the broader RWA landscape in 2024. It is clear that they are having a watershed moment, with the market capitalization of Tokenized Treasuries having experienced a remarkable surge of more than 10x, exceeding $1.5 Billion currently, fueled by both institutional and retail adoption. By offering the security and stability of traditional government bonds combined with the benefits of blockchain technology, they present a compelling investment opportunity.

As more people become comfortable with the idea of digital representations of government-backed assets, the path for CBDCs will become smoother, and one possessing greater utility potential. The triage of Tokenized Securities, RWAs-at-Large, and CBDCs substantiate and bolster each other’s potential and prowess within the (blockchain) financial ecosystem. Tokenized Treasuries demonstrate the potential for blockchain technology to transform even the most traditional corners of finance, making them more efficient, accessible, and innovative.

Major players possessing treasure troves of conventional financial wisdom and expertise – like BlackRock, Franklin Templeton, and Matrixport have emerged as pioneers in this new race. As regulatory frameworks develop and blockchain infrastructure continues to evolve aided by an increasingly optimistic outlook, Tokenized Treasury Securities are poised for substantial, exponential growth, driving further innovation in the DeFi space and contributing to the broader adoption of Web3 technologies.