- Introduction

- What is Mara?

- Market Overview

- Mara’s Product Ecosystem

- Market Competition

- Achievements and Roadmap

- Team

- Conclusion

Introduction

While African nations harbor immense potential, the current ecosystem for blockchain-based platforms is severely underdeveloped. Foreign crypto exchanges often seem inaccessible to African crypto users due to the lengthy KYC approval process, which often results in rejection. Independent brokers charge exorbitant exchange rates for fiat-to-crypto transactions, and they get away with this because most administrations haven’t enacted pertinent regulatory frameworks. With its comprehensive offerings, Mara is an African-first organization seeking to alleviate these concerns.

What is Mara?

Mara is building a centralized cryptocurrency exchange with Pan-Africa servicing, an open finance and lending platform, and an NFT marketplace, all tailored to the requirements of the African populace. Mara aims to provide a complete ecosystem for Africans to access the crypto economy with full accreditations in compliance with global authorities.

Market Overview

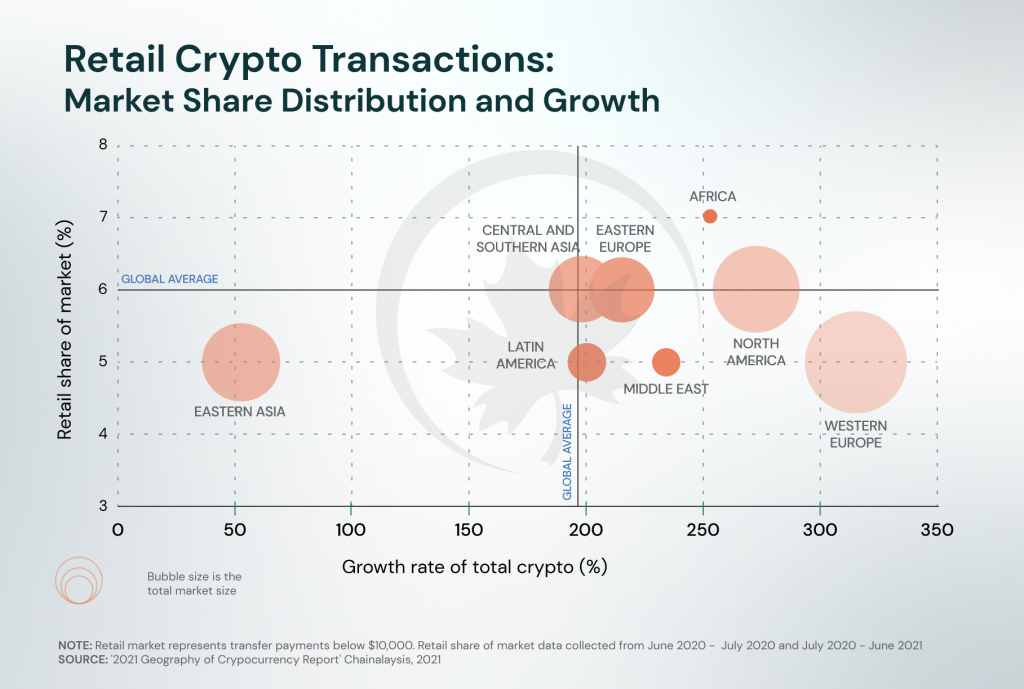

Africa is the 3rd fastest-growing crypto market in the world. A report by KuCoin stated that the crypto transactions increased by up to 2670% in 2022. Administrations in key nations such as Nigeria and Kenya have made it difficult for customers to access cryptocurrency platforms through general bank accounts. Still, despite the adversity, P2P networks such as Paxful and LocalBitcoins, along with informal P2P trading, have driven the transactional volume to unprecedented levels. This displays the incredible affinity harbored by the African populace towards crypto.

While the recent crash has undoubtedly been detrimental, the long-term trajectory is remarkably promising, leaving Mara’s fully licensed centralized exchange well-positioned to capitalize on the growth trend.

African nations also boast some of the highest crypto adoption rates in the world. This, coupled with the generally disarrayed state of Sub-Saharan’s credit market with excessive interest rates, provides an excellent opportunity for crypto lending protocols. Globally, lending protocols’ TVL has grown astoundingly in recent years, but the current market conditions have dampened the surge.

Mara’s Product Ecosystem

Apart from centralized crypto exchange services, the company will also provide peripheral tools such as the Mara Wallet, a user-friendly brokerage app with seamless transactional capabilities involving crypto and fiat assets to access the Mara crypto exchange. Mara’s Pro-Exchange will provide an exhaustive collection of technical analysis tools and trading options to attract seasoned users.

Mara has also secured partnerships with the industry’s leading technology providers to ensure seamless functionality. Mara has partnered with Smile Identity for fast KYC processing. The company has also stated that its KYC/AML procedures will be compatible with international fiduciary laws.

The company is also building a Layer-1 blockchain network called Mara Chain which will provide African developers a platform to create various protocols advancing the African crypto economy.

Market Competition

Mara is uniquely positioned to cater to the needs of African customers. Due to the unfavorable environment created by African financial authorities, several African customers have reverted to P2P networks like Paxful and LocalBitcoins. But these networks are riddled with scams and aren’t very secure. The user interface is often intricate, and the networks also lack scalability. Foreign Centralized Exchanges like Binance and Digital Currency Group’s Luno are devoid of P2P networks’ deficiencies, but accessing them is a cumbersome task. Mara will be a fully licensed Centralized crypto exchange with an emphasis on African demographics’ preferences providing it significant strategic advantages to surpass such competitors, but already established local players such as Yellow Card, Quidax, Buycoins, and Busha also offer a considerable threat.

Achievements and Roadmap

- Mara has secured $23 Million in stock and token sales from more than 100 investors, including several industry bigwigs such as Coinbase Ventures, Alameda Research (FTX), Distributed Global, TQ Ventures, Nexo, Huobi Ventures, and Day One Ventures.

- The firm also announced it would be the official crypto partner of the Central African Republic, the second nation in the world to recognize Bitcoin as legal tender after El Salvador. The firm will advise the President to enable the strategic development of infrastructure to support Blockchain-based platforms.

- Looking ahead, the firm plans to deploy the Mara Chain in Q4 2022, while the Pro-Exchange comprising advanced technical analysis tools will be released in Q1 2023. With the initial launch in Kenya and Nigeria, by the end of the first phase of its growth plan, Mara intends to become Africa’s premier licensed cryptocurrency exchange through alliances with notable players in multiple established markets.

- In phase two, Mara aims to further consolidate its Pan-Africa presence through channel partnerships with significant telecoms and local mobile money providers.

- Mara will launch its lending platform and NFT marketplace in phase three.

Team

Chi Nnadi, Lucas Llinás Múnera and Dearg OBartuin and Kate Kallot are co-founders of Mara.

Chi Nnadi (CEO) is a seasoned entrepreneur committed to leveraging cutting-edge technology to hasten sustainable development. He is the founder and former CEO of Sustainability International, a non-profit organization that used smart contracts to incentivize a community-driven clean-up of oil spillages in Nigeria. He also co-founded Sela, a blockchain-based impact project verification tool.

Dearg OBartuin (CTO) has extensive experience building and developing FinTech companies. Dearg is the founder and former CEO of Openbank, a real-time payments and settlement engine used by start/scale-ups to test products in crypto markets. Previously, he served as CTO for the Pantera-backed BitPesa (AZA) and Binance-backed Founders Bank.

Lucas Llinás Múnera (COO) is a former Uber executive and Wharton Business School, graduate. Before joining Mara, we also served as the head of growth at the Colombian fintech firm, Coink.

Kate Kallot (CIO) is the Chief Impact and Ecosystem Development Officer at Mara where she oversees developer ecosystems and advocacy alongside presiding the Mara Foundation, dedicated to accelerating blockchain education and social impact in Africa.

Over the past 10 years, she has occupied various leading positions in AI and IoT at Intel, Arm and NVIDIA with a goal to build a truly global and inclusive AI community and make AI accessible to everyone.

Conclusion

The African economy has always been plagued by inefficient payment systems and weak domestic currencies. But with the emergence of Bitcoin and the subsequent crypto economy, the African masses found a reliable alternative. The conditions prevalent in many African nations provide immense scope for the adoption of cryptocurrencies, and Mara, with its Africa-first approach coupled with its stringent adherence to global compliance standards, is well stationed to dominate the exchange services sector in a key market with limitless potential.