Since the announcement of the tentative roadmap of Ethereum during the 2022 Ethereum Community Conference (ETHCC) and the Merge right around the corner, the forums have ignited discussions on the evolution of Ethereum. In this edition of our newsletter, we will be covering the metamorphosis of Ethereum from a PoW to a PoS consensus mechanism.

Ethereum – From Genesis to Present

The idea of Ethereum popped up to Vitalik after his character from World of Warcraft was downgraded. With Ethereum, he tried to address the power disparity problem with centralized entities running various organizations worldwide. Ethereum was first pitched in 2013 and became a full-fledged network two years later.

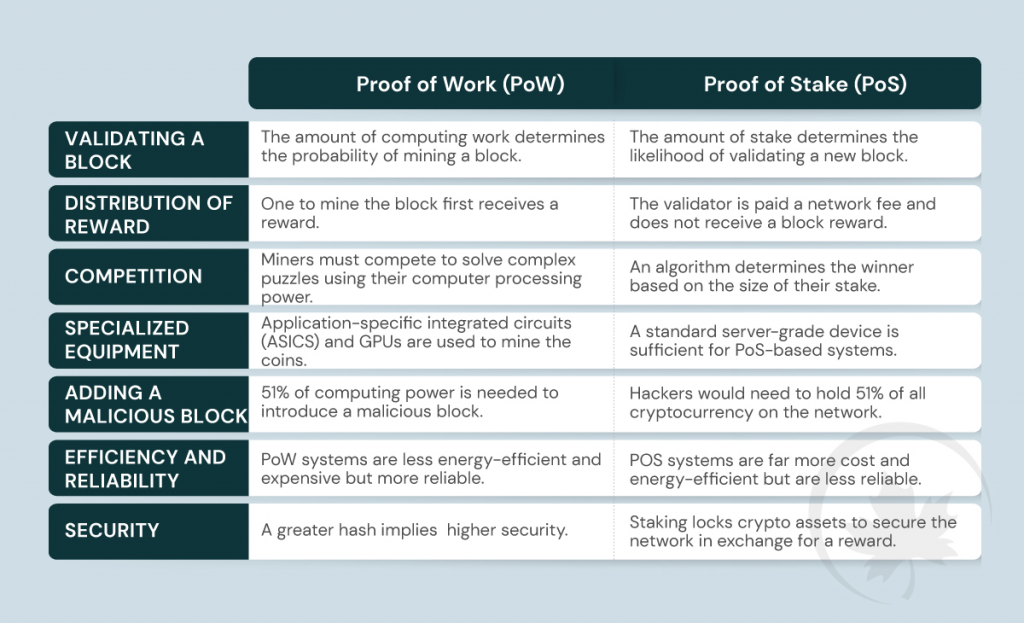

Ethereum followed the footsteps of bitcoin in enabling consensus within the network. It utilized the Proof of Work (PoW) consensus algorithm for the users to agree on the state of the network. Bitcoin was built to be a currency focused on transferring value between individuals, but Ethereum was created to go beyond transactions by creating an open internet for applications to be built, owned, and operated by the participants.

The Ethereum blockchain has become a home for 3000+ dApps, and the increasing complexity of dApps building on Ethereum demands higher throughput. The Ethereum Foundation had foreseen the need for a better consensus mechanism to support the growing number of applications and laid down a plan to facilitate the eventual shift to PoS through a “Difficulty Bomb.”

Since August 2015, starting from block 200,000, the Ethereum blockchain’s programming code has built an increase in mining difficulty. It was structured to make the rewards minimal compared to the computation power required. This was done to enforce a shift to PoS from PoW. The point where the difficulty reaches a threshold is called the “Ethereum Difficulty Bomb.” The difficulty increases exponentially, making the prospect of mining useless.

The Timing of “Difficulty Bomb” Updates

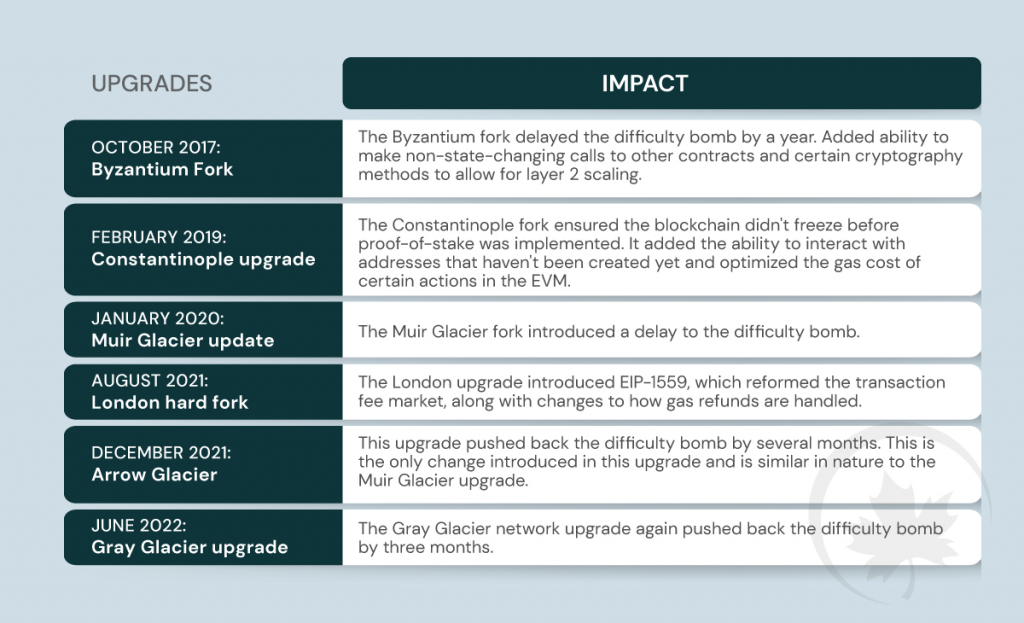

While triggered in August 2015, the increase in difficulty only became noticeable a year later, in November 2016. Since then, several hard fork upgrades have delayed the bomb’s detonation, i.e., the point at which $ETH mining becomes practically useless. The updates are as follows:

The Merge

PoS Adoption, why is it necessary?

Ethereum’s blockchain hosts around 200 DeFi projects and accounted for 76% of the NFT transaction volume in 2021. Its dominance is reflected in various aspects of the Web3 ecosystem, but in its current condition, Ethereum isn’t very well prepared to maintain its predominant position.

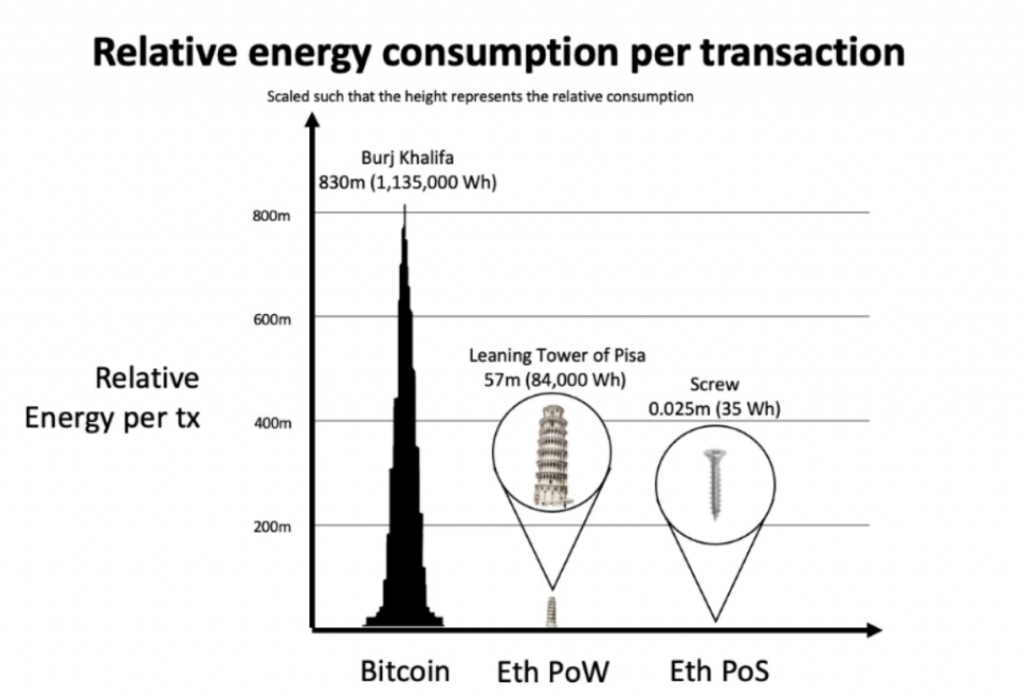

In the present global scenario where institutions and individuals emphasize environmental impact, the existing PoW mechanism causes exorbitant carbon emissions as miners compete to update the ledger first by solving complex mathematical and cryptographic problems guzzling through massive amounts of computing power and thus electricity. According to Digiconomist, Ethereum consumes 113 terawatt-hours of energy annually, the same amount as the Netherlands. Mining activity also creates a humongous amount of electronic waste as specialized ASIC machinery often becomes obsolete in 1.5 years. Ethereum is also tediously slow, averaging only about 15-20 transactions per second, a far cry from its layer 1 counterparts.

PoW vs. PoS

Implications of the Merge

PoS will enable the creation of Ethereum2.0, addressing many issues extant PoW infrastructure faces making the network more scalable and appropriate for the Web 3.0 era. PoS promises a 99% reduction in energy consumption, positioning Ethereum as a green blockchain. Gas prices will eventually be far more affordable than current rates as PoS will prepare the network for sharding and other significant updates to boost transaction throughput. The transition will also make Ethereum more competitive compared to other Layer 1 programmable smart contract networks, like Cardano and Solana, which have already embraced certain variations of PoS.

The Merge will also be an event of immense significance for investors. Apart from the considerable improvement in Ethereum’s long-term perspectives, the transition will reduce fresh block rewards from 12,000 $ETH per day to 1,280 $ETH, increasing scarcity, and making ETH a deflationary asset as opposed to its current inflationary status. Given the similarity of the process to Bitcoin halving, this event has been termed the “Triple-Halving” of Ethereum.

How will the transition happen?

Ethereum will achieve the consensus mechanism transition through a three-phase process. In December 2020, Ethereum unveiled the Beacon Chain, a consensus layer separate from the main network that will conduct and coordinate the network of stakers. The Beacon chain was created solely to provide a seamless transition to the PoS system by essentially becoming the Mainnet execution system’s consensus engine. The Beacon chain will initiate the transition in phase 0. Starting with Phase 1, Ethereum2.0 will store the whole transaction history of Ethereum and implement smart contracts on the PoS network. In phase 3, the current Ethereum Virtual Machine (EVM) will be replaced by the Ethereum WebAssembly, or eWASM, finally combining the Beacon chain and the Mainnet to complete the Merge.

The Future of Ethereum

Commenting on the future of the network at the Ethereum Community Conference in France, Buterin mentioned Ethereum project is 40% complete as of now, and the figure will reach only 55% after the Merge implying significant development of the network even after the much-awaited consensus mechanism upgrade. Ethereum will eventually experience what Buterin refers to as “surge,” “verge,” “purge,” and “splurge.”

While the Merge is an event of immense importance, it won’t increase the network’s transaction speed or minimize the gas fees directly. The Surge pertains to scalability improvement to enable faster transaction processing through sharding which is the distribution of the storage and computation workload across a horizontally bisected database. In the blockchain context, the entire network will be split into smaller shard chains. Ethereum sharding will complement layer 2 rollups by dispersing the load of managing the substantial quantity of data required by rollups throughout the whole network, hence lowering congestion. This could potentially enable the chain to process 100,000 transactions per second, according to Buterin.

The Verge will bring about another significant scaling upgrade. Altering the network’s cryptographic constructions at a fundamental level, Verkle trees will replace the existing Merkle Patricia trees resulting in a substantially smaller proof size. This reduction would also make Statelessness viable, a highly desirable property for network nodes.

The Purge will primarily deal with the reduction of hard disk space requirement for validators through simplification of the protocol and deletion of historical data. After the prior four stages, the Splurge denotes a series of miscellaneous improvements to ensure seamless functioning and general development of the Ethereum landscape.

Conclusion

The market is optimistic about Ethereum’s transition and long-term potential. The outcome of the various upgrade proposals to the Ethereum 2.0 will provide the user base access to a network that is more scalable, sustainable, and secure. It would be interesting to see the effect of this upgrade on the existing Layer 2 solutions on top of Ethereum.

Disclaimer: This article is a summary of the writers opinions and research. Digital assets are a volatile asset class and readers should be aware of the potential risks of investing in blockchain projects. This is not investment advice & we will not accept liability for any loss or damage that may arise directly or indirectly from any such investments.