On 13th October 2021, the Polkadot founders Gavin Wood and Robert Habermeier announced that the network had reached the technical capability to support its first ever cohort of parachains. This was followed by a motion submitted to the Polkadot Council to open the network’s first parachain auction beginning from 11th November, 2021. We at Mapleblock Capital support multiple projects in the Polkadot ecosystem, and share the multichain vision of the Polkadot team. In this article we give an in-depth look at parachains, the auction mechanism, and look back at the Kusama parachain auctions that happened this year

What are Polkadot & Kusama?

The Polkadot network is a project by Web3 Foundation and Parity Technologies that can be best described as a blockchain of blockchains. Its vision is based on interoperability and a shared security model between multiple different blockchains, by running them as parallel networks across its numerous shards called parachains. At the core of the Polkadot network is the relay chain which serves as a L0 protocol designed to provide security and cross-chain interoperability to all the L1 networks in the ecosystem. It is one of the biggest plays focused on building an infrastructure layer for a multi-chain future.

Kusama is the ‘canary network’ of Polkadot and serves as an experimental network to test new code, features with faster iterations and lower stakes. It is in a way a proof-of-concept for Polkadot’s NPoS consensus model.

The Polkadot ecosystem offers the following features to the parachain:

- Interoperability: cross-chain communication between blockchains

- Self-Governance: blockchains can customise their governance

- Upgradability: Polkadot enables forkless upgrades

- Shared-security: reduced cost of network security & more secure consensus layer

Network Architecture

The network architecture can be divided into 4 main components:

Relay Chain

The relay chain is the heart of the network responsible for consensus and cross-chain interoperability, but has reduced functionality. The relay chain can’t run smart contracts.

Parachains

Parachains are a diverse set of specialised blockchains that connect to the relay chain for consensus. They are the core component of Polkadot’s multi-chain model. The network also has common-good parachains that serve as public utility infrastructure controlled by Polkadot governance

Parachains are native blockchains that have the following features:

- Customizable governance, block production, and tokenomics

- Shared security from Polkadot’s Relay Chain

- Can post cross-chain transactions with other parachains

Parathreads

Parathreads are similar to parachains but follow a pay-as-you-go model instead of leasing a Parachain slot auction.

Bridges

Bridges are a special type of parachain that allow communication with non-substrate based blockchains outside the Polkadot ecosystem. Eg. Ethereum, Solana and Bitcoin

How to get a Parachain Slot?

For any project to participate in the Polkadot or Kusama ecosystem as a parachain, they must lease a parachain slot via an auction process. Parachain slots are leased for a fixed duration; Polkadot offers 2 year slots divided into 3 month periods & Kusama offers 1 year slots divided into 6 week periods.

The number of parachain slots is limited in order to create competition, it also helps projects gain status in the community on winning a slot auction. Parachain slots can be allocated in 3 ways:

- Common-good chains: allocated by on-chain governance eg. Statemint (Polkadot) and Statemine (Kusama)

- Parathread: slot is auctioned on a per-block basis and works as a pay-as-you-go model. A parathread can be shared by multiple projects

- Public auction: sold via non permissioned candle auction mechanism

Auction rules and schedule

In the public auctions the teams must bid for a slot using $KSM/$DOT of their own or source the funds from the community using a crowd loan. Funds are locked for the period of the lease and returned back to the teams after the lease period ends. The auction runs for a period of 1 week via a Candle auction mechanism. This ensures that bidders are putting their actual bid early.

How does the Auction work?

- Teams bid by specifying a continuous range between the 1-8 periods for a slot and the amount of $KSM/$DOT they are willing to lock up during the lease duration

- Teams can bid funds during the entirety of the auction period and can view the bids by other projects and increase their bid

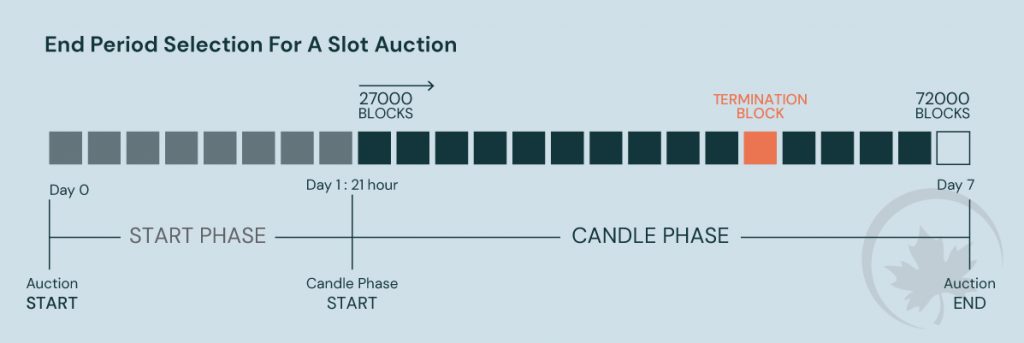

- The highest bid at the end of the auction is determined as a winner but the cut-off limit for bidding is determined as a random block throughout the bidding period. The termination block can lie anywhere after the 27,000 (day 2) block to the last 72,000 (day 7) of the bidding period.

The termination block is calculated randomly via Verifiable Random Function at the end of the 1-week bidding period. The winning bid’s KSM amount remains locked for the duration of the lease, after which it can be unlocked. Teams can extend their lease by winning another auction before the conclusion of their current slot’s lease period.

Determining the Slot winners

An auction is for the right to occupy a parachain slot in each of eight periods, making up the total lease time. These eight three-month periods may all go to the same bidder (gaining them a two-year uninterrupted period beginning at the start of the next lease period), or they could go to eight individual bidders or any other combination that maximises the amount of $DOT locked during the lease period.

This format allows for various use cases; a new project may wish to “try out” being a parachain for six months only by purchasing just the first two periods. Conversely, a project might want to secure a two-year runway by making a single bid for all eight periods. Or perhaps be guaranteed a 12-month period in 12 months’ campaign time, once the project is developed, by making a bid on the final four periods. Existing parachains may wish to keep their position renewed by consistently winning the last slot and thus always keeping their remaining lease between 21 and 24 months.

To account for all of these scenarios, the auction mechanism is designed to maximize the amount of DOTs held on bond over the entire two-year period, so the highest single bidder for any given slot’s lease period may not always “win”, hence giving room to multiple variations. Assuming there is only one parachain slot available (as will be the case with all initial auctions). We illustrate how winners are determined using the following example:

Assume the following bids were made during the auction:

Team A bids 200 $DOT, for the duration of the entire eight periods, making the total locked value 200*8 = 1600

Team B bids 100 $DOT, but for only the first two periods, making the total locked value 100*2 = 200

Team C bids 300 $DOT, for the last six periods, making the total locked value 300*6 = 1800

Team D bids 350 $DOT, for the duration of the first four periods, making the total locked value 350*4 = 1400

Team E bids 200 $DOT for the duration of the last four periods, making the total locked value 100*4 = 400

There are 3 ways to allocate the eight slots between these teams:

Even though Team D had the highest bid and Team A bid for the entire duration of the slot period, neither of them could result in the highest total locked $DOT. Combination 2 results in the largest pool of locked DOTs and hence it wins the auction.

Crowdloans

The Polkadot/Kusama auctions allow projects that do not have the financial resources to win an auction to bootstrap liquidity from their community in the form of crowdloans. Community members bond their $DOT/KSM and cannot earn staking rewards during the lease period of the parachain. However projects can create incentives for their community typically in the form of native token rewards. In the recent Kusama parachain auctions most teams raised contributions from crowdloans.

Teams can structure their crowdloan in various ways, hosting it either natively on Kusama or on a 3rd-party platform. The typical process for a crowdloan conducted natively on Kusama looks something like this:

- Teams create a crowdloan campaign by setting a maximum contribution amount and a campaign end date. A campaign can last for several auctions. The end date accounts for the possibility that a team can choose to participate in multiple auctions.

- $KSM Contributors initiate a special transaction by transferring the assets to the campaign’s index, this is not the same as sending assets to an external account.

- $KSM contributions can be submitted throughout the duration of the crowdloan campaign or until an auction is won.

Crowdloaned $KSM remains locked for the whole duration of the lease period, post which it is returned to the contributor. In case a crowdloan campaign ends without the team winning an auction, then contributors can withdraw their staked $KSM. Since this crowdloan module is on the Polkadot Relay Chain, contributors can trust that their contribution is safe and will be returned to them at the end of lease or if their team does not win the auction.

Investing tokens in a crowdloan carries significant risk as contributors will be illiquid during any market volatility. However, backing the right projects has yielded a significant ROI for contributors as we will see in the next section.

Recap of the Kusama parachain auctions

So far the Kusama network has successfully completed two batches of parachain auctions. The first batch of parachain auction was concluded on July 20th 2021 and the second batch concluded on 13th October 2021. For those committed to the Kusama ecosystem, investors saw ROI as high 2058% without even losing exposure to their $KSM/$DOT. It would be interesting to keep an eye on how this affects the demand to participate in Polkadot crowdloans.

Data source: https://parachains.info/auctions#tab-faq-crowdloan

On 19th October 2021, the Kusama community passed motion 377 which will schedule 48 parachain auctions on a weekly basis starting on 23rd October 2021. Here is a short summary of all the projects that won the slot auctions in the first two batches:

Karura

Karura is the sister network of Acala, which is a DeFi platform made for Polkadot integration. The network already has an up and running platform that offers a suite of financial applications including a trustless staking derivative (with liquid KSM), a multi-collateralized stablecoin backed by cross-chain assets (kUSD), and an AMM DEX – all with micro gas fees that can be paid in any token.

MoonRiver

Moonriver is a smart contracts platform that allows Solidity (Ethereum) smart contracts to be executed in Kusama. Hence Moonriver seeks to act as a bridge between Kusama and Ethereum. Moonriver is a companion network to Moonbeam and provides a permanently incentivized canary network. New code ships to Moonriver first, where it can be tested and verified under real economic conditions. Once proven, the same code ships to Moonbeam on Polkadot.

Shiden Network

Shiden Network acts as a multi-chain decentralized application layer on Kusama. Kusama Relaychain does not support smart contract functionality by design, hence it needs a smart contract layer. Shiden supports Ethereum Virtual Machine, WebAssembly, and Layer2 solutions from day one. Similar to Moonriver, Shiden Network can bridge to Ethereum and also to Cosmos, Secret Network and other Blockchains.

Khala Network

Khala Network is again a Canary Network for Phala Network which has been designed for Polkadot. Phala Network seeks to provide strong guarantees of confidentiality without sacrificing cross-contract interoperability, which means the confidential contracts in Phala Network can interact with other confidential contracts freely. Further, as a Kusama parachain, Khala Network enables cross-chain interoperability of smart contracts to confidentially operate assets on another blockchain.

Bifrost Finance

Bifrost is a multichain middleware platform that enables developers to use multiple blockchain protocols simultaneously and seamlessly. Bifrost used its main network (not Canary Network) to participate in the auction, when the Kusama slot expires, it plans to snapshot the data to Polkadot’s genesis block to complete the migration of the mainnet from Kusama to Polkadot.

KILT Protocol

KILT removes the need for companies to collect passwords and user data by helping users prove their identities online through its protocol. The project was created partially to get the software industry involved in web3, along with other organizations desiring increased trust and data sovereignty. KILT is a simple protocol (comes with an easy JavaScript SDK) for creating, requesting, issuing, presenting, and validating digital credentials.

Calamari

Calamari Network, the Kusama Network canary net of Manta Network, is a privacy-preservation protocol for the entire DeFi stack. Calamari’s goal is to offer privacy as a utility service to the entire Kusama ecosystem and will be working closely with all Kusama projects to enable privacy for their tokens.

Basilisk

Basilisk helps young cryptoprojects distribute tokens to their communities while navigating initial price discovery. It provides a gateway to liquidity bootstrapping in Kusama. Basilisk has the ambition to fully decentralize its governance and quickly become the first community-run parachain on Kusama.

Altair

Altair combines the industry-leading infrastructure built by Centrifuge to finance real-world assets (RWA) on Centrifuge Chain. From art NFTs to undiscovered assets — Altair enables users to tokenize their most experimental assets and finance them. Altair acts as a canary network to its Polkadot counterpart, Centrifuge, newest experimental features are tested on Altair before they go live on Centrifuge Chain.

Heiko Finance

Parallel Finance is a decentralized money market protocol that offers lending, staking, and borrowing in the Polkadot ecosystem. Depositors can lend and stake simultaneously to earn a double yield on their staked coins, and borrowers can collateralize to borrow.

Kintsugi

Kintsugi is the Polkadot counterpart of interBTC, a fully trustless and decentralized Bitcoin bridge. Kintsugi is maintained by a decentralized network of collateralized Vaults who secure locked BTC on Bitcoin. It features a MakerDAO-like multi-collateral model, allowing for stable and interest-earning assets like $BTC as collateral.

Why become a Parachain?

In our final section we try to breakdown the cost and benefits of becoming a parachain in the first place.

The Cost

It is important to understand that the $KSM/$DOT is returned to bondholders unless a project intends to continuously lease a slot in the Kusama/Polkadot ecosystem. This means that the real cost is the opportunity cost of not staking/LPing the tokens for the duration of the lease. This also carries a risk incase of a price drop as the teams will be illiquid and incapable of exiting their positions in the bonded tokens.

For now, we will assume that a team is long term invested in the ecosystem and try to calculate the cost of leasing a parachain slot.

Let’s take an example based on the data from Kusama auctions:

- In a typical auction a team would bond 20% of the total $KSM contribution by the project community

- The project will reward a percentage of it native token supply to the community for the crowldloan. Even though rewards may be issued in an stablecoin

- Assuming that the price of $KSM only increases since an auction, we will consider the ATH($623 USD) price for our estimate, to calculate the maximum possible cost

- Let’s assume the staking reward for $KSM is at maximum a 20% per year

In the case of the first successful auction winner Karura, there was a total of 501,138 (105,328 by the project) $KSM bonded. Thus, loss over a 1 year lease period is:

105,328*0.2*623= $13.1 million USD

Additionally, we need to look at the cost that a project incurs by distributing its native tokens to the community. In the case of Karura it was 11% of total supply.

A parachain can run without issuing a native token for block rewards. The native validators become ‘collators’ and the security part is completely outsourced to the relay chain. While the native token reward may seem like a lot, a significant percentage of the token supply would anyway go to the validators in case the chain was running its own consensus. In the case of popular L1 chains, this is tens of millions of dollars and billions in the case of chains like Ethereum.

The Benefits

Apart from the interoperability and cross-chain benefits described before, a less obvious benefit of winning a parachain auction, is that it gives massive community exposure and upside to a project, due to the network effects of the Polkadot/Kusama ecosystem. This results in large price appreciation of the native tokens of these projects as we have seen in the case of batch 1 auctions.

Conclusion

With its shared security, interoperability, and elaborate governance structures, Polkadot is the leading infrastructure layer project working to solve the interoperability problem between blockchains.

The fair and unique auction mechanism gives every project a chance to be part of their ecosystem and ensures that only the best ones get on-boarded. The crowdfunding alternative also substantially reduces the cost of running a blockchain as compared to running a chain independently or running it on some other chain.

With a wide spectrum of projects participating in Kusama auctions, ranging from smart contracts to Bitcoin bridges, the Kusama/Polkadot ecosystem is growing at a remarkable speed. As long terms supporters of Polkadot’s vision for interoperability, we are looking closely at the upcoming parachain auctions on Polkadot and the growth of their ecosystem.

Disclaimer: This article is a summary of the writers opinions and research. Digital assets are a volatile asset class and readers should be aware of the potential risks of investing in blockchain projects. This is not investment advice & we will not accept liability for any loss or damage that may arise directly or indirectly from any such investments.

References

https://polkadot.network/blog/polkadot-is-ready-for-parachains/

https://kusama.network/auctions/

https://polkadot.network/launch-parachains/