- Introduction

- Chain Abstraction: A History and Lead-Up

- Deriving the Meaning of Modularity (Ethereum, Celestia, L2 Rollups)

- Modularity and Chain Abstraction: The Ecosystem

- Abstraction on Legacy Chains

- Aggregated DeFi Services and Network Abstraction

- Conclusion

Introduction

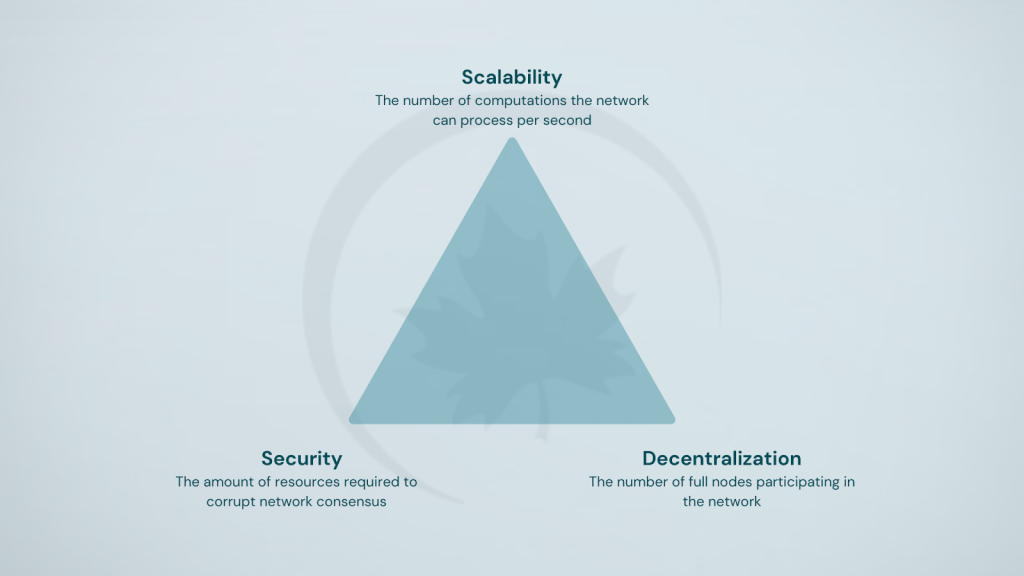

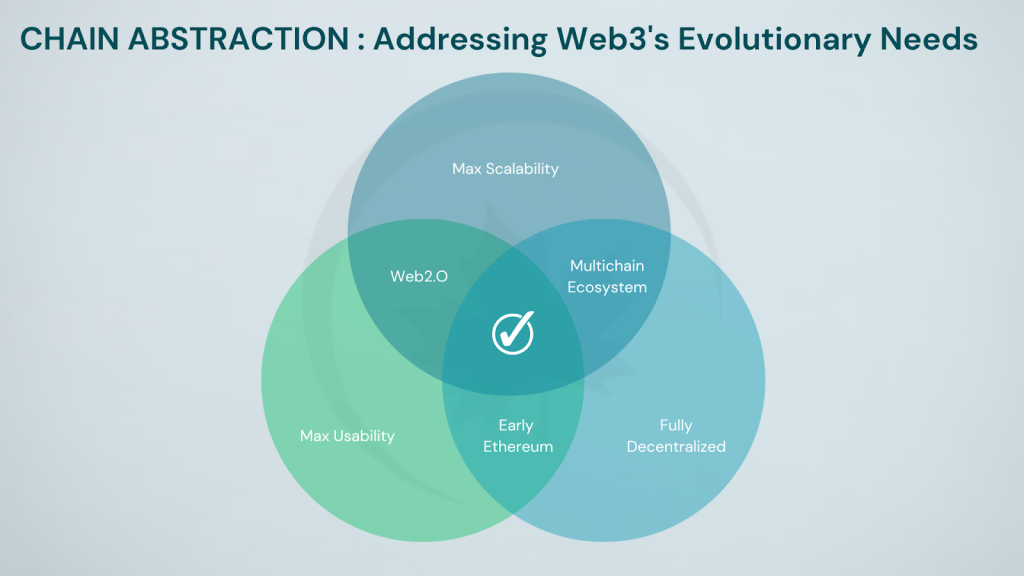

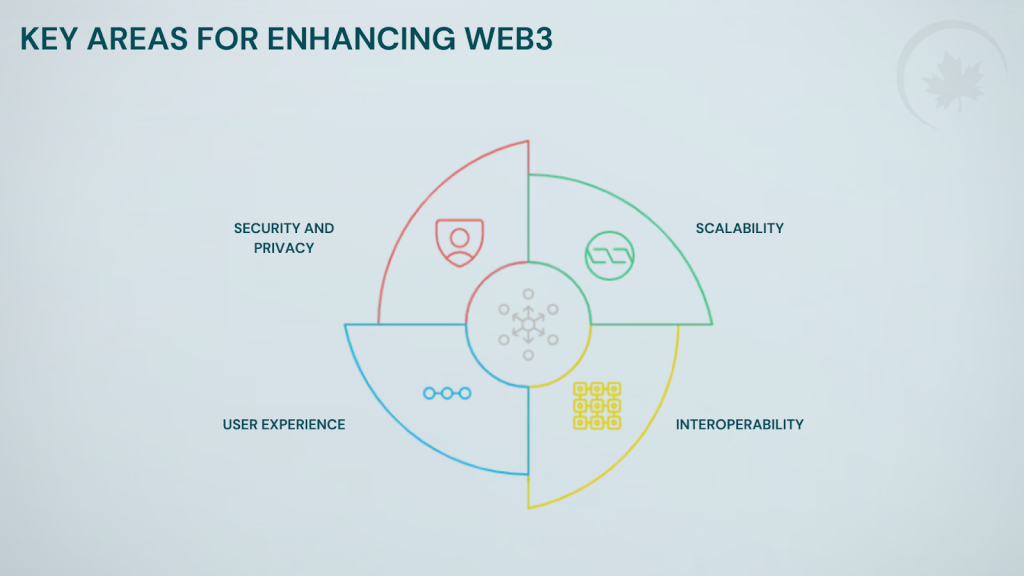

The blockchain world has been blessed with a yet-unsolved problem, often called the Blockchain Scalability Trilemma. It refers to the trade-off between three critical aspects of blockchain technology: security, scalability and decentralization. Every distributed ledger possesses these three fundamental attributes – and the blockchain trilemma posits that enhancing any two of these aspects necessitates a compromise on the third. Initially articulated by Vitalik Buterin, this concept forms the core of projects like Ethereum and Celestia, which are centered around addressing this challenge.

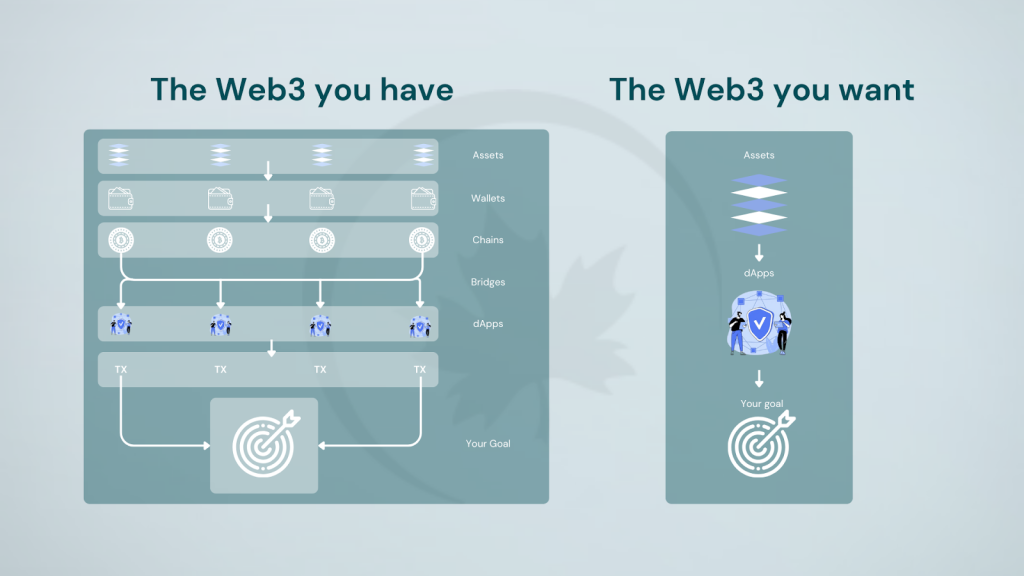

In the rapidly evolving world of blockchain technology, a groundbreaking development is reshaping the landscape: Chain Abstraction. While not touted as a direct solution to this posit of infrastructural-scalable deadlock, it has made many developers and users more enthusiastic about working on solving problems like the Trilemma by utilising true interoperability and by erasing the UX boundaries between various blockchains that pester users, instead of relying on absolute resolution on a single chain – thus allowing the users to craft their own paths in the space and not limit the utilisation of the USPs of the various chains only to the familiar users, the whales and the early-adopters.

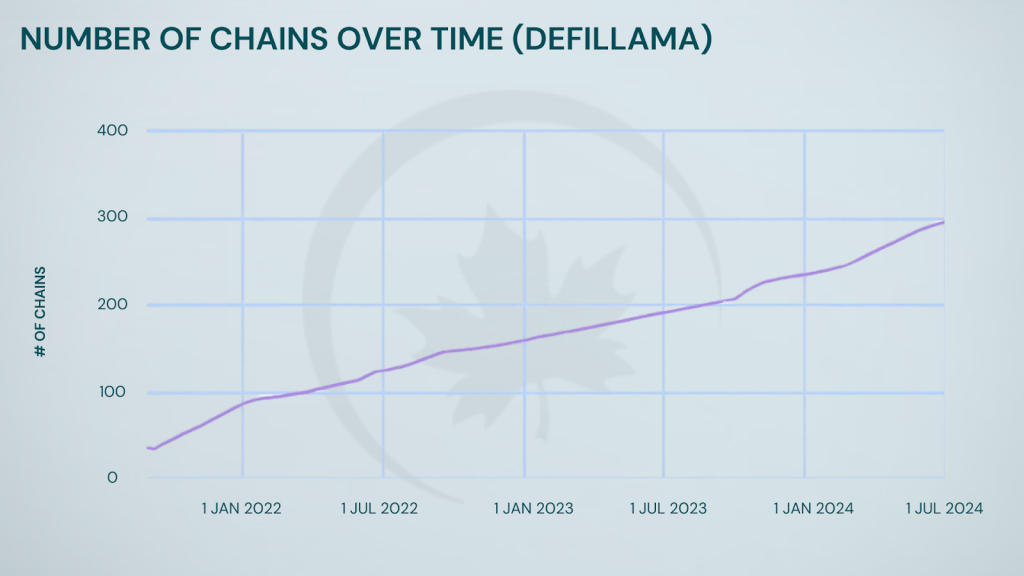

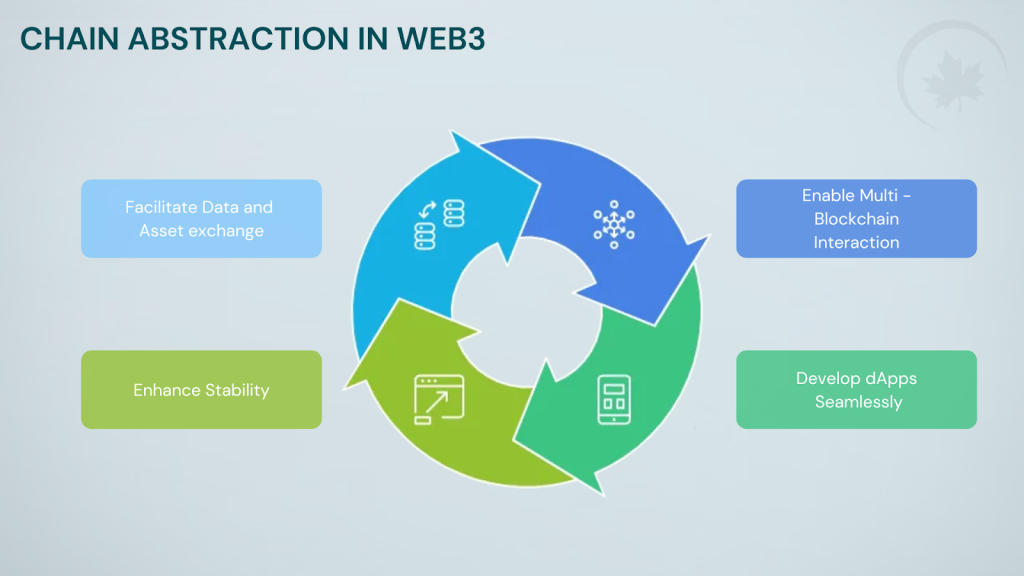

The Modularity and Chain Abstraction ecosystem has seen a remarkable 300% growth in adoption over the past year, signalling a paradigm shift in how we approach blockchain interoperability and scalability. Modular Chains and Chain Abstraction are innovative concepts that address some of the most pressing challenges faced by traditional blockchain networks. At its core, Chain Abstraction refers to the process of creating a layer of abstraction that allows seamless interaction between different blockchain networks, regardless of their underlying architecture or consensus mechanisms, while Modular Chains are blockchain systems designed with a modular architecture, allowing for greater flexibility, scalability, and interoperability. The core reasons behind this development are multifaceted and stem from the inherent structure of blockchain technology, which includes layers such as consensus, execution, data availability (DA), interoperability, and settlement. These advancements aim to solve critical issues that have plagued the blockchain industry for years. The lack of interoperability between different chains has led to fragmented liquidity, limited cross-chain communication, and inefficient asset transfers. Real-life examples of these problems include the inability to directly transfer assets between Ethereum and Bitcoin networks without using centralized exchanges or complex bridge protocols. Additionally, high gas fees and network congestion on popular networks like Ethereum have hindered widespread adoption of decentralized applications (dApps). Moreover, security vulnerabilities associated with cross-chain bridges, as evidenced by the $600 Million Ronin bridge hack in 2022 – which attained worldwide popularity – and other damaging hacks on bridging processes since, have raised concerns about the safety of inter-chain transactions.

Chain Abstraction and Modular Chains aim to address these issues by creating a more unified and efficient blockchain ecosystem. Contrary to the purely conceptual orientation of modularization, chain abstraction technology leans more towards the foundational level, requiring teams to aggregate tangible industry resources, precipitate TVL assets, and accumulate user data. Some of the biggest players in this sector include Particle Network, NEAR Protocol, and zkSync, backed by prominent investors such as Binance Labs, a16z, Galaxy VC and Polychain Capital. These projects are at the forefront of developing solutions that promise to revolutionize how we interact with blockchain technology, making it more accessible, secure, and user-friendly for both developers and end-users.

Chain Abstraction: A History and Lead-Up

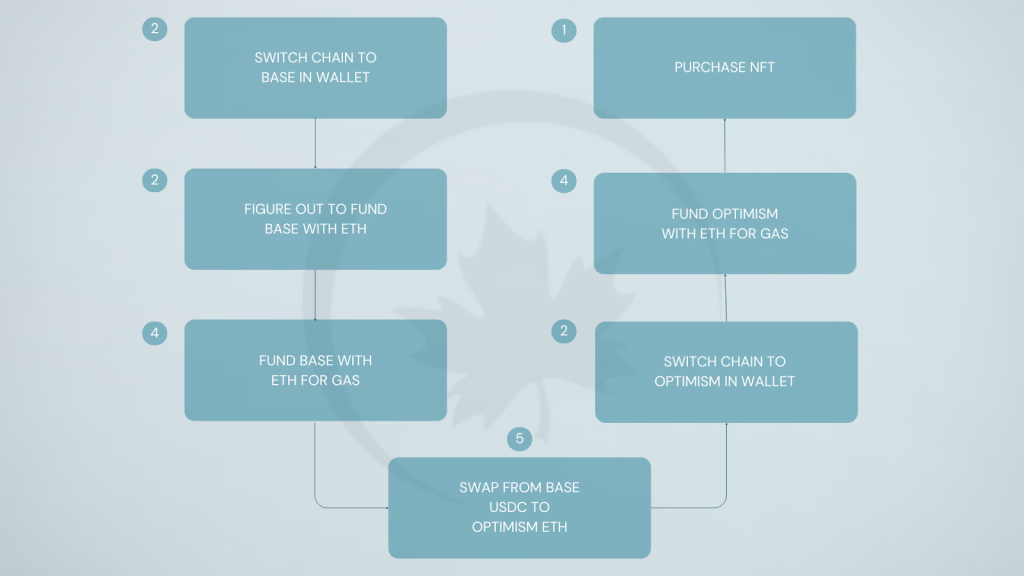

The concept of Chain Abstraction emerged from the early recognition of the limitations and challenges posed by the proliferation of isolated blockchain networks. As the blockchain ecosystem expanded, it became increasingly clear that the lack of interoperability between different chains was a significant barrier to widespread adoption and efficiency. Furthermore, it is also likely that Layer 2 scaling solutions exist increasingly in tandem with Layer 1s, as a smaller set of nodes can communicate globally significantly faster than a larger set. This would allow L2s, like rollups, to scale to virtually no limit, while inheriting security from L1s. However, even in the current state of having only a few dozen L1s and L2s, we’ve already seen concerns being voiced about substantial UX hurdles in this multi-chain present.

On the asset-handling and storage front, some wallets provide the dashboard to track assets in dapps, for example a LP position in AMM DEX, but currently, no single provider captures all the dapps. One of the key challenges in managing assets across multiple blockchains is that balances are isolated states across chains. This isolation means that users need to keep track of their assets on each blockchain separately, requiring multiple wallets.

Additionally, moving assets between chains typically involves using cross-chain bridges or exchanges – which, as highlighted above, and very frequently in popular media, is one of the more targeted and vulnerable components of the entire blockchain universe. A multi-chain future therefore has many problems to overcome including fragmented liquidity, complexity for end users with multiple bridges, RPC endpoints, different gas tokens and markets.

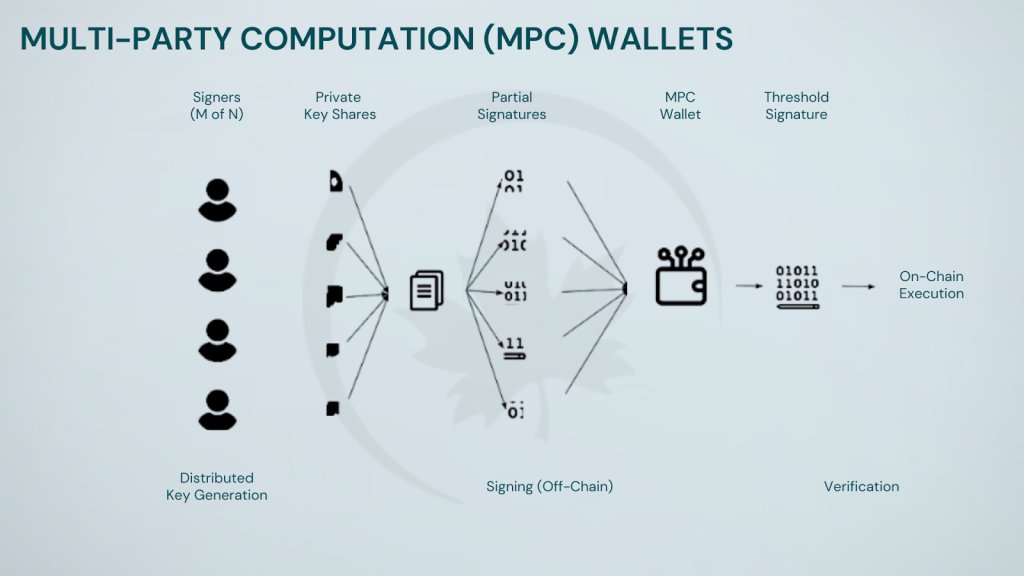

Traditionally, blockchain accounts function as a singular entity, where the address serves as a representation of ownership and the private key grants access and authorizes transactions. Account abstraction disrupts this tight coupling by introducing a crucial separation. The account address remains the public face, representing ownership of assets, while the private key (or any other signing mechanism) becomes decoupled and resides within the smart contract governing the account. Further innovations like Liquidity and Gas Abstraction, which can make for a full-on chain abstraction and cross-chain asset management experience have also been deployed in 2024. Early attempts at Chain Abstraction focused on creating interoperability solutions, such as wrapped tokens, cross-chain bridges and atomic swaps. However, these solutions were often complex and required significant manual intervention. For example, the Wrapped Bitcoin (WBTC) project, launched in 2019, allowed Bitcoin to be used on the Ethereum network. However, these solutions often introduced new complexities and security risks, as evidenced by numerous bridge hacks and exploits over the years.

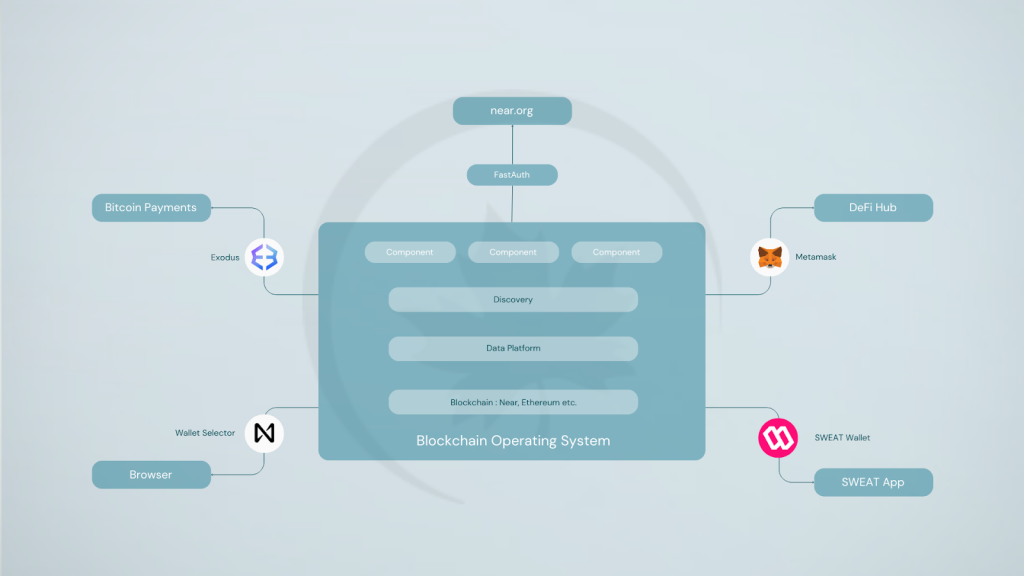

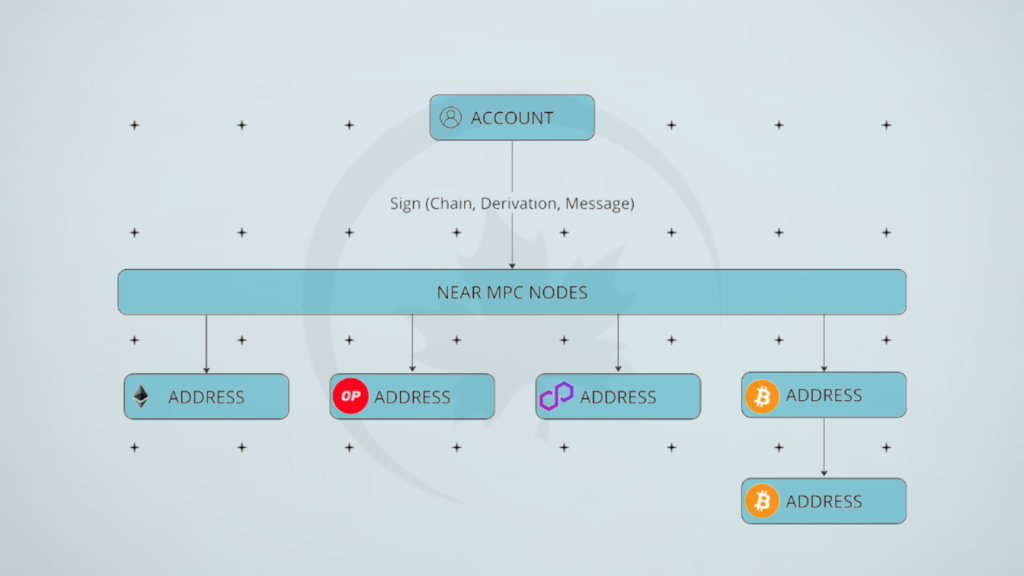

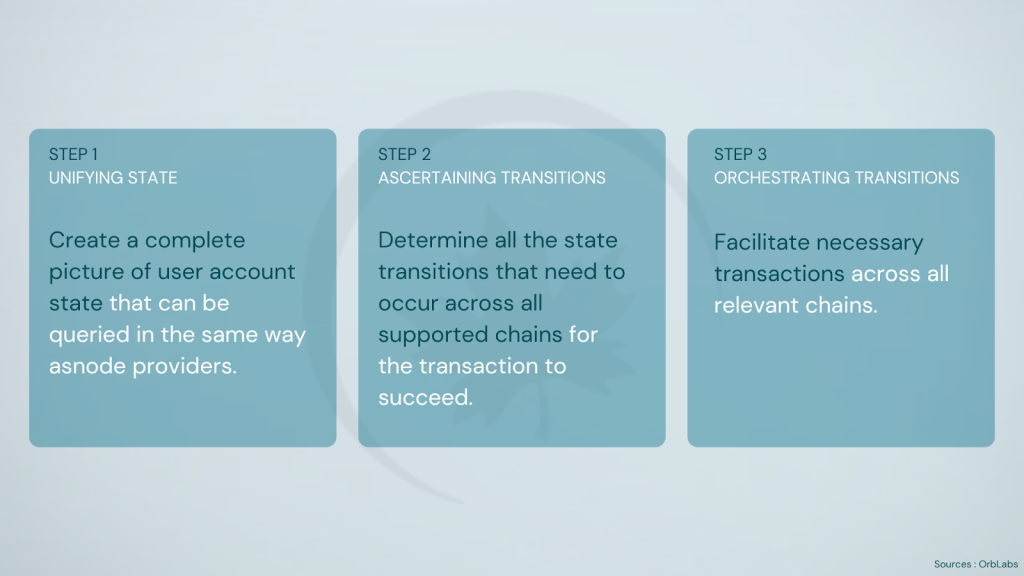

The theoretical framework for Chain Abstraction involves creating a layer of abstraction that sits above individual blockchain networks, allowing for seamless interaction and communication between different chains.Chain Abstraction thus represents an experience where the user is exempted from the manual processes required to interact with multiple chains. The multi-layer stack offers various approaches to chain abstraction across different levels: application, account, and blockchain. Hence this process typically involves standardization of data formats and transaction structures across different chains, development of cross-chain communication protocols, implementation of smart contract interfaces that can interpret and execute transactions across multiple chains, and creation of unified wallet interfaces that can manage assets from various chains seamlessly.Some of the landmark technologies that have emerged to facilitate Chain Abstraction include the Inter-Blockchain Communication (IBC) protocol, developed by the Cosmos ecosystem, which enables sovereign blockchains to transfer tokens and data between each other. Polkadot’s cross-chain messaging system (XCMP) allows parachains to communicate and transfer assets seamlessly. NEAR Protocol’s Chain Signatures enable transactions to be signed and executed across multiple chains without the need for traditional bridges. Because NEAR accounts are natively smart contracts, there is a lot of flexibility out of the box: any NEAR account can have any number of keys, rotate keys for security, and have multi-signer patterns. Additionally, with the Multichain Gas Relayer, one can even abstract the complexity of multiple gas tokens for different chains.

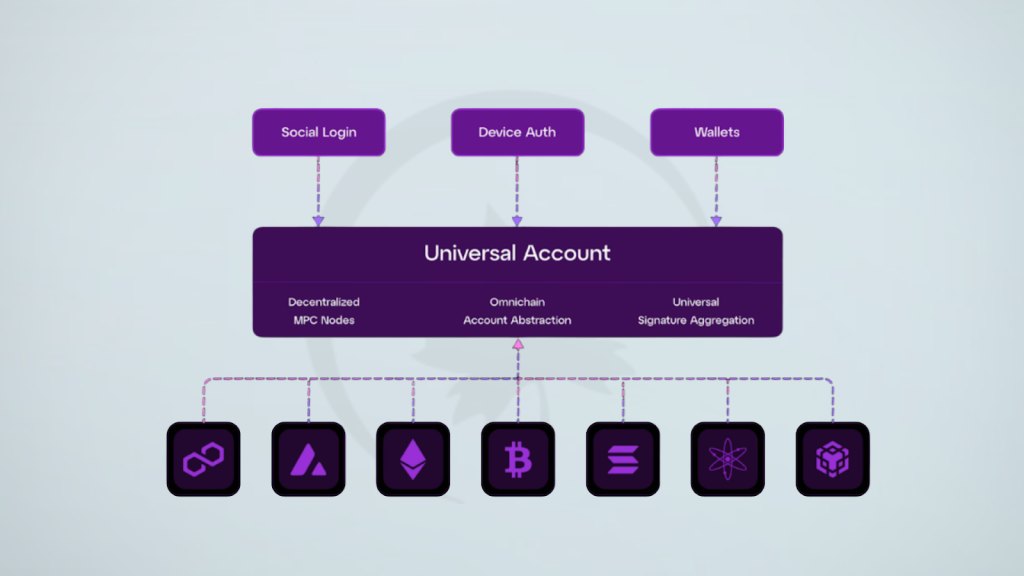

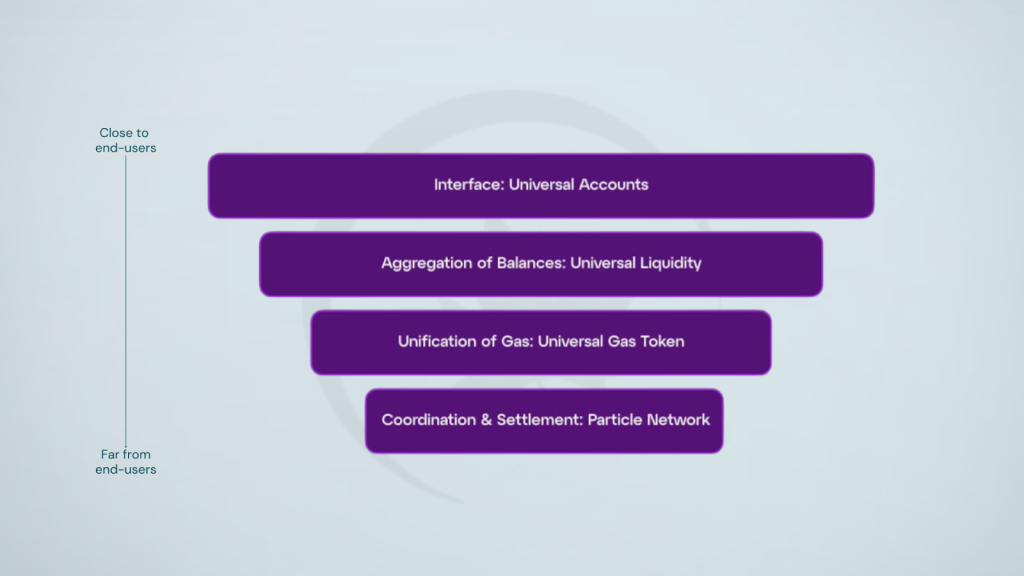

Particle Network is another well-backed frontrunner – Particle Network’s breakthrough with a Universal Account, Liquidity and Gas model is bringing together a number of abstraction philosophies into real-world deployment. Furthermore, chains built with the same stack (or infrastructure if you prefer) unlock direct compatibility – like Elastic Chain from ZKsync or the Superchain from Optimism.

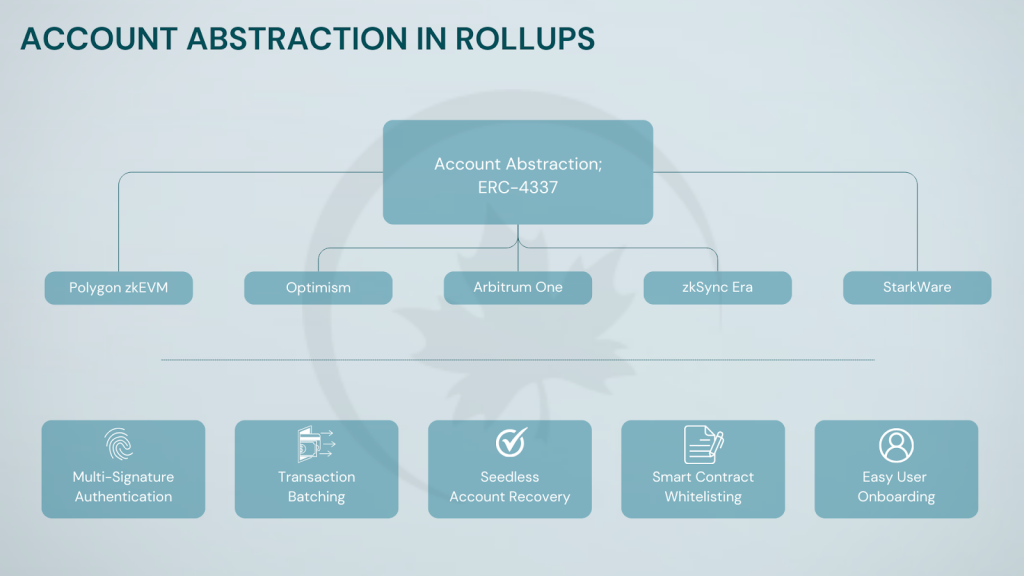

The EIP-4337 came with an account abstraction faculty in Ethereum with no consensus-layer protocol changes. EIP-4337 introduced account abstraction without any modifications to the core protocol. EIP-4337 achieved the goal of account abstraction allowing users to use smart contract wallets containing arbitrary verification logic instead of EOAs as their primary account. The proposal completely ruled out the need at all for users to also have EOAs (as status quo SC wallets and EIP-3074 both), fast-tracking Ethereum’s run-up to speed on AA (Account Abstraction).

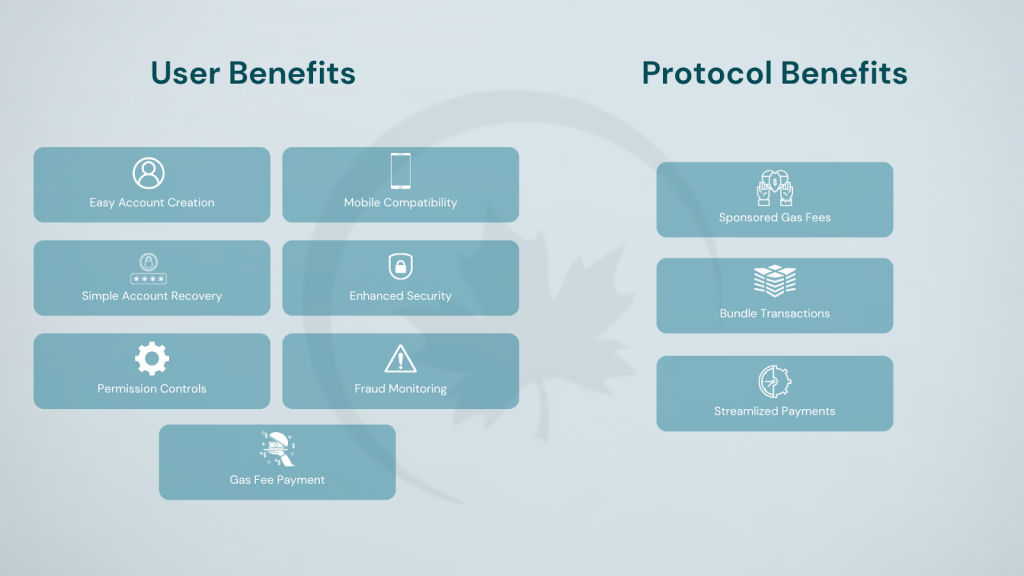

The benefits of Chain Abstraction are numerous and far-reaching. It enhances interoperability by allowing users to interact with multiple blockchain networks through a single interface, simplifying the user experience and reducing barriers to entry. Improved liquidity is achieved as assets can flow more freely between different chains, potentially reducing price discrepancies and improving overall market efficiency. Ideas like EOAs (Externally Owned Accounts) and CBAs (Contract-Based Accounts) are striding to enable this freedom of flow. Security is increased by reducing the reliance on centralized bridges and exchanges, mitigating some of the risks associated with cross-chain transactions. Scalability is improved as modular chains and abstraction layers can help distribute the load across multiple networks, potentially alleviating congestion on popular chains (and Dapp-populated chains) like Ethereum. Developer flexibility is enhanced, allowing the creation of applications that leverage the strengths of multiple chains without being constrained by the limitations of a single network. By enabling dApps to access value and users from around the ecosystem, chain abstraction can help optimize transaction costs and scalability. This is because, in the presence of chain abstraction, developers can choose the most cost-effective and scalable blockchain for specific tasks without regard for their social or economic power.

Additionally, account abstraction enhances security features by enabling each account to function as a smart contract. This allows for the customization of transaction validation and execution processes based on individual account logic. As a result, advanced security options like multi-signature requirements, conditional transactions triggered by specific events, and spending limits can be implemented. This flexibility empowers users to customize security settings according to their requirements, thereby improving protection against unauthorized access and transactions.

Deriving the meaning of Modularity – Comparing Ethereum, Celestia and Layer-2 Rollups for Ethereum

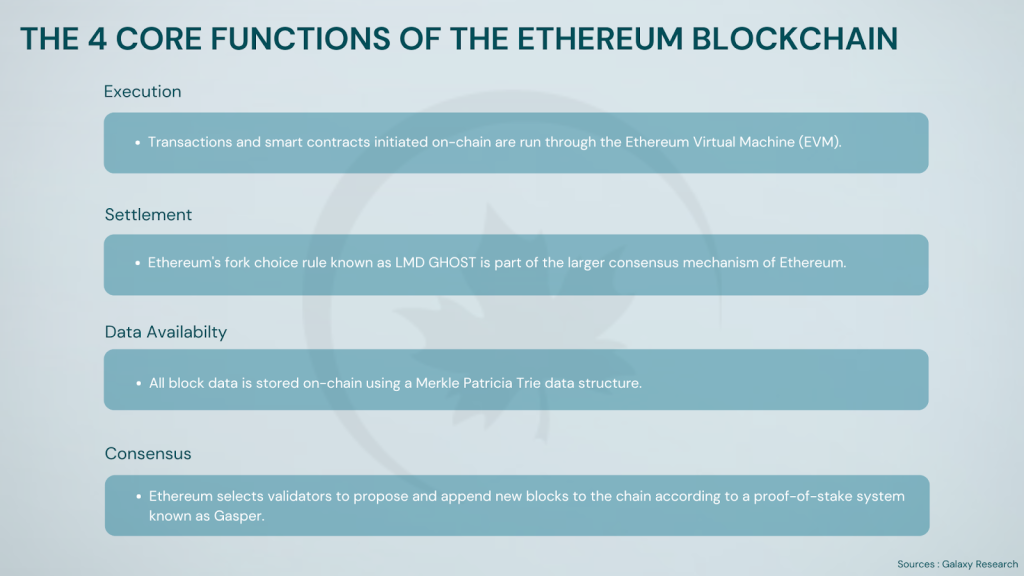

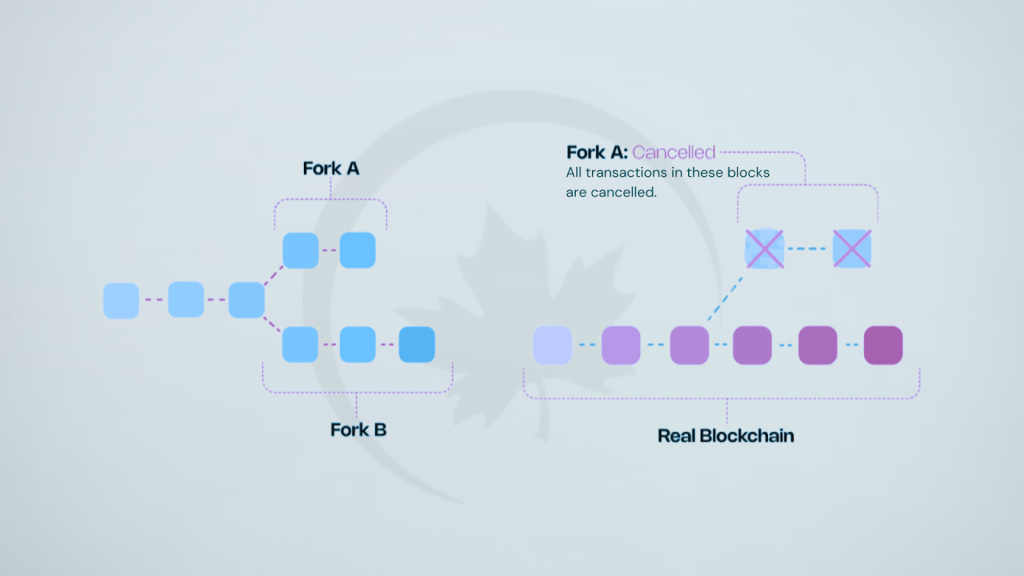

Ethereum’s architecture as a monolithic blockchain encompasses four crucial functions within a single network, showcasing both the power and limitations of this approach. At its core, the Ethereum Virtual Machine (EVM) serves as the execution environment, a Turing-complete system that processes all transactions and smart contracts. This unified approach ensures consistency but can lead to scalability challenges. The EVM’s operations are underpinned by a sophisticated data storage system utilizing Merkle Patricia Tries. These cryptographic data structures efficiently store and verify the integrity of transaction data, account states, and smart contract code. The trie structure allows for rapid proof of inclusion or exclusion of specific data points, crucial for Ethereum’s overall security and functionality.Ethereum’s consensus mechanism has evolved from proof-of-work to the more energy-efficient proof-of-stake system known as Gasper. This transition represents a significant technological leap, incorporating concepts from Byzantine Fault Tolerance (BFT) consensus algorithms. Gasper introduces the concept of finality gadgets, which provide stronger guarantees about the irreversibility of transactions after a certain point. The Last Message Driven (LMD) Greedy Heaviest Observed Sub-Tree (GHOST) fork choice rule is a critical component in Ethereum’s consensus layer. This algorithm determines how the network should resolve competing views of the blockchain state, ensuring that all nodes converge on a single, agreed-upon version of the ledger. LMD GHOST is particularly effective in handling network latency and temporary forks, contributing to Ethereum’s robustness in maintaining consensus across a global network of nodes.

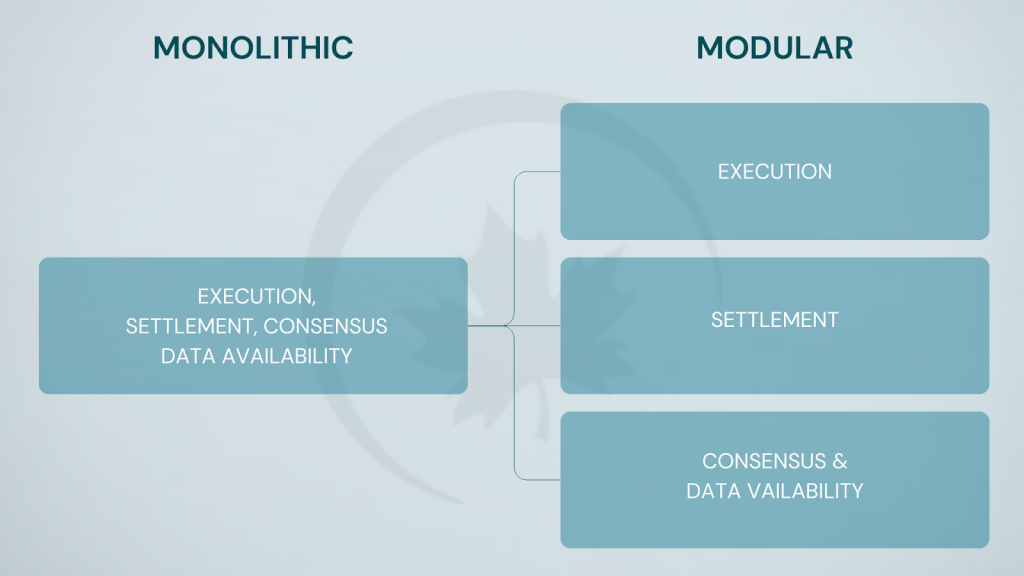

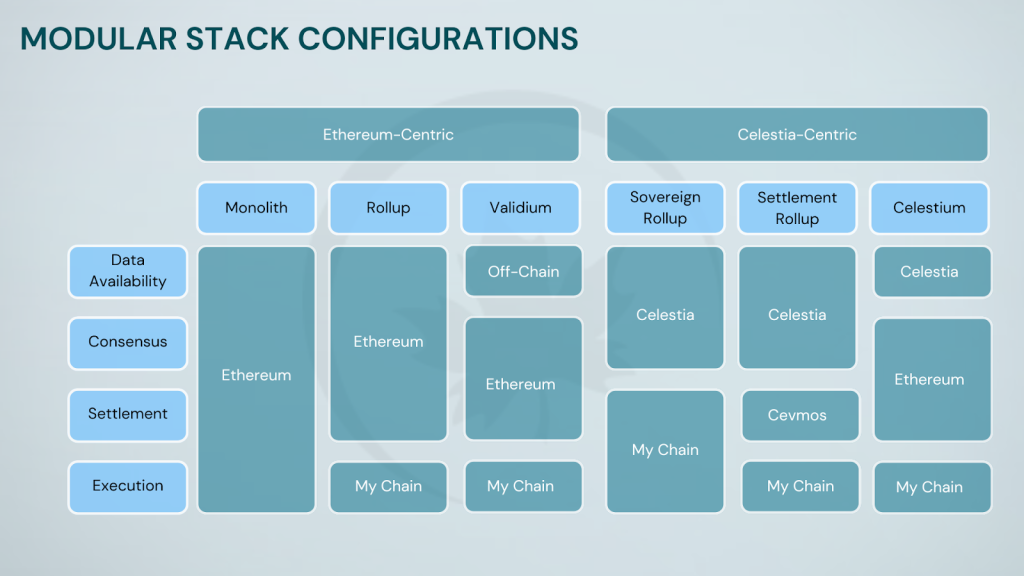

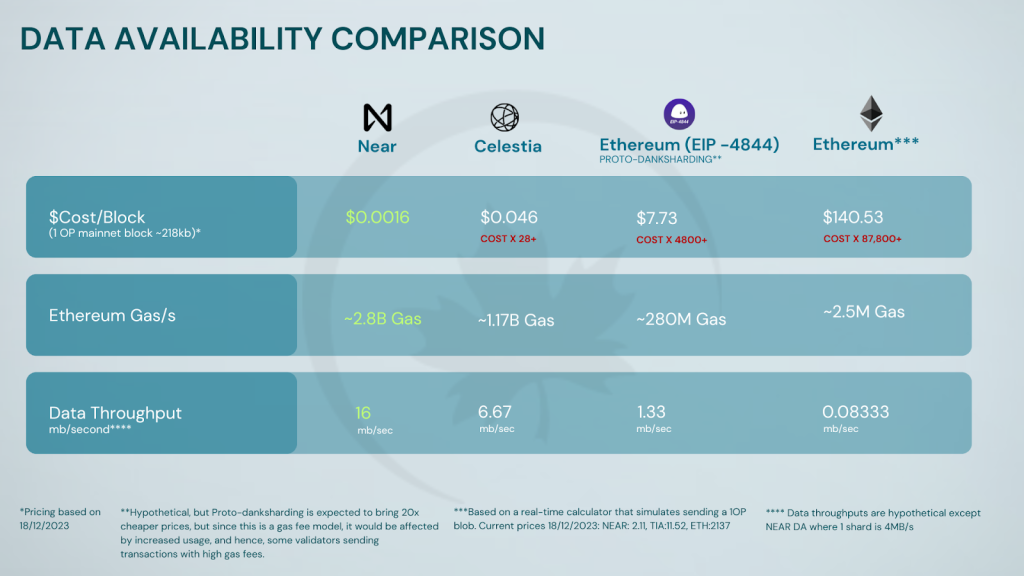

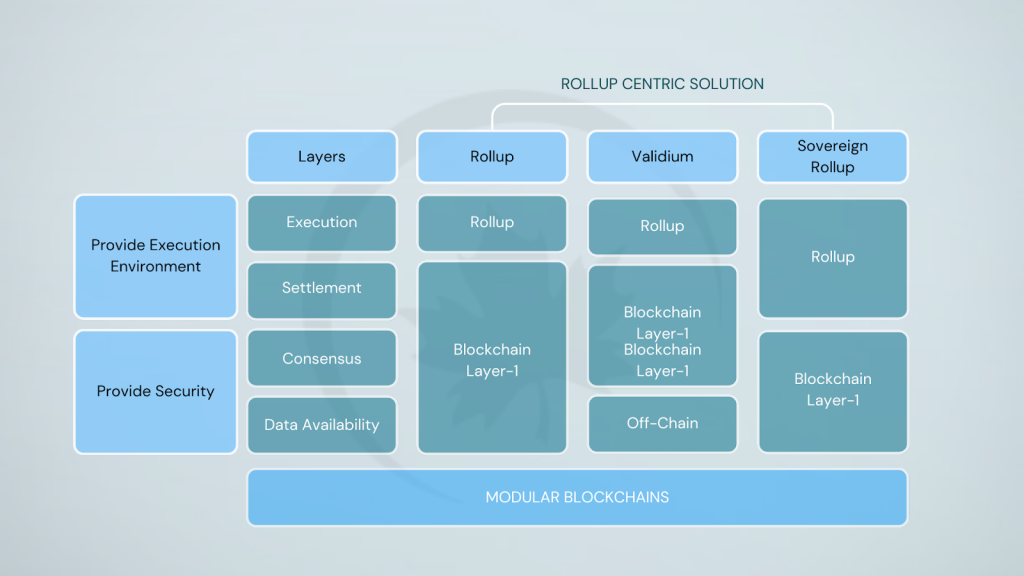

In contrast, Modular blockchains represent a paradigm shift in blockchain architecture, disaggregating these four core functions across specialized layers or networks. This approach allows for optimization of individual components and potentially greater scalability. Celestia exemplifies this modular approach by focusing exclusively on data availability and consensus. By eschewing native smart contract functionality, Celestia can optimize its architecture for these specific functions, potentially achieving greater efficiency and throughput in these areas.

Celestia’s data availability layer employs innovative techniques such as data availability sampling and erasure coding. These methods allow light clients to verify the availability of block data without downloading the entire block, significantly reducing resource requirements for network participants. This approach could enable more decentralized and scalable blockchain networks by lowering the barriers to participation.

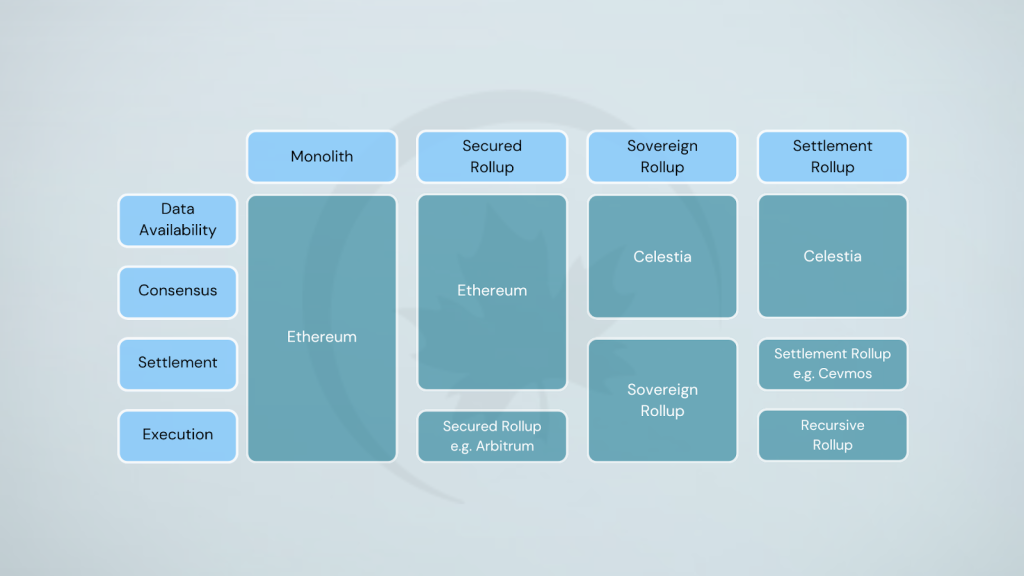

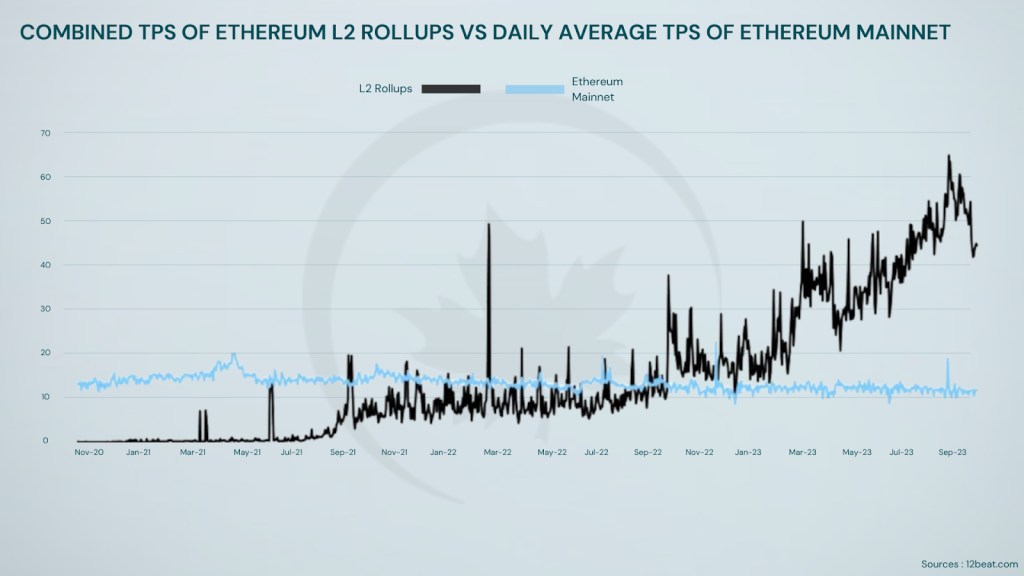

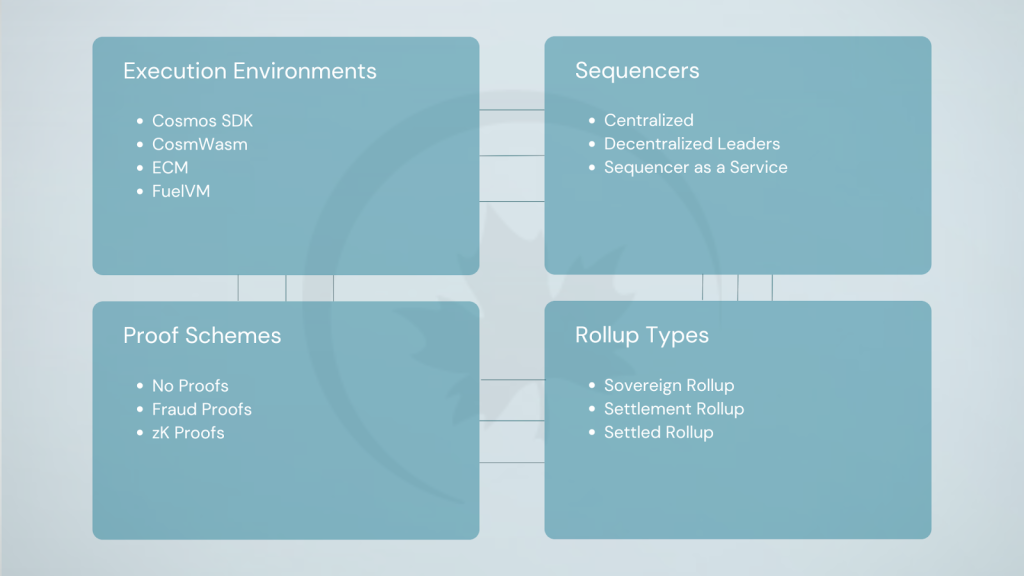

Layer-2 rollups further illustrate the potential of modular blockchain design, and are one of the principal methods by which the Ethereum blockchain is vying to catch up with more inherently Modular chains. Rollup is an L2 scaling solution that extends the concept of sidechains. They help reduce the load of Ethereum by performing transaction executions on L2 (off-chain). Rollups offer a solution to perform transactions secured by blockchain at a lower cost. The basic idea strongly resembles the concept of shadow chains proposed by Vitalik Buterin in 2014. By focusing on transaction execution and leveraging the security and data availability of a base layer (typically Ethereum), rollups can achieve orders of magnitude improvements in transaction throughput and cost-efficiency. Optimistic rollups and Zero-Knowledge (ZK) rollups represent two distinct approaches within this paradigm, each with its own trade-offs in terms of security assumptions, proof generation complexity, and withdrawal times. Projects working on rollup interoperability protocols to solve the issue around liquidity fragmentation include Polymer Labs and Catalyst while examples of notable settlement layers being built for Ethereum include Eclipse, Caldera, and Dymension.

Rollups significantly enhance Ethereum’s modularity by offloading transaction processing from the main Ethereum chain to specialized Layer 2 chains. This approach allows Ethereum to maintain its core functions while delegating specific tasks to rollups, which handle transaction execution off-chain. Rollups aggregate multiple transactions into a single batch, compressing and posting them back to the Ethereum mainnet. This process reduces the load on Ethereum, increases throughput, and lowers transaction costs.

By separating execution from data availability and consensus, rollups enable Ethereum to scale more efficiently without compromising security or decentralization. This modular architecture allows Ethereum to focus on its strengths as a secure and decentralized base layer, while rollups provide the necessary scalability and performance enhancements.

The integration of rollups into Ethereum’s ecosystem exemplifies a shift towards a more modular blockchain design, where different layers specialize in distinct functions, leading to a more robust and scalable network overall. This modularity not only improves Ethereum’s performance but also fosters innovation by allowing developers to build and deploy rollups tailored to specific use cases, further enhancing the versatility and adaptability of the Ethereum network.

The modular blockchain approach opens up new possibilities for blockchain interoperability and specialization. By decoupling core blockchain functions, it becomes possible to create purpose-built chains that excel in specific areas while relying on other specialized networks for complementary functions.

Modularity and Chain Abstraction: The Ecosystem

Designing scalable blockchains by removing core functionalities as opposed to replicating them across layers, hubs, shards, parachains, subnets, etc. is a relatively new concept – it is second nature to most existing protocols. The four core functions of a blockchain are captured as : Execution, Settlement, Data Availability and Consensus. [Data Availability (DA) refers to the record keeping function of a blockchain. Once nodes propagate a transaction, they should store a copy of the transaction and ensure that other nodes can retrieve this data for a period. This involves the storage of all blockchain-related information, encompassing the ledger of transactions, the timing of their execution, and more. Consensus is the activity through which nodes order transactions in a specific block and determine collectively how to append new blocks to the chain. This aspect is crucial for achieving a unanimous agreement among nodes regarding the validity of transactions.]

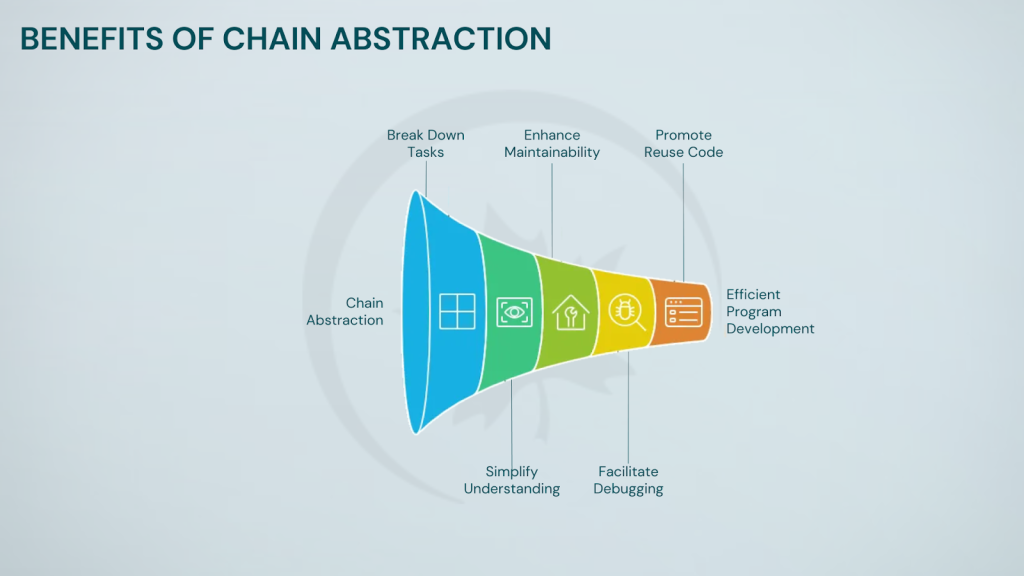

Modular Chains and Chain Abstraction platforms offer several unique selling points that set them apart from traditional blockchain architectures. They provide flexibility, allowing for easy upgrades and customization of specific components without affecting the entire network. Scalability is enhanced by separating different blockchain functions, such as consensus, execution, and data availability, enabling modular chains to achieve higher throughput and lower latency. Interoperability is a key feature, enabling seamless communication and asset transfers between different blockchain networks. The developer experience is improved, as developers can build applications that leverage multiple chains without needing to understand the intricacies of each network. Achieving Chain Abstraction requires the use of a complex set of technologies to provide reliable, cost efficient, secure, fast, and private execution.

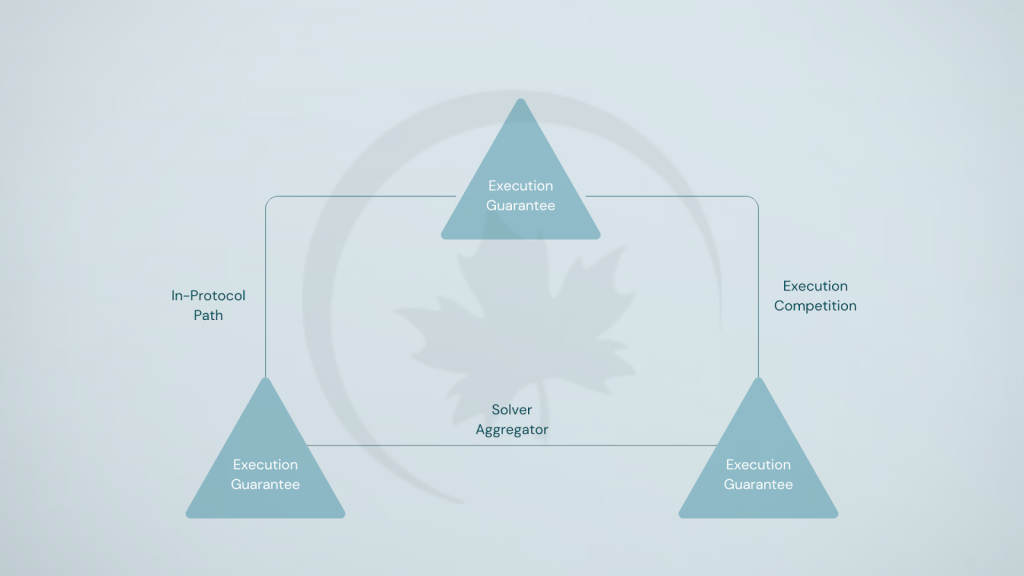

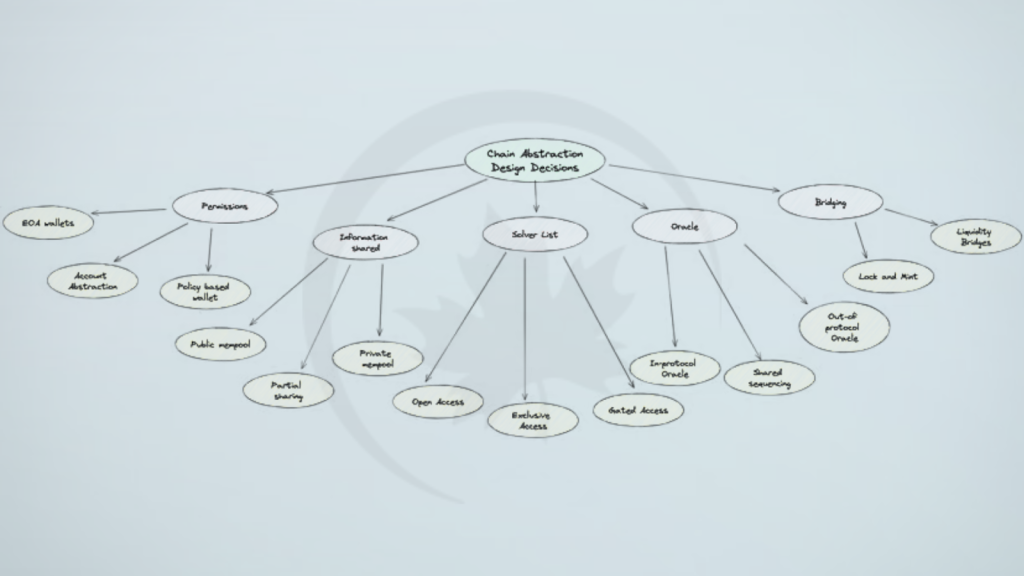

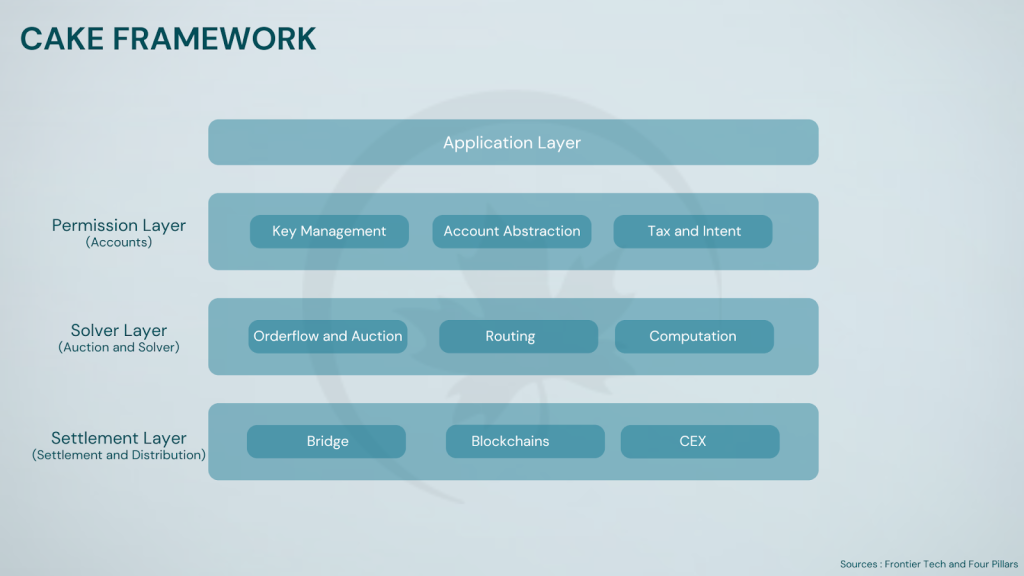

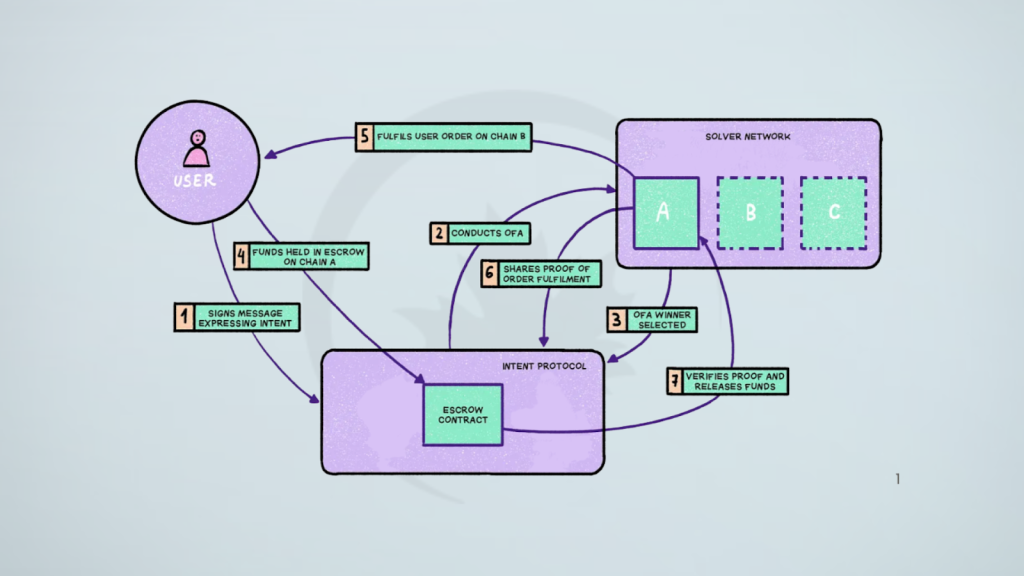

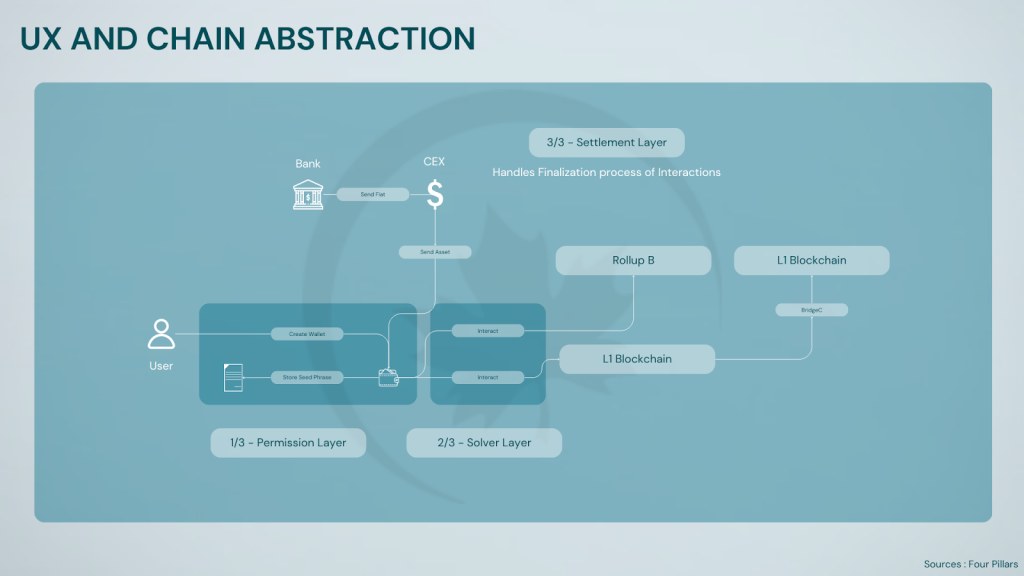

Some prominent examples of Modular Chains and Chain Abstraction platforms include Particle Network (a comprehensive Web3 development platform that offers chain-agnostic APIs and SDKs), NEAR Protocol (a sharded, proof-of-stake blockchain that has implemented native chain abstraction features) Cosmos (an ecosystem of interoperable blockchains built using the Cosmos SDK and connected via the Inter-Blockchain Communication (IBC) protocol) and Polkadot (a multi-chain network that enables customized side-chains (parachains) to connect to a central relay chain). The CAKE (Chain Abstraction Key Elements) framework introduces a structured approach with three layers: Permission, Solver, and Settlement. This framework seeks to make the overall process of interactions more clearer, making different providers to coordinate, and help users to understand which projects handle which operations. The intricate processes involving interactions on various chains and the actual transaction execution can be handled behind the scenes within the infrastructure layers of CAKE.

The architectural construct of Modular Chains differs significantly from traditional monolithic blockchains. In a modular architecture, the blockchain’s core functions are separated into distinct layers: the consensus layer, responsible for agreeing on the order of transactions; the execution layer, which processes transactions and updates the state of the blockchain; the data availability layer, ensuring that transaction data is available and can be retrieved by network participants; and the settlement layer, which finalizes transactions and provides security guarantees. This modular approach allows for greater flexibility and scalability, as each layer can be optimized independently. For example, a blockchain could use a highly secure consensus mechanism while leveraging a separate, high-performance execution layer to process transactions quickly.Chain Abstraction is implemented using a set of tools and libraries that allow developers to create applications that work on multiple blockchains. These tools and libraries provide abstraction from the details of how specific blockchains work.One example of such a tool is Connext. Connext allows users and developers to interact with any blockchain using the same interface, and uses hash bridge technology to ensure the security and reliability of its transactions.

The Permission Layer hosts several pioneering projects aimed at simplifying user interactions across blockchains. Talking about NEAR Protocol and Particle Network, the two acclaimed projects in this Layer is a good starting point to establish the State of Innovation in the Abstraction TechStack.

NEAR Protocol’s Chain Signature stands out with its ability to enable NEAR accounts to sign and execute transactions on multiple blockchain protocols. This is achieved through a process involving foreign address derivation, transaction construction, signature requests via a multichain MPC smart contract, signature reconstruction, and finally, transaction execution on the target blockchain.

NEAR DA is integrated with Arbitrum Nitro, Optimism, and Polygon CDK. L2 built on these stacks can easily switch to NEAR and store data here to reduce costs. One of it’s users, Madara by Starknet, is a Layer 2 solution that utilizes the NEAR DA layer. Madara leverages NEAR’s cost-effective data availability solution for Starknet rollup. The collaboration with Movement Labs empowers developers to create custom rollups on the NEAR blockchain using the MoveVM and attract developers to build dApps on NEAR by providing a user-friendly platform and secure data storage. NEAR DA is a promising solution that can reshape the Data Availability landscape, offering a more cost-effective, scalable, and secure option compared to existing DALs.

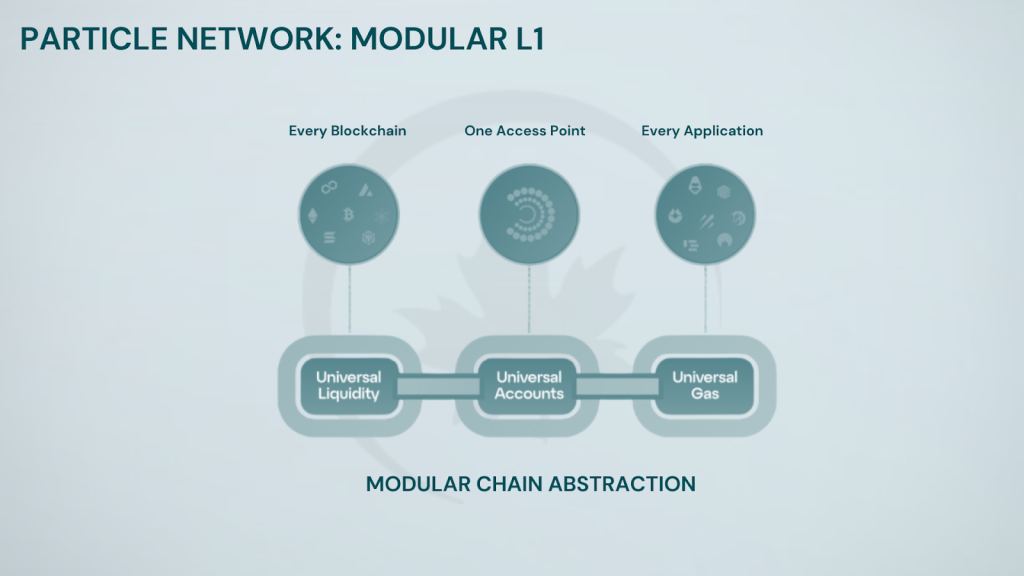

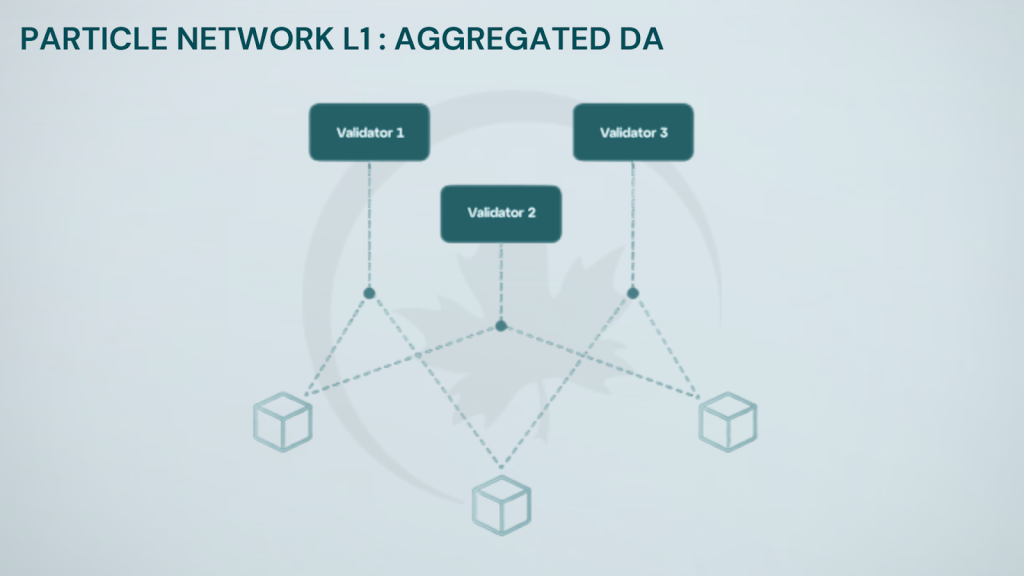

Particle Network offers a fundamentally distinct approach to solving fragmentation – a suite of ‘Universal’ features that significantly enhance user experience. Their Universal Gas allows users to pay gas fees for cross-chain transactions using any token, eliminating the need for multiple native gas tokens. The Universal Liquidity feature unifies liquidity across connected chains through optimistic execution of cross-chain atomic transactions and swaps, while their Universal Account feature allows users to manage a single address and balance across various blockchains, further simplifying multi-chain interactions.

In the Solver Layer, one of the headstarters is Enso Network, which acts as a unifying connectivity layer in the crypto ecosystem. It maintains a shared network state, aggregating data from various blockchains and representing it as entities in a unified graph. This approach eliminates the need for developers to create manual integrations for each smart contract and protocol. Enso enables developers to express desired outcomes using intent requests that span multiple blockchain frameworks, with network participants crafting solutions to fulfill these intents. Atlas EVM is another key player in the Solver Layer, and it focuses on Execution Abstraction. It allows decentralized applications to run auctions that pair User Operations with Solver Operations, optimizing task fulfillment and maximizing miner-extractable value (MEV). A notable feature of Atlas is its trustless execution environment, which allows each frontend to customize auction parameters and value allocation according to their specific needs.

Khalani Network is another innovative stride that presents a unique approach in the Solver Layer with its decentralized infrastructure designed for intent-driven coordination. Its architecture comprises three core components: an intent compatibility layer that standardizes and publishes intents, the Validity VM (VVM) which provides an environment for general-purpose intent processing, and a universal settlement layer enabling atomic and multi-domain settlements. This structure effectively integrates Khalani into various intent-centric applications and ecosystems. A range of protocols are tinkering with various parameters to create their own intent solutions. These include the likes of Across, DLN, UniswapX, and Anoma, and more niche solutions like Everclear focus only on making settlements as efficient as possible. Khalani Network helps solvers coordinate and collaborate to fill these complex orders.

The Settlement Layer is the final layer – crucial in ensuring the finality and immutability of transactions. It serves as the cornerstone for validating and securing transactions. The base of the Settlement Layer is formed by L1 rollups, which are responsible for transaction processing and immutability. L2 rollups offload some transaction processing from its L1, while also relying on the security of the underlying L1 blockchain, periodically anchoring transaction data to the L1 chain to ensure finality. Token Bridges (CCTP, CCIP, xERC20) and AMBs are another keystone inside of this layer. AMBs or ‘Arbitrary Message Bridges’ are protocols that relay data between different blockchains. This ‘arbitrary’ data can be anything that a user wishes to send. LayerZero, Wormhole and Hyperlane are three of the most prominent AMBs currently in use. These AMBs are infact Out-of-Protocol Oracles – meaning they require third-party validators separate from the ones running consensus to transfer information between chains. They are different from In-Protocol Oracles, which are deeply integrated into the consensus algorithm of an ecosystem, and use the validator set running the consensus to transfer information. Cosmos IBC is used for chains running the Cosmos SDK, Polygon ecosystem works on AggLayer, and Optimism operates on the Superchain. Each In-Protocol Oracle uses dedicated blockspace to transfer information among chains of the same ecosystem. As can be realised in the next section, a lot of the solutions on conventional blockchains are infact In-Protocol Oracles, as opposed to the newer alternatives, which are Out-of-Protocol, and are discussed here. On/Offramps and CEXs also need to be considered when building universal compatibility of solutions-stacks.

Safe{Core} (previously Gnosis Safe) has integrated an ERC 7579 adapter for Safe smart accounts built by Rhinestone, designed to supercharge the module ecosystem for smart accounts. This new adapter marks a significant leap forward in the interoperability of smart accounts and gives developers a chance to distribute their smart account modules to Safe’s large ecosystem. Safe, which is an on-chain asset custody protocol, had secured over $100 Billion in assets as of now. It is establishing a universal ‘smart account’ standard for secure custody of digital assets, data, and identity. Safe and Chainlink Labs have established a Strategic Alliance to support Account Abstraction adoption and ecosystem security.

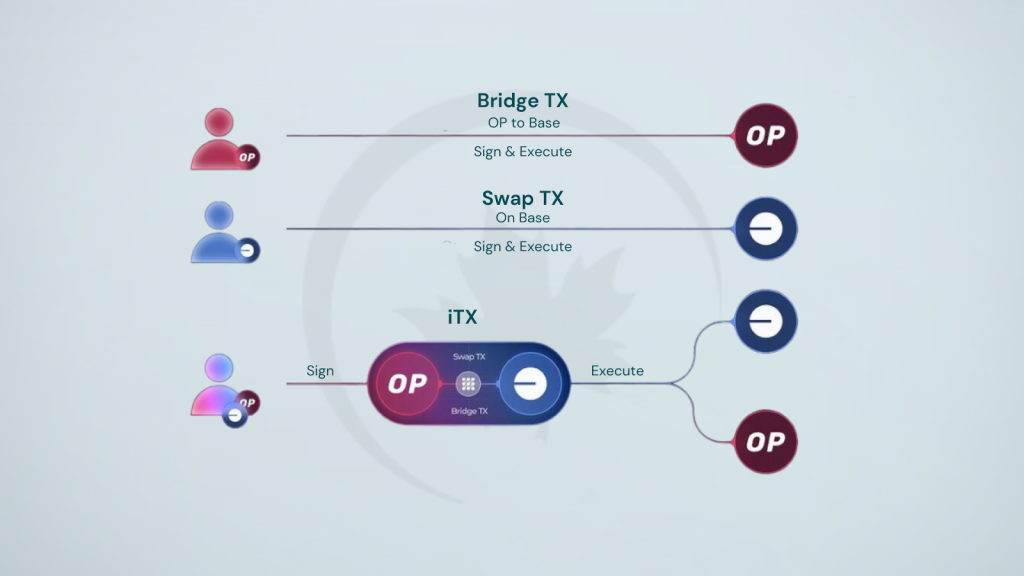

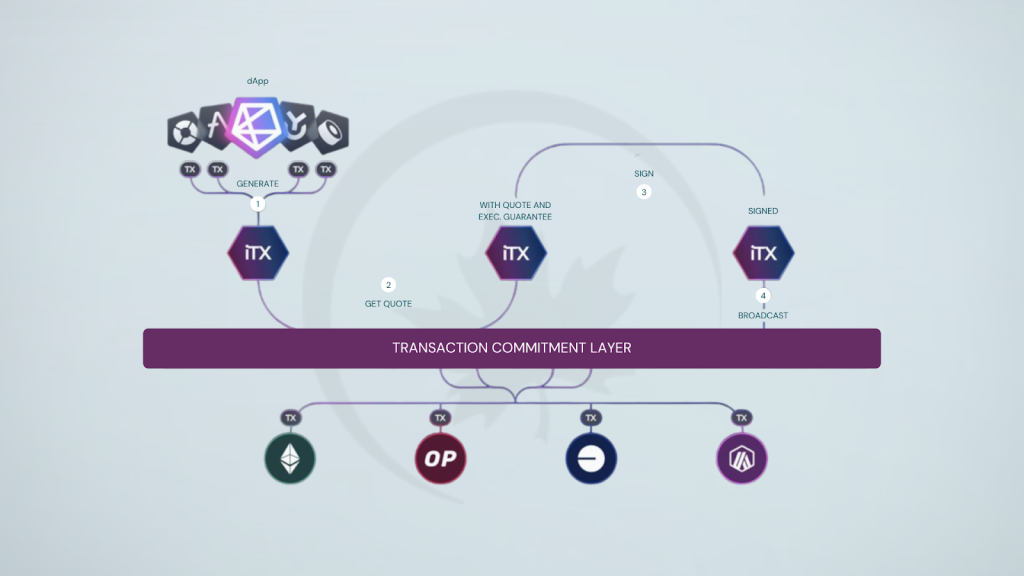

Klaster is another project that represents significant advancement in blockchain abstraction technology, offering a novel infrastructure for developing chain-abstracted applications. This innovative system introduces a network of Nodes that function as a Transaction Commitment Layer, strategically positioned between decentralized applications (dApps) and multiple blockchain networks. Klaster’s approach to interacting with external entities, such as users and dApps, is through interchain transactions (iTx), which facilitate seamless communication across different blockchain ecosystems. In the traditional Ethereum model, an Externally Owned Account (EOA) executes transactions on the Ethereum Virtual Machine (EVM) in a bundled operation, where signing and execution occur simultaneously. This process typically involves a single EOA wallet popup, through which users interact with the blockchain or Remote Procedure Call (RPC). While this method has been the standard for some time, it has limitations in terms of flexibility and cross-chain functionality. The introduction of Account Abstraction (AA), as defined in ERC-4337, marked a significant step forward in enhancing user experience and transaction flexibility. In this more advanced approach, users can approve their User Operations (UserOps) and then delegate the execution to a Bundler. This separation of approval and execution provides greater control and potential for optimization. However, it’s important to note that the AA model is still confined to a single blockchain network, specifically the one where the user’s smart account is deployed. Klaster’s innovative approach builds upon these concepts and takes them several steps further. By breaking the boundaries of single-chain operations, Klaster enables account owners to approve a complex series of potentially interdependent UserOps that can target multiple blockchain networks, all with a single off-chain signature. This signature is then provided to a Klaster Node, which assumes a role similar to that of a Bundler in the AA model, but with significantly expanded capabilities. The Klaster Node is responsible for orchestrating the execution of these operations across various blockchain networks, effectively creating a bridge between different ecosystems.

This multi-chain orchestration capability represents a paradigm shift in how blockchain interactions can be structured and executed. It opens up new possibilities for creating more complex and interconnected decentralized applications that can leverage the strengths of multiple blockchain networks simultaneously – which is the core tenet of what abstraction savants are working on right now. Thus, the implications of Klaster’s approach are far-reaching. By enabling seamless cross-chain interactions, it paves the way for more sophisticated decentralized finance (DeFi) applications, cross-chain asset transfers, and multi-chain smart contract executions. From a technical perspective, Klaster’s Transaction Commitment Layer introduces an additional level of abstraction that allows for more flexible and powerful transaction models. This layer can potentially handle complex logic for determining the optimal execution path across multiple chains, considering factors such as gas fees, transaction speed, and network congestion. This could result in more efficient and cost-effective transactions for users. However, it’s important to note that while Klaster’s model offers significant advantages, it also introduces new challenges, particularly in terms of security and trust. The reliance on Klaster Nodes for orchestrating cross-chain transactions requires careful consideration of potential attack vectors and the need for robust consensus mechanisms to ensure the integrity of these multi-chain operations. This is where the importance of the Abstraction Security Stack comes in.

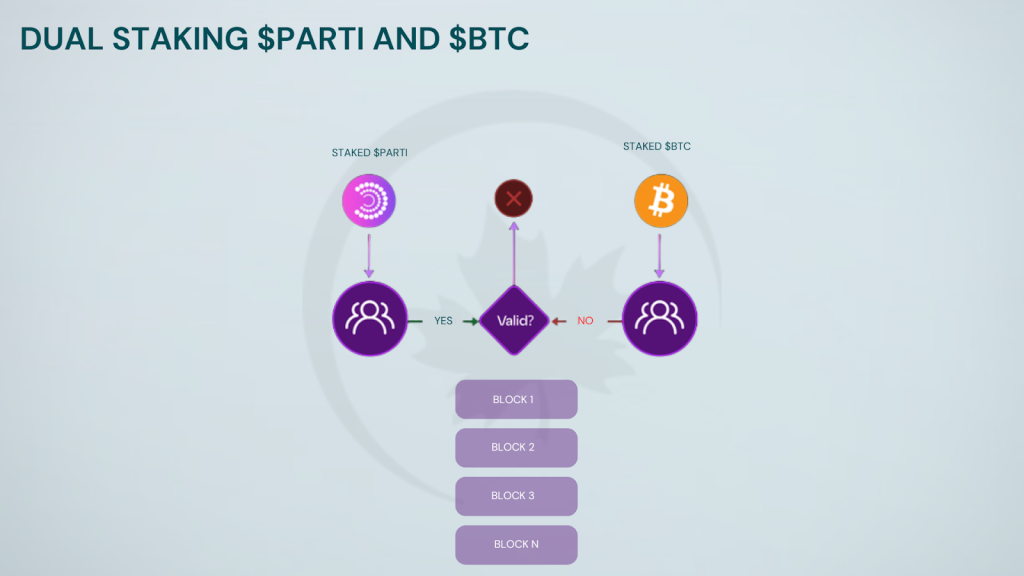

The security stack of Modular Chains and Chain Abstraction platforms typically includes consensus mechanism; cryptographic proofs, such as zero-knowledge proofs or other techniques to verify the validity of cross-chain transactions; decentralized validator networks with multiple independent validators ensuring the integrity of cross-chain operations; rigorous security audits of the smart contracts that facilitate chain abstraction; and economic incentives, including staking mechanisms and slashing penalties to incentivize honest behavior among validators and relayers.

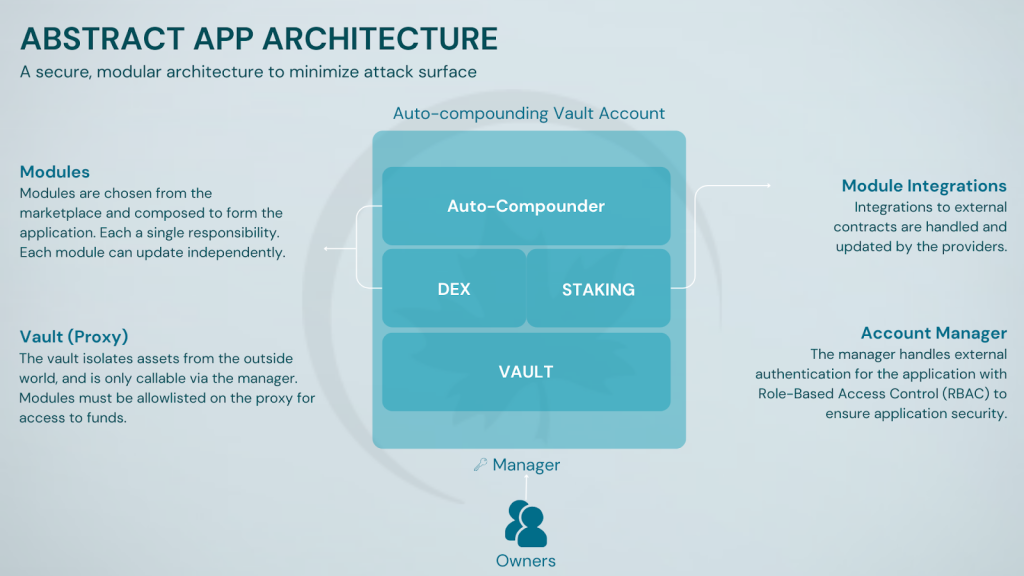

For example, Particle Network uses a dual staking system that employs both the Particle Network Token ($PARTI) and BTC staking via Babylon. This ensures a high level of security and reliability for on-chain assets. The total value locked (TVL) in Chain Abstraction and Modular Chain projects has grown significantly, with some estimates placing it at over $5 Billion as of early 2024. Abstract Money Interchain App provides a full-stack CosmWasm development experience, including smart-contract, middleware, and frontend tooling. The Abstract SDK streamlines the development of interchain applications with a powerful and easy-to-use modular application framework whose capabilities are fully realized via account-abstraction and our on-chain application infrastructure. It also enhances the security approach as follows :

Intent-based solutions are a crucial component of many Chain Abstraction platforms. These systems allow users to specify their desired outcome (e.g. “swap Token A for Token B at the best available rate”) rather than the specific steps required to achieve it. The abstraction layer then determines the optimal path to fulfill this intent, which may involve multiple chains and protocols. Wallet-Coordinated Messaging utilizes capabilities provided by AA or policy-based wallets to offer a cross-chain experience that is compatible with any intent type. It serves as the ultimate CA aggregator, redirecting user intents among various CA designs to address specific intents. These features are embedded in the Avocado wallet, Near Account Aggregator, and Metamask Portfolio, for starters.When looking at and comparing the structure, benefits, and safety prospects of traditional bridging solutions with Chain Abstraction, several key differences emerge – with security being the most consequential one. While bridges often rely on centralized or semi-centralized validators, Chain Abstraction typically leverages more decentralized security models. Chain Abstraction can often provide more efficient routing of transactions across multiple chains compared to point-to-point bridges. The user experience is enhanced, as Chain Abstraction aims to provide a seamless, chain-agnostic experience, whereas bridges often require users to interact with multiple interfaces. In terms of scalability, as the number of blockchain networks grows, Chain Abstraction solutions can more easily accommodate new chains compared to the need for creating new bridges for each pair of networks. Furthermore, Chain Abstraction allows for Key Management Abstraction (KMA) and Bridge Abstraction Management (BMA) – methods for smoothening experiences with both managing private keys, transactional security and the interaction of asset-storage infrastructure with asset-transfer bridges.

Abstraction on Legacy Chains

To understand the significance of Chain Abstraction, it’s essential to compare monolithic and modular blockchain architectures.The two most valuable monolithic blockchains are Bitcoin and Ethereum. However, the limitations of each of these networks have inspired scaling solutions that offload transaction activity to separate layers (i.e., protocols) with varying degrees of functionality and interoperability. The original Bitcoin and Ethereum designs combine all core functions (consensus, execution, data availability, and settlement) into a single layer. This design can lead to scalability issues as the network grows. In contrast, modular blockchains separate these functions, allowing for greater flexibility and potential scalability improvements. Many existing chains are exploring or implementing Chain Abstraction features. Some of the most prominent players in this space include Ethereum 2.0, Celestia, and Polkadot, all of which have embraced modularity to different extents. The Ethereum community has been actively discussing and developing Account Abstraction (EIP-4337), which, while not directly related to Chain Abstraction, lays the groundwork for more flexible account models that could facilitate cross-chain interactions. On the side of Bitcoin’s expansion, Bitcoin developers have experimented with layered scaling solutions through the development of the Lightning Network, which enables users to create bi-directional payment channels atop Bitcoin that function independently from Bitcoin except when opening or closing a channel. Aside from Lightning, other layered scaling projects on Bitcoin include the Liquid sidechain created by blockchain infrastructure company Blockstream and Rootstock. Ethereum is also going through with other techniques such as Plasma, sharding, and rollups. Building on our prior coverage on prominent EIPs (see our May 2024 Edition), here’s a re-compilation of recent, consequential EIPs, this time from an angle of infrastructural focus with regards to enabling abstraction on Ethereum.

Permission Layer

EIP-4337, also known as “Account Abstraction via Entry Point Contract Specification,” has been a game-changer for the Permission Layer. This proposal enables smart contract wallets to be as easy to use as externally owned accounts (EOAs), without requiring changes to the Ethereum protocol. This proposal has enabled projects like Particle Network and Socket Protocol to innovate further, offering more flexible key management and signature abstraction solutions.

Solver Layer

EIP-1559, introduced in the London hard fork, has had a profound impact on the Solver Layer. While primarily known for its changes to Ethereum’s fee market, it has also influenced how solvers operate in the ecosystem. The introduction of a base fee and priority fee (tip) system has made it easier for solvers to predict and optimize gas costs. This has led to more efficient auction markets for solvers, as seen in projects like Atlas EVM and Socket Protocol’s MOFA (Modular Order Flow Auction).Furthermore, EIP-1559’s burn mechanism has implications for MEV (Miner Extractable Value, now Maximal Extractable Value) strategies, influencing how solver networks like Khalani and Essential operate.

Settlement Layer

EIP-4844, also known as “Shard Blob Transactions,” is set to have a significant impact on the Settlement Layer, particularly for Layer 2 solutions. This proposal introduces a new transaction type that accepts “blobs” of data, which are cheaper to store than calldata. This proposal is particularly relevant for projects like EverClear (formerly Connext), as it allows for more efficient clearing and settlement of cross-chain transactions. In addition, EIP-3651 (Warm COINBASE), while seemingly minor, has implications for the Settlement Layer. By making the COINBASE warm, it reduces gas costs for transactions that interact with the block producer, potentially impacting how CEXs and on/off-ramps operate.These EIPs, among others, have collectively pushed the boundaries of what’s possible in terms of blockchain abstraction and modularity. They’ve enabled innovators across all layers of the infrastructure stack to create more efficient, user-friendly, and interoperable solutions.

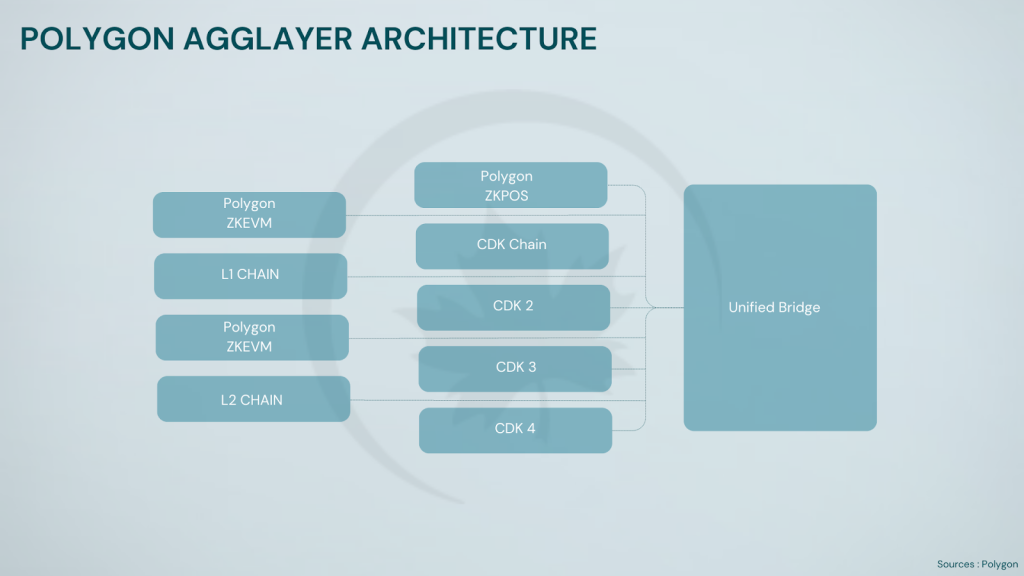

The new solutions like NEAR are also enabling existing chains to benefit from their endemic architectural features to provide improvements that contain varying degrees of semblance to not just an abstraction-compatile chain, but infact an abstraction-ready chain. That being said, the incumbents of the blockchain world have such versatile traffic, dApp ecosystem and security features, that they’ve been making remarkable strides themselves to ensure their relevance with regards to this paradigm of development.Polygon, as a Layer 2 scaling solution for Ethereum, has been working on improving interoperability with other chains. Their recent acquisition of Mir Protocol aims to enhance zero-knowledge proof technology, which could be leveraged for more efficient cross-chain transactions. zkSync, another Layer 2 solution, has implemented native account abstraction, which simplifies user onboarding and interaction with decentralized applications. Account versioning in ZKsync facilitates future updates and changes to the account abstraction protocol by allowing accounts to specify which version of the protocol they support. The Polygon CDK allows projects to launch ZK-based interconnected L2s or connect existing L1s ones to the AggLayer, maintaining liquidity, users, and state. While not directly Chain Abstraction, this feature demonstrates the undercurrents of a larger trend towards the flow of attention in conventional blockchain developer communities towards more user-friendly, modular blockchain interfaces.

The NEAR Protocol integrates zkWASM, a project being developed in collaboration with Polygon, and leverages EigenLayer’s powered Fast Finality to enhance transaction processing speeds – benefitting all stakeholder ecosystems.The distribution of assets from traditional blockchains onto Modular Chains is gaining traction as a means of improving utility and cross-chain interoperability. For example, wrapped versions of popular assets like Bitcoin and Ethereum are becoming increasingly common on various chains, allowing users to leverage these assets across multiple ecosystems.Chain Abstraction also plays a crucial role in helping blockchains become quantum-resistant. As quantum computing technology advances, it poses a potential threat to current cryptographic methods used in blockchain networks. Modular architectures and abstraction layers can potentially allow for easier upgrades to quantum-resistant cryptography without requiring a complete overhaul of the entire blockchain network. This sentiment can be seen in the co-adoption of Modularity principles with Quantum-resistant cryptography on the Ethereum network via recent EIPs, with many more of such prudent measures to come.

Chainlink and Folks Finance : Aggregated DeFi Services and Network Abstraction

A rare foray into one of the most crucial pieces of the overall Blockchain TechStack – Chainlink, can be made from an angle of it’s importance in supporting abstraction services to scale, and similarly, in the advanced DeFi services provided by Folks Finance, that streamline the flow of money to keep the machinery churning.

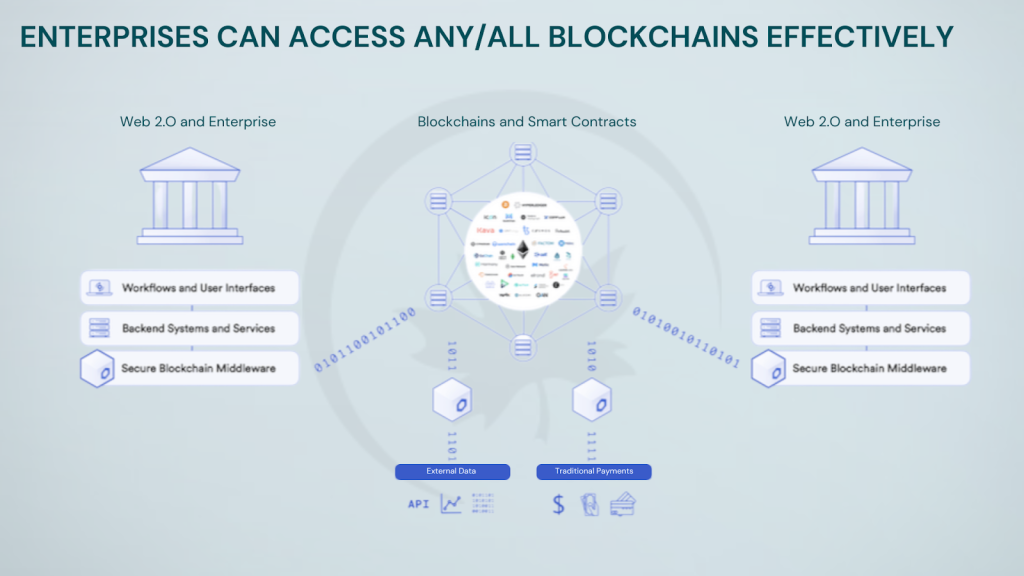

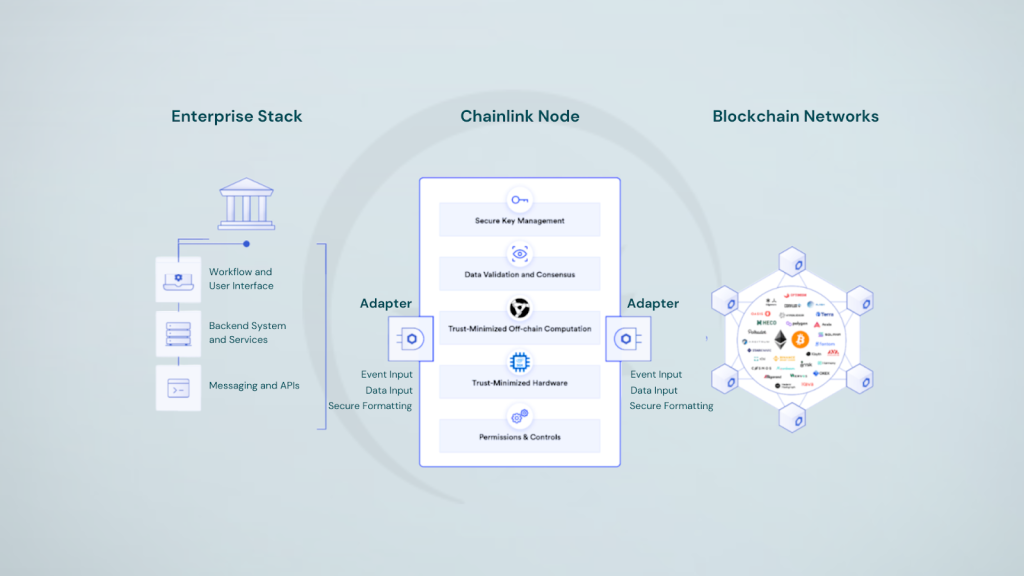

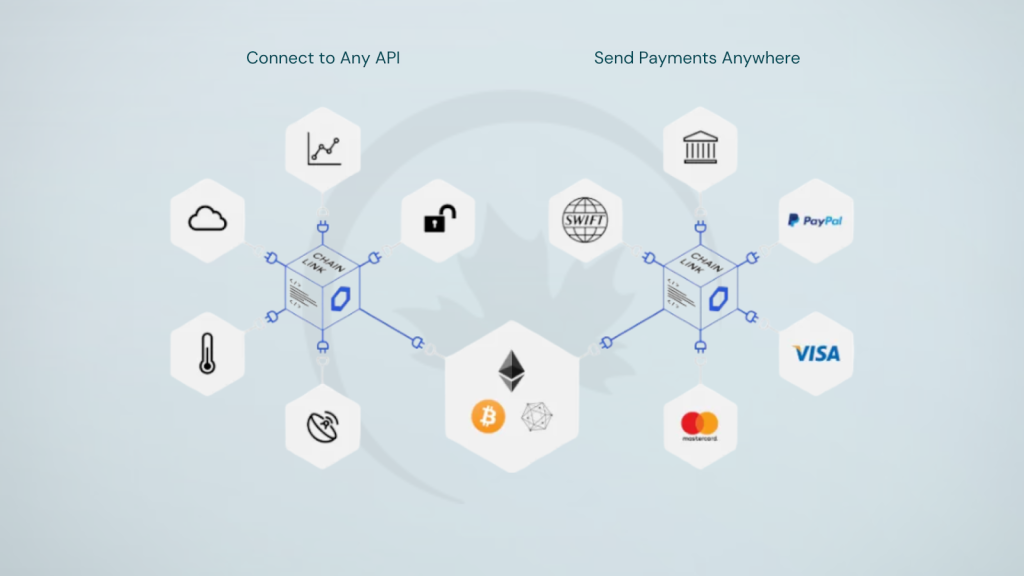

Chainlink’s oracle networks helps smart contracts in reliably connecting to any external API and to leverage secure off-chain computations for enabling feature-rich applications. Chainlink currently secures tens of billions of dollars across DeFi, insurance, gaming, and other major industries, and offers global enterprises and leading data providers a universal gateway to all blockchains.

Folks Finance is a community-driven decentralized platform providing permissionless DeFi tools across multiple networks. The Folks Finance protocol is a non-custodial web dApp that runs several smart contracts deployed on the Algorand Blockchain. These smart contracts enable some of the frontier DeFi services to be accessed and executed on a wide variety of legacy + up-and-coming blockchains alike.

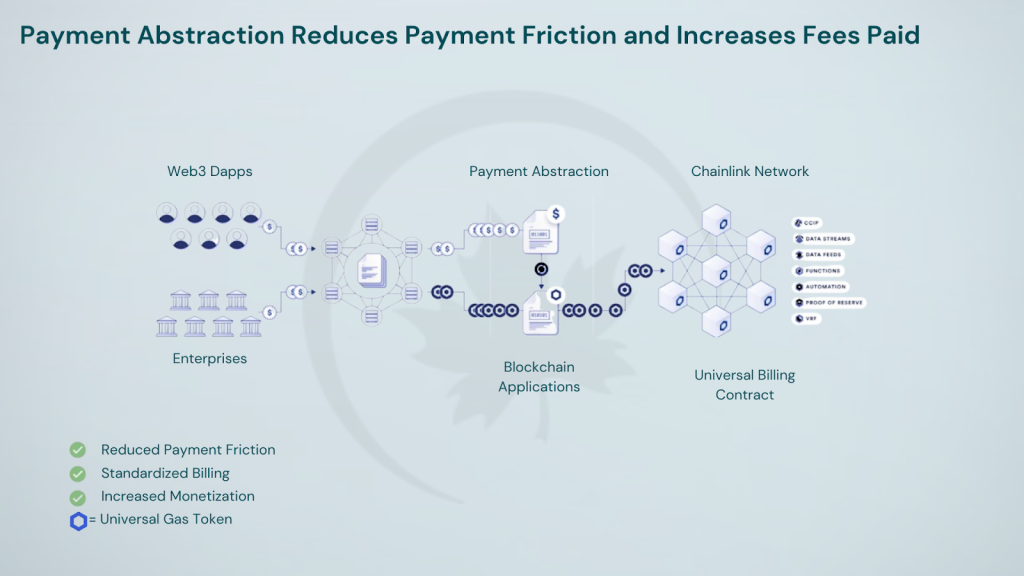

Chainlink’s decentralized oracle network serves as a crucial backbone for blockchain interoperability and chain abstraction projects, providing secure and reliable cross-chain communication – a fundamental requirement for the seamless operation of multi-chain applications. At the heart of Chainlink’s offering is the Cross-Chain Interoperability Protocol (CCIP), a universal, open-source standard for cross-chain communication. CCIP allows smart contracts on different networks to seamlessly interact, transfer tokens, and execute instructions across blockchain ecosystems. This protocol is designed to be blockchain-agnostic, supporting both public and private chains, and is secured by the decentralized oracle networks that Chainlink is renowned for. The CCIP creates a critical abstraction layer for enterprises, enabling them to build cross-chain applications without needing to understand the intricacies of each individual blockchain.

Chainlink has further deepened it’s stack with the Smart NAV, which leverages DTCC’s digital asset capabilities. NAV data is a critical building block that underpins the traditional fund industry today. With Chainlink, NAV data can be accurately reported and synchronized on-chain in an automated and secure manner, providing real-time transparency and built-in access to historical data. Beyond this use case, Chainlink also provides a chain-agnostic approach for disseminating NAV data, enabling the data to securely propagate across any blockchain or existing offchain system. The Chainlink Network goes far beyond onchain data delivery to meet the three requirements of tokenized assets, providing cross-chain interoperability as well as dynamic synchronization to power programmable assets that stay updated across any environment.

Complementing CCIP, Chainlink’s decentralized data feeds deliver real-world data to smart contracts across multiple chains, ensuring consistent and accurate information across different blockchain environments. This is particularly crucial for DeFi applications that require up-to-date price information across various assets and chains. The platform’s Verifiable Random Function (VRF) provides cryptographically secure randomness across multiple chains, essential for gaming and NFT applications in a chain-abstracted environment. Additionally, Chainlink Automation enables the creation of decentralized, trust-minimized automation for smart contracts across various networks, facilitating cross-chain operations without constant manual intervention

With more than 2600 integrations, around 200 different projects have actively integrated CCIP – making it a critical component of atleast 1 in every 13 different blockchain mainnets in the cumulative ecosystem. Several prominent chain abstraction projects leverage Chainlink’s technology. LayerZero utilizes Chainlink oracles for secure cross-chain messaging and value transfer, Axelar Network incorporates Chainlink’s price feeds for accurate cross-chain asset valuation and Polygon zkEVM leverages Chainlink’s data feeds for DeFi applications spanning Ethereum and Polygon.

Arbitrum uses Chainlink oracles for secure cross-chain data transfer between Ethereum and Arbitrum. More recently, Airchains, a modular ZK rollup solution, joined the Chainlink BUILD program to accelerate the adoption of modular blockchain infrastructure. Sygnum, Fidelity International, Chainlink, and Matter Labs collaborated on a project giving the CeFi giants access to the NAV data and services to weld a point-of-contact into the DeFi ecosystem.

Chainlink has launched several initiatives and accelerator programs to further advance the goals of interoperability and abstraction security in the blockchain space. The Chainlink SCALE program (Sustainable Chainlink Access for Layer 1 and 2 Enablement) is designed to accelerate the adoption of Chainlink oracle services across rapidly growing blockchain networks. The Chainlink Labs Grant Program has been expanded to specifically target projects working on cross-chain interoperability and security solutions. Aforementioned frontrunning projects like Klaster and Safe have also established strategic alliances, or benefitted from the innovation at Chainlink Labs to support Account Abstraction adoption and on-chain ecosystem security in their respective projects. In particular, the partnership with Safe (formerly Gnosis Safe) aims to leverage Chainlink’s oracle networks to provide additional security layers for smart contract wallets, adding to Chainlink’s current arsenal of security features like Threshold Signatures, which enhance security by requiring multiple parties to sign off on cross-chain transactions, and its Node Reputation System, which adds an extra layer of security by prioritizing reliable oracle operators.

Just like empowering and securing Smart Contracts is quintessential for ensuring consistent innovation, security and scale in any pioneering blockchain technology, not the least in trans-chain ideas like Chain Abstraction, the ease and safety of commitment of funds, investments, and transactions is another highly critical factor for keeping any ecosystem, that has a financial component to it, alive. That is the weight that DeFi service providers have to wield. In the realm of DeFi, Folks Finance plays a significant role in offering aggregated services that complement and benefit from the interconnected Web3 ecosystem. Folks Finance’s multi-chain lending protocol is designed to work across multiple chains, aligning with the principles of chain abstraction. The platform offers interoperable yield strategies, allowing users to access yield opportunities across different chains without needing to understand the underlying complexities. Potentially enabling cross-chain collateralization, Folks Finance allows users to use assets from one chain as collateral on another, enhancing capital efficiency in a chain-abstracted environment. The platform provides a unified interface for accessing various DeFi services across multiple chains, simplifying the user experience and embodying the principles of chain abstraction. It also implements cross-chain risk assessment models to secure lending and borrowing activities in an abstracted environment. The platform utilizes a decentralized governance model that can adapt to the security needs of an evolving, abstracted blockchain ecosystem, all the while fostering trust as it’s regular smart contract audits contribute to the overall security of the DeFi ecosystem across multiple chains.

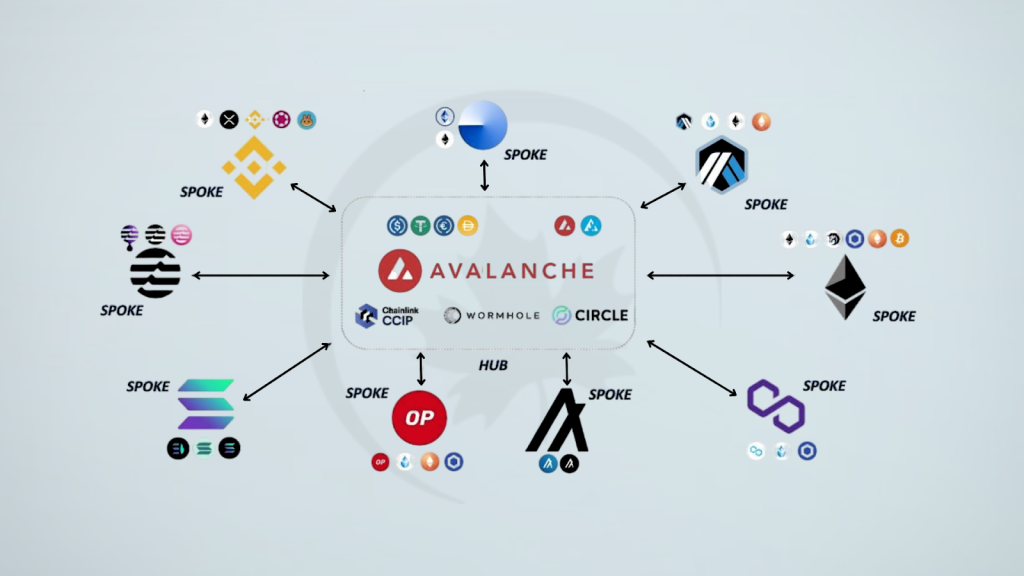

With a host of unprecedented features, Folks Finance aims to offer the most efficient and flexible on-chain permissionless loans and to build sustainable DeFi – a hub-and-spoke model integrating multiple legacy and pioneer chains in it’s service suite, enabled by leveraging robust messaging technologies like Wormhole, Chainlink CCIP, and Circle’s CCTP. This hub-and-spoke model will capitalize on the strengths of each connected blockchain, ultimately enabling seamless wallet connectivity from major chains and access to cross-network liquidity. A plethora of prominent chains serve as the Spokes to the central Hub – these Spokes currently include chains like Binance Chain, Arbitrum, Algorand,Polygon, Solana, Ethereum and more.

For starters, Folks has implemented separate smart contracts for each loan, offering users the ability to efficiently select the most suitable collateral and loan pair. This feature ensures the optimal configuration of parameters such as Loan-to-Value ratio and under-collateralization thresholds, prioritizing both user convenience and protocol security. Once a loan position is established, users enjoy the flexibility to manage their position, including adjusting collateral amounts and making partial or full loan repayments. The Folks Router is a flagship innovation – a DEXs aggregator that empowers users when swapping tokens across multiple decentralized exchanges (DEXs) on the Algorand blockchain, by searching across multiple DEXs on the Algorand blockchain to find the best possible rates for your token swaps. Their innovative design allows flexible flash loans where one can request multiple flash loans from different pools concurrently. On the security front, Folks Finance’s Ultraswap platform offers a streamlined solution to the intricate “loan looping” tactic within DeFi markets. By utilizing flash loans and the Folks Router, Ultraswap consolidates the procedure into a singular transaction, enhancing operational efficiency and accuracy.

Conclusion

The Chain Abstraction and Modular Chain ecosystem has seen a significant increase in venture capital funding, with over $500 Million invested in related projects in 2023 alone, a number that is significantly larger in 2024 given the proactive nature of venture funding into pioneering crypto technologies and with the larger awareness and welcoming adoption of niche blockchain development projects that can benefit the overall on-chain universe at large, pertaining to the influx of assets – both retail and institutional – via financial instruments and derivatives such as crypto ETFs and on-chain derivatives and DEX activity. Between January and August 2024, the number of projects supporting chain abstraction technology increased by over 150%, and interest from capital markets has also surged significantly, with total investments exceeding $1 Billion.This influx of capital has led to several early success stories, such as the rapid adoption of Particle Network’s chain-agnostic APIs by developers and the growing popularity of NEAR’s Chain Signatures technology. As of July 2024, NEAR Protocol has solidified its position as a leading blockchain platform, ranking high in terms of TVL and user engagement, with daily active addresses reaching 1.2 million—a 42% quarter-over-quarter increase and a 377% rise over six months. At the same time, Particle Network has had 900+ dAppintegrations and more than 17 Million activated wallets, raised $25 Million from a whole array of investors, successfully launched the People’s Alliance and thus has successfully deployed into it’s much awaited Particle Testnet V2.New network services and development platforms are emerging to support traditional chains in providing abstraction services to their users. For example, the Arcana Network offers a suite of tools for developers to build decentralized applications with enhanced privacy and seamless user onboarding across multiple chains and targets upto 90% customer retention via seamless user-experience. With 100+ Partners onboarded, 21K+ SDK downloads and 2K+ dApps, Arcana recently partnered with BVM Network to Enhance Bitcoin L2 Infrastructure. The Lit Protocol provides programmable cryptography solutions that enable developers to create chain-agnostic applications with advanced access control features. Axelar Network delivers secure cross-chain communication and asset transfer capabilities, allowing developers to build interoperable decentralized applications. LayerZero offers an omnichain interoperability protocol that enables seamless messaging and asset transfers between different blockchain networks. On the front of more infrastructural advancements – one example of such a tool is Connext. Connext allows users and developers to interact with any blockchain using the same interface. It uses hash bridge technology to ensure the security and reliability of its transactions, and has seen strong traction going ahead. From early 2024 to the present, chain abstraction technology has gradually permeated various sectors, including decentralized finance (DeFi), non-fungible token (NFT) trading, and cross-chain communication. Projects in these areas have integrated chain abstraction technology to significantly simplify user operations and enhance the overall user experience.Interoperability between various Modular Chains is becoming increasingly important as the ecosystem grows. Projects like Cosmos and Polkadot are leading the way in creating standards and protocols for cross-chain communication, taking advantage of their pre-eminence, and paving the way for a more interconnected blockchain landscape. Numbers paint an optimistic picture for the future of Chain Abstraction and Modular Chains – there are nearly 300 chains with significant liquidity and on-chain expressiveness, from Layer-1 to Layer-3 solutions. This number is growing, and in need of modularity and abstraction. According to Binance Research (2024), the number of daily active users interacting with chain-abstracted applications grew by 200% in the past year. Additionally, the total value locked in cross-chain DeFi protocols leveraging abstraction technologies has surpassed $10 Billion, showcasing the growing confidence in these solutions. That being said, there is still scope for a more 360°, well-rounded approach to Chain Abstraction – one that involves minute changes in the definitions of the functionalities at the different steps of Abstraction, but one that is highly consequential, and deserving of attention – especially in light of the ripple effects it can have in a highly interconnected yet fundamentally decentralised world, and in order to avoid systemic risks for the blockchain base layers and to ensure effectiveness beyond just the UX, which primarily popularised this niche of on-chain development, but to ensure the integrity of timeless non-negotiables like execution, security and composability – in the realms of architecture and deployment.

As we look towards the future, the era of abstracted decentralization promises to bring about a more unified, efficient, and user-friendly blockchain ecosystem. By breaking down the barriers between different chains and simplifying the user experience, Chain Abstraction and Modular Chains are poised to drive the next wave of blockchain adoption across various industries, from finance and gaming to supply chain management and beyond.The journey towards a fully abstracted and interoperable blockchain landscape is still in its early stages, but the rapid progress and growing interest from both developers and users suggest that we are on the cusp of a transformative period in the evolution of decentralized technologies. As these solutions mature and become more widely adopted, we can expect to see a blockchain ecosystem that is more accessible, efficient, and capable of supporting the complex applications and use cases that will define the Web3 era.