Introduction

The Crypto industry has been constantly looking for the next big thing that can make crypto mainstream. This is now more close to reality than not. Decentralized Physical Infrastructure Networks, or DePINs, are predicted by many well-known cryptocurrency community members to be crucial in making cryptocurrencies more widely accepted. This excitement results from DePIN’s extraordinary powers, which allow it to accomplish amazing things. DePIN initiatives hold the potential to generate entirely new products and services that were previously unthinkable by utilizing cryptocurrency incentives to synchronize the actions of millions of participants. DePIN’s ability to innovate surpasses that of traditional centralized systems due to the alignment of incentives and decentralized collaboration, which opens the door for revolutionary advancements across multiple industries.

DePIN

The emergence of Decentralized Physical Infrastructure Networks (DePIN) signifies a revolutionary shift in the way we conceptualize, build, and oversee physical infrastructures. This novel strategy combines the core principles of decentralization with the token economy that is intrinsic to blockchain technology, indicating a change in direction towards a new paradigm in infrastructure development that is marked by increased efficiency, fairness, and community engagement. DePIN is an intriguing example of how technological innovation and practical application can coexist peacefully, and it represents a significant step toward transforming vital infrastructure into more inclusive and user-driven systems.

Tokenization and blockchain technology are used by Decentralized Physical Infrastructure Networks (DePINs) to effectively manage and reward crowdsourced infrastructure projects. These projects deliver concrete, practical value and services by utilizing blockchain technology.

Businesses that have a significant financial stake in creating and maintaining physical infrastructure, like telecommunications companies, stand to gain the most from DePIN concepts. These businesses can trade the physical resources required for their infrastructure with volunteers who serve as network nodes by using DePINs.

Volunteers receive tokens in exchange for connecting their hardware to the companies’ services; these tokens can be redeemed when the company’s token value increases. Similar to how cloud companies operate, this model lets entrepreneurs start businesses without requiring their infrastructure or hardware. Prominent entities such as Uber and Airbnb have effectively leveraged analogous business models.

DePIN Architecture

Large corporations have historically held a monopoly on the deployment and management of physical infrastructure, including power grids, mobility networks, cloud services, and wireless networks. This is because these kinds of projects come with hefty capital requirements and logistical difficulties. As a result, there is little competition and innovation since these centralized organizations have enjoyed nearly monopolistic control over end-user pricing and services. Because of this, customers frequently receive poor quality service, as shown by the low Net Promoter Scores (NPS) in the US for sectors like telecommunications that are primarily controlled.

The Sharing Economy model allows contributors and their assets to be leveraged to provide valuable goods and services. Using this model, businesses such as Uber and Airbnb have prospered. People can pool their resources like cars or lodging to accommodate customers’ needs. But even with their success, platforms like Uber are still centralized businesses that maintain control over their drivers, networks, and business practices. The goal of the decentralized physical infrastructure movement is to take the idea of the Sharing Economy a step further while being more equitable and inclusive of the companies and people who play a key role in creating and sustaining the network.

These projects seek to distribute power and rewards among participants by decentralizing control and utilizing blockchain technology, encouraging a more cooperative and community-driven approach to infrastructure development. This decentralization movement promises to build a more sustainable and democratic ecosystem in which the advantages of participation are distributed more fairly among all parties involved.

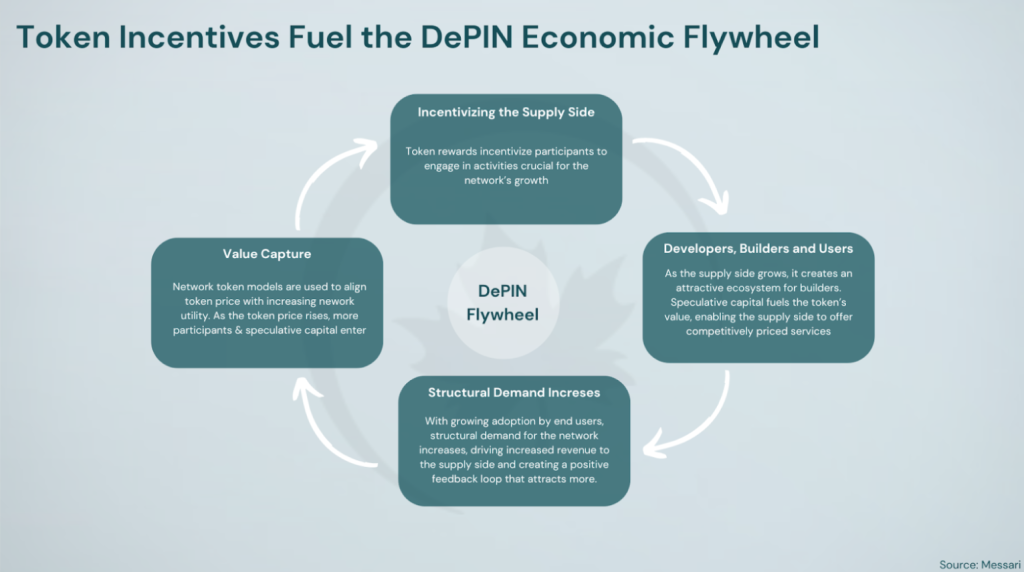

Through mechanisms like burns and buybacks, DePIN projects use tokens to create a positive flywheel effect, where increased usage drives up the token prices. This incentivizes contributors to further develop the network, as the value of the tokens they receive as payment rises.

Investors become more interested in the DePIN network as it grows, and they contribute money to help it continue. Developers can use contributor/user data, if it is publicly shared or the project is open-source, to create decentralized apps (dApps) based on the data. By improving the ecosystem’s value proposition, these dApps attract more users and contributors, sustaining the growth cycle in a positive way.

DePIN Advantages

Increased Innovation and Competition

DePIN facilitates open competition and fosters innovation across multiple industries by eliminating the entry barriers typically associated with traditional infrastructure networks. This increased accessibility encourages new players to challenge established players’ dominance in oligopolized or previously monopolized markets. DePIN thus provides a platform for a variety of players to present innovative ideas, spurring innovation and eventually helping customers with more options, better services, and affordable prices.

Cost Efficiency

Distributed infrastructure cost refers to the reduction in overhead and expenses achieved through a decentralized physical infrastructure network. This is accomplished by harnessing the combined resources of all participants within the network. In such a system, the burden of infrastructure expenses is distributed among the network’s contributors which results in more efficient utilization of resources and lower overall costs compared to centralized models.

Community Empowerment

Infrastructure deployment and maintenance are encouraged by DePIN by offering token rewards to contributors. Because of its bottom-up design, users can be assured that the network is owned by all of them instead of just a few controlling shareholders. This decentralized ownership structure fosters a sense of ownership and responsibility among contributors, leading to greater engagement and commitment to the network’s success.

Security and Transparency

Comparing traditional centralized networks with decentralized networks, the former offers a more robust and secure infrastructure. Building a network in a decentralized manner lowers its susceptibility to risks like hacking, corruption, and hijacking that are often connected to centralized control. Decentralized infrastructure improves resilience and lessens the impact of possible threats by distributing control and decision-making across a distributed network of nodes. This guarantees increased stability and security for the system as a whole.

Market Overview

The market capitalization of all DePIN projects exceeded $25 billion in February 2024, which is a significant achievement in the growth and adoption of decentralized physical infrastructure networks. This achievement underscores the increasing importance and potential of DePIN solutions in the cryptocurrency space, indicating a growing trend toward the creation and uptake of decentralized infrastructure.

Moreover, distinct subcategories have emerged within the DePIN project landscape, including data processing, storage, and AI. Artificial intelligence is the most popular market segment among these, driven by increased investor enthusiasm due to developments in the chip and AI industries. Notably, the expansion of DePIN initiatives focused on artificial intelligence has been greatly aided by recent spikes in capital influx, which were set off by Nvidia’s quarterly data disclosures.

The growing need for creative solutions to concrete problems is driving the adoption of DePIN programs in a variety of industries. These projects, which cover everything from wireless networks to computing power and data storage, are successfully taking on big problems and offering novel solutions that appeal to investors and important stakeholders.

There are currently many different projects with a broad range of industries and technological specializations in the DePin landscape. Examples include the real-time rendering services offered by Render Network and the wireless blockchain infrastructure by Helium, each with a unique value proposition.

Moreover, well-known blockchain development platforms such as Filecoin, Solana, Cosmos, Ethereum, and Polkadot have become the go-to options for developing DePin projects. These platforms are attracting interest from developers and investors due to their strong infrastructures and ecosystems that facilitate the creation and execution of DePin initiatives.

Conclusion

Through the utilization of token incentives and blockchain technology, DePIN presents a novel method for building physical infrastructure networks in the future. With its promise of increased effectiveness, affordability, and group ownership, this ground-breaking model is set to transform the conventional approaches to infrastructure development.

DePINs are at the forefront of blockchain technology, providing new opportunities for the development and administration of real-world infrastructure in a way that is more equitable, effective, and better serves the interests of all network users. With the ongoing development of technology and the emergence of new applications, DePINs have the potential to play a significant role in influencing how our physical environment changes.

DePIN represents a significant shift in the way we design, build, and oversee physical infrastructure. It presents an infrastructure deployment process that is more efficient, decentralized, and equitable. DePIN has the potential to disrupt established industries and scale quickly, making it a significant player in the infrastructure space. We anticipate significant disruption and innovation in the processes surrounding the building and maintenance of physical infrastructure networks as more and more DePIN initiatives are launched and put into action.