Introduction

The crypto market entered a deep bear market in 2022 as global liquidity constricted and the Federal Reserve kept raising interest rates. The market was in a state of upheaval as many projects failed.

As a result, governments all over the world started to intervene and control the cryptocurrency sector. To safeguard investors, control speculation, and guarantee that crypto assets are utilized for proper reasons, regulations have been put in place. These rules caused the market to stabilize and start to recover.

At this point, institutional investors began to enter the space, attracted by the increased security and transparency offered by these regulations. This influx of capital provided much needed liquidity and helped to drive up prices across all major cryptos.

In addition, new protocols emerged that allowed for faster transactions, more efficient trading methods such as DEXs (Decentralized Exchanges), and improved security measures such as multi-signature wallets. These advances further enhanced investor confidence in crypto assets and drove prices even higher.

2022 will be remembered as a bear cycle in the long run crypto journey. This correction was much needed to taper the crazy and almost insane bull run we saw in 2021. This correction was very much due, and has now set the government in motion as well to monitor and regulate the crypto industry closely. This is very much needed for the current market, to make crypto even more mainstream going forward.

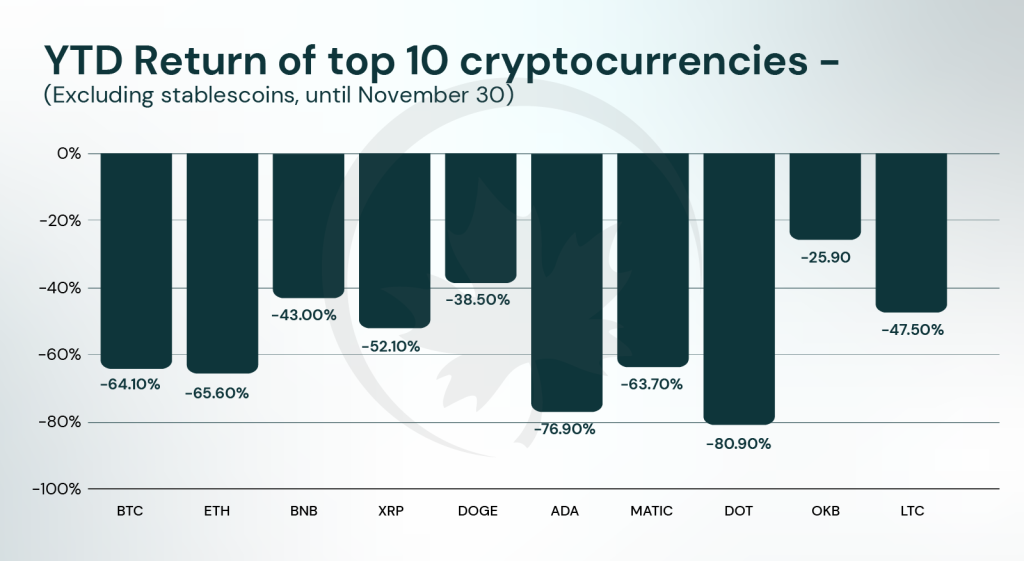

The yearly return in 2022 of all top cryptocurrencies has averaged at about -50%. And it gets even worse for the medium and small cryptocurrencies.

This shows the huge impact of the bear we have seen this year.

Overall, 2022 was a challenging year for crypto but one that ultimately saw significant progress.

Major headlines for each quarter and highlighted below for a quick overview.

Market pulse

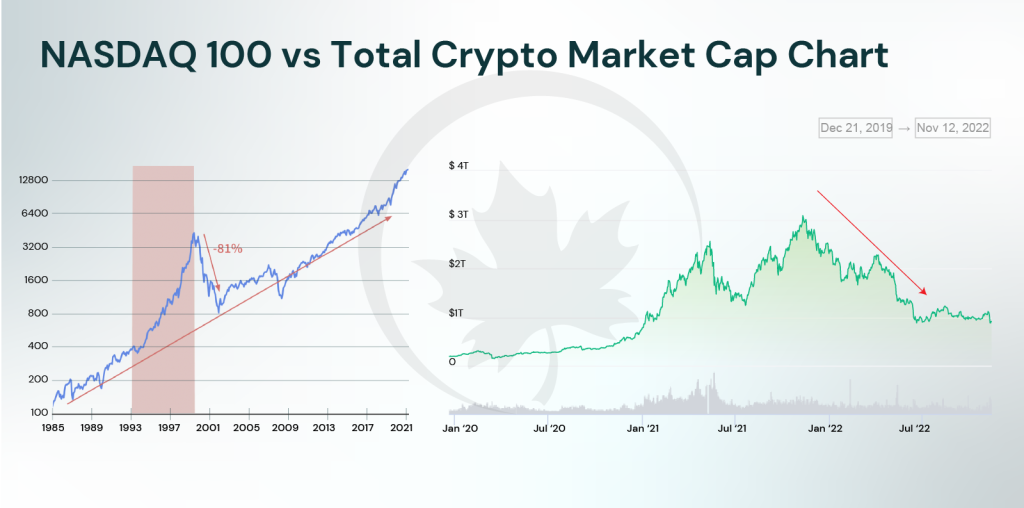

The 2022 crypto crash can be compared with the 1999 dotcom crash. The breakthrough technology boom of the internet was followed by an insane bull run. The stories we hear from the dot-com crash are very similar to the ones we saw during the 2021 crypto bull run. During the internet bull run, any firm could raise funding easily by just adding “.com” to the company name and many were listed too in the same manner at crazy valuations. This is similar to what we saw during the crypto bull run, where any firm could raise funding by just calling themselves – NFT, blockchain etc.

However, following the dot-com burst, there were many internet companies that got built during the very cold period of no expectations from the internet craze. This was when the real value of the technology breakthrough called the internet was realized. It took almost 15 years for the NASDAQ to reach the highs of the dot-com bubble later. We believe we will be seeing something very similar with the next technology breakthrough that will upgrade the entire internet – Web 3.0. And it’ll take a minimum of 10 years to realize the real value from blockchain, and reach the sky high market expectations of 2021.

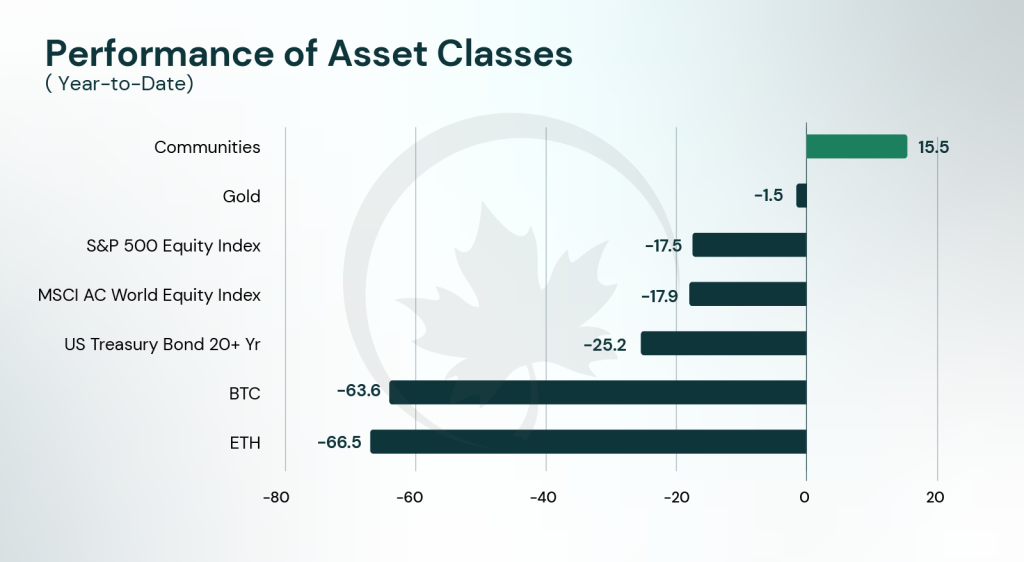

An overview of the performance of cryptocurrencies when compared with other asset classes reveals that 2022 has been a bad year across all the asset classes. The weak macroeconomic conditions only made it worse for the crypto market. Even the 20 yr T-bill had a never before seen -25% yearly return for 2022 due to the high inflation and rising interest rates.

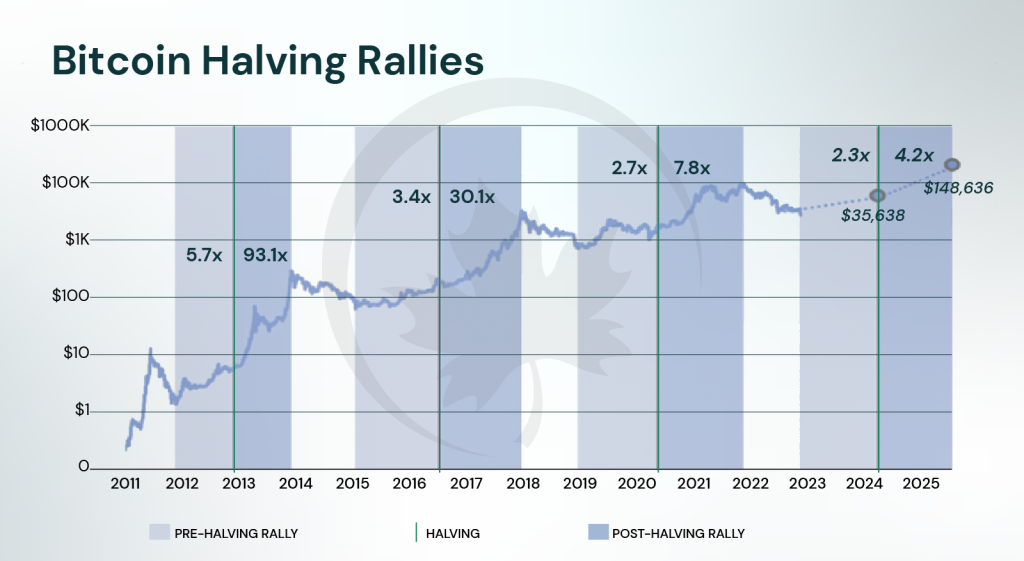

An analysis by Pantera Capital reveals the theory behind Bitcoin halving rallies. From prior market cycles, we may infer that crypto usually rose steadily following each bear phase. The halving of BTC, which occurred 456 days before the market bottomed and was followed by a gradual rise and an upward explosion when it was complete, was one event that was crucial to the previous bull markets.

The market might start to rebound as early as next year, according to some analysts, given the market’s next halving date falls between February 2024 and June 2024. On the bright side, historical patterns indicate a bullish period starting within 18 months.

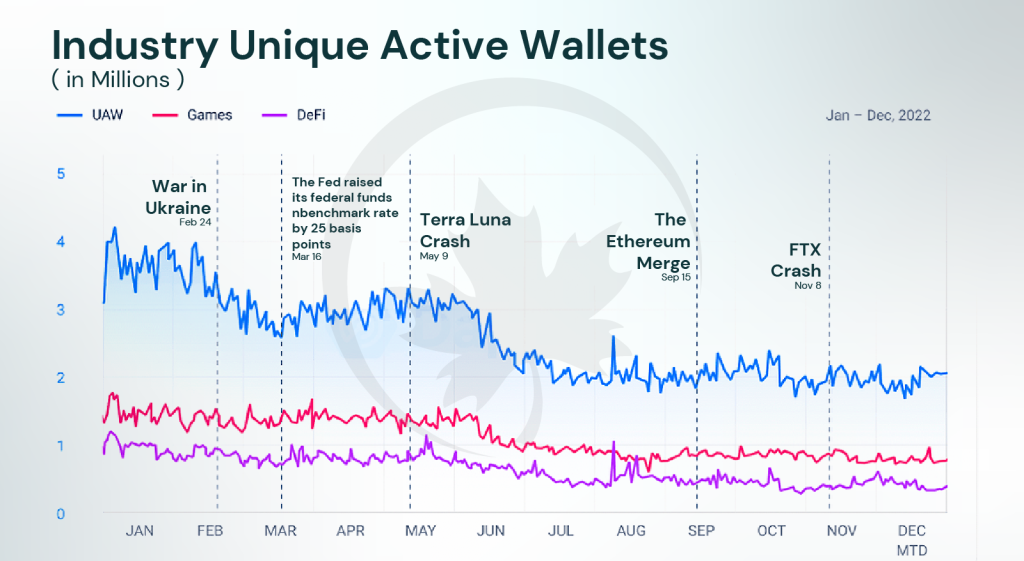

Another interesting observation is in regards to the trend we see in Unique Active Wallets (UAWs). Despite the crash across markets, UAW has fallen up to 50%. It is interesting to note that UAW has managed to remain constant post the Terra crash irrespective of further crashes like FTX happening. This shows the reliance & strong belief of the current users which will be key for further development of Web3 going forward.

Top 10 events of 2022

- Russian Ukraine war

While 2022 will be known for the frauds and the demise of a number of key organizations in the cryptocurrency industry, we shouldn’t lose sight of bitcoin’s fundamental quality as a non-censoring global store of wealth.

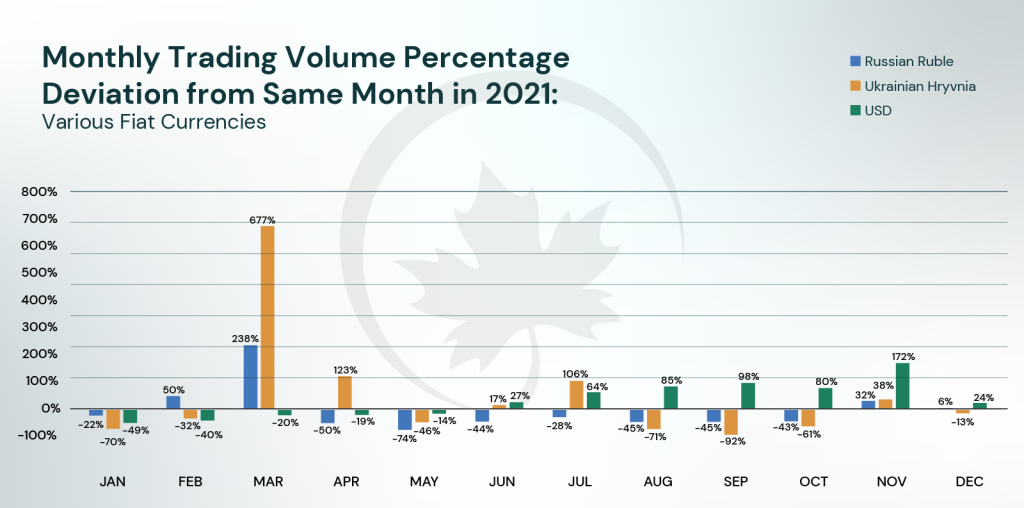

BTC volumes increased in both the Russian Ruble and the Ukrainian Hryvnia following the horrific war in Ukraine. The trade volume in BTC increased by 677% in March 2022 compared to March 2021, while BTCRUB increased by 238%. USD volumes were 20% lower than in March 2021 at the same time. Excess quantities continued for a time, but compared to the USD, these currencies were less affected by market meltdowns in terms of volume, indicating that the trajectory of BTC volumes in Russia and Ukraine has been more driven by necessity than by speculation.

- Terra crash

The fall of Terra, which was previously hailed as one of the top 10 crypto assets, is considered to be the most notorious episode ever.

Numerous investors have suffered serious losses as a result of Terra’s collapse, which caused the price of UST to drop to $0.2 in a matter of days and the price of LUNA to practically zero. Terra’s market valuation also collapsed by $40 billion. Additionally, the 80,000 Bitcoins sold by LFG added to the market’s decline as BTC’s price fell day after day, deepening the bear market.

- 3AC bankruptcy

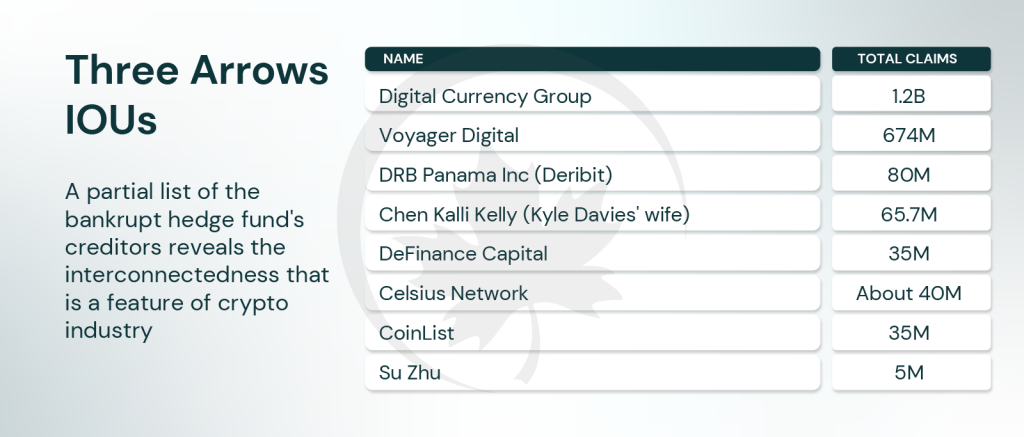

In the early wake of Terra’s failure, rumors spread that Three Arrows Capital was having issues with liquidity and was perhaps misusing customer cash. The following week, Voyager Digital urged Three Arrows Capital to repay all outstanding loans totalling $675 million.

Other lenders of Three Arrows Capital, including Genesis Global Trading, BlockFi, BitMex, FTX, and Blockchain, among others, yelled for return of their loans when Three Arrows Capital failed to repay the loan on time and the event was made public.

As more and more institutions revealed Three Arrows Capital’s bad debts, the entire industry was in shock, and money kept escaping the scene. Since that time, the crypto industry has experienced the “Lehman Moment.”

- FTX collapse

As a central exchange, FTX kept client assets. As a sister firm in need of operating capital for business expansion, Alameda borrowed money from FTX by mortgaging FTTs and SOLs as security. As a result, the initial mix of client assets is swapped out for a set of incredibly similar and volatile altcoins, like FTT and SOL from stablecoin and BTC, even if the change in book value is little. Coindesk set off the chain reaction by publishing information obtained from FTX’s financial sheet. Then, CZ, the creator of Binance, declared that he would sell off his FTT holdings to reduce risk. This sparked a panic and led the price of FTT to crash, leading to a simultaneous mass devaluation of FTX’s assets on the book and user aversion to FTX. As a result of the lack of cash and the fact that the remaining assets—the significantly depreciated FTTs and SOLs—cannot cover the loan, FTX ultimately filed for bankruptcy protection.

- Interest rate hikes

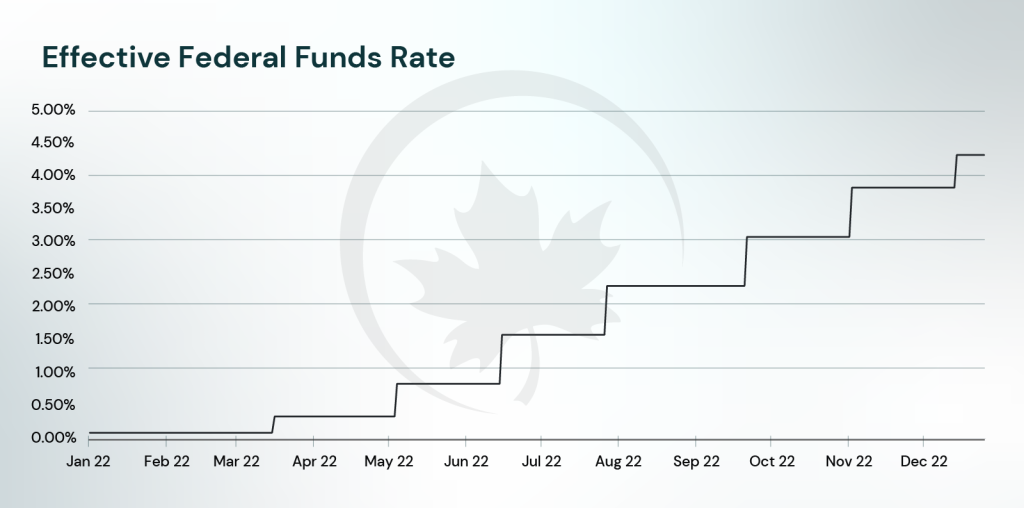

The two most important elements affecting the world’s macroeconomic markets in 2022 are global inflation and the response of central banks to it by raising interest rates. The rate of inflation in this cycle is high and recurrent, and interest rate increases are swift and significant. The benchmark interest rate has risen to its highest level since 2008 in just eight months, while the current inflation rate in the US has hit its highest level since 1980.

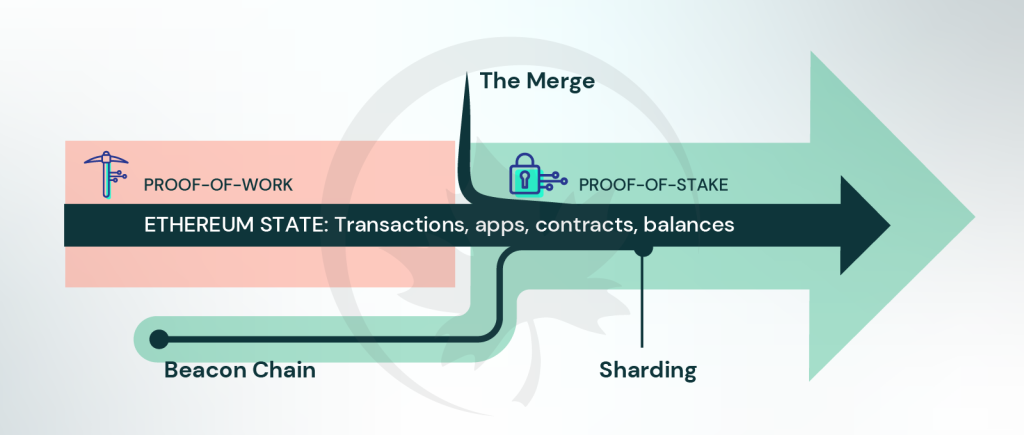

- ETH merge

For Ethereum, 2022 was a turning point as the chain switched from Proof of Work to Proof of Stake. It was long anticipated and hotly contested, but it eventually occurred. In Ethereum, PoW and PoS were combined. Inessence, this change rendered Ethereum’s mining industry obsolete. As a result of holders’ commitment to validate transactions, energy use directly connected to Ethereum has significantly decreased. Since Binance, Coinbase, and Kraken account for 27% of all staked Ether, the shift has not been entirely good and has brought to light many centralization issues. Additionally, 58% of all Ethereum blocks created after the merger have been OFAC compliant. Any design decision has drawbacks, but Ethereum’s decision to use PoS has been recognised and discussed well in advance and is usually well received by the market.

- Tornado Cash crackdown

On August 8, 2022, the Office of Foreign Assets Control (OFAC) of the U.S. Department of the Treasury added Tornado Cash and the associated crypto wallet addresses to its Specially Designated Nationals List (SDN). As a result, U.S. citizens are not permitted to interact with the protocol or any associated Ethereum addresses without incurring penalties. The North Korean hacking outfit Lazarus Group utilised Tornado Cash extensively for money laundering at up to $7 billion in criminal operations, endangering U.S. national security, and $437 million in assets for on-chain addresses. This is the major cause for the prohibition on Tornado Cash.

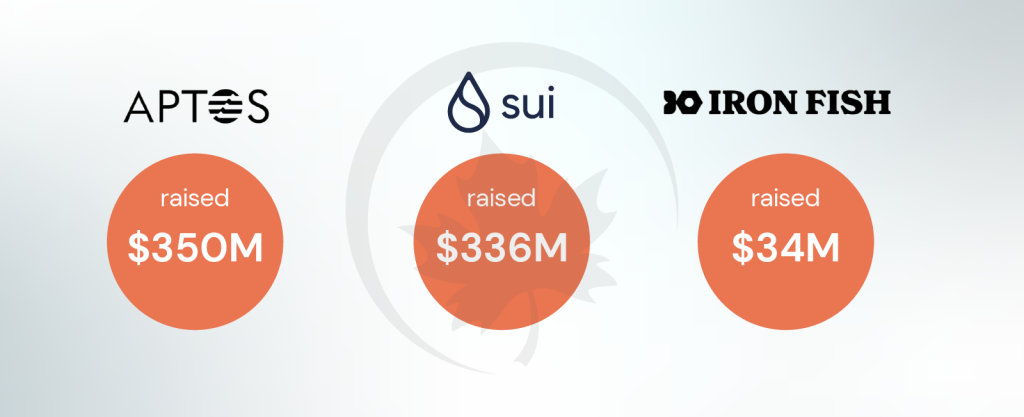

- New L1s competition

Scalability, safety, dependability, and upgradeability are major architectural tenets for the Aptos blockchain, which was created to facilitate widespread use in the web-3 era. For this reason, blockchain infrastructure must adopt the characteristics of cloud infrastructure, which has emerged as a reliable, scalable, affordable, and constantly growing platform for developing popular apps.

Sui is the first permissionless Layer 1 blockchain created from the bottom up to let designers and programmers build experiences for the next billion web3 consumers. Sui Move, which is descended from the main Move programming language, serves as the foundation for the Sui platform.

Iron Fish is a blockchain project that is decentralized, proof-of-work (PoW) based, censorship-resistant, and open to the general public. Strong privacy assurances are supported for each transaction by its design.

- Meta’s another failed attempt

Despite the creator Mark Zuckerberg’s ambition for the technology, Facebook parent firm Meta’s attempts to build a “metaverse” have failed and failed to get enough interest from consumers to succeed.

The major metaverse of the Big Tech firm, Horizon Worlds, has claimed a poor user base and difficulties to retain people.

According to internal papers, the business lowered its initial aim of achieving 500,000 monthly active users on its virtual reality platform Horizon Worlds by the end of 2022 to just 280,000 MAUs. As of October, there were just 200,000 MAUs.

Internal statistics shows that just 9% of the worlds created by creators have had at least 50 visitors.

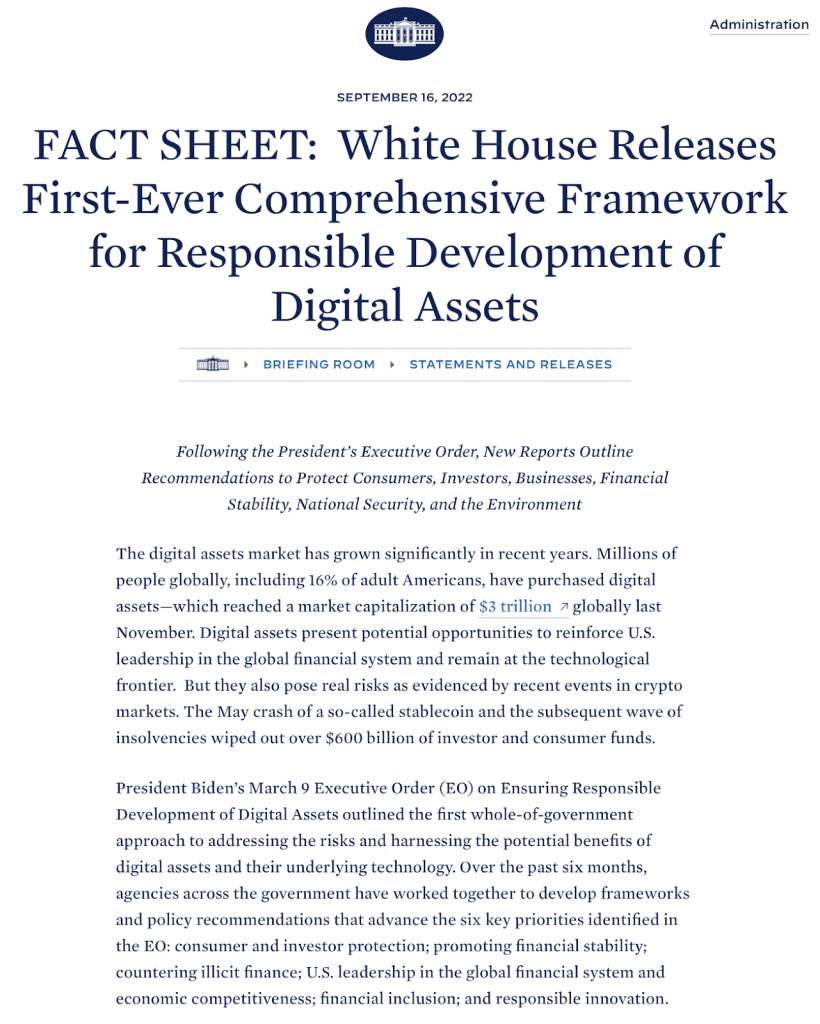

- Complete crypto regulation

Risks associated with digital assets are significant for investors, enterprises, and consumers. The value of these assets might fluctuate greatly in price; for example, the market capitalization of cryptocurrencies is currently less than one-third of its peak in November 2021. Consumers are nevertheless often misinformed by sellers about the characteristics and projected returns of digital assets, and widespread noncompliance with relevant laws and regulations continues. According to one survey, about a quarter of digital currency offers had disclosure or transparency issues, such as copied documentation or fraudulent guarantees of returns. Outright fraud, scams, and theft are on the rise in the markets for digital assets: according to FBI figures, recorded financial losses from digital asset scams increased by about 600% in 2021 compared to the previous year.

Accomplishments

- Russian Ukraine war

The core value proposition of BTC was put to test during the Russian Ukraine war. The bull and bear runs, and excessive trading cycles sometimes makes one forget what is the real utility of BTC in the entire spectrum of new age blockchain technologies.

Bitcoin is a digital global storage of value, beyond the control of governments and businesses. That is how it is very similar to gold. Bitcoin’s core attribute is that it is non-censoring money.

This core utility of BTC was clearly demonstrated during the war. Following the war, the BTC trading volumes in both Bitcoin Hryvnia and Bitcoin Ruble shot up. BTCUAH saw a 677% YoY jump, and BTCRUB saw a 238% YoY jump compared to March 2021.

But, so called “well respected” Fiat currency, USD volumes saw a 20% YoY drop during the same time due to global market meltdowns.

This shows that, BTC trading volumes during the war rose out of utility which Fiat failed to provide. Thus, confirming the long held belief that BTC is digital gold true.

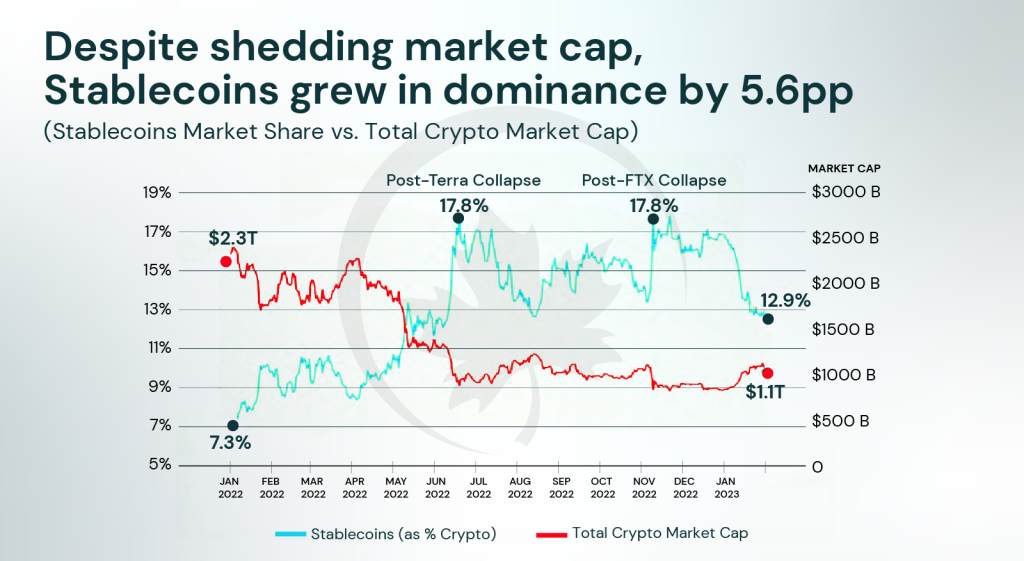

- Stablecoins win the bear

Stablecoins are stable, because they are pegged 1:1 to a reserve asset or an algorithm like a fiat currency. This enables stablecoins to become the bridge between the fiat currencies and the new age digital currencies.

The stability of these stablecoins was put to test in 2022. With Terra collapse, the inherent vulnerability of algorithmic stablecoins was exposed. However, it’s very interesting to see that though Terra, a stablecoin collapsed to nothing, other stablecoins became the goto storage of value when the crypto market started melting down. This is due to the inherent promise of stablecoins to be tied to fiat currencies. The stablecoins market cap is dominated by the trio of USDT, USDC and BUSD. During the market collapse, stablecoin dominance increased up to 17.8% of the total cryptomarketcap.

Technically, stablecoins market cap can surpass the market cap of bitcoin. It’ll be interesting to wait and watch, which digital store of value, Bitcoin or stablecoins would consumers prefer in the long run. To understand this conflict better, a parallel can be drawn from traditional finance. Though gold or gold bonds represent the safest store of value (like bitcoin), the foreign exchange market (like stablecoins) is huge compared to the gold market. This is primarily attributed to the additional utility fiat provides in easing transacting in the market, which gold doesn’t provide.

- DeFi rises from the ashes

There is no doubt in saying that centralized exchanges are vital in the crypto market. It is these CEXes that drove the mainstream adoptions in the early days of crypto with their simple UI and onboarding process. However, the fundamental difference between a centralized and decentralized exchange is very clear. And, this difference became well established during the bear market of 2022. The next larger wave of adoption will see an increasing preference among consumers to trust a decentralized system rather than a centralized one.

In the early days of DeFi, there weren’t many use cases and the protocols developed on blockchain infrastructure were copies of traditional finance products. However, starting 2020, in a span of 2 years only, a $100 billion industry of DeFi stood tall with funds and banks pouring more money.

Though the market cap of DeFi protocols has seen a great decline of 75% in 2022 from their peak in 2021. The awareness, adoption by traditional finance institutions and the increasing new possibilities of DeFi makes it a formidable force for the future of finance itself.

We believe we will see many more innovative DeFi protocols and even greater adoption among traditional institutions like banks, funds, insurance etc, ultimately making DeFi the defacto standard to do finances among everyone.

- ETH merge

The long awaited and debated Ethereum merge finally happened in 2022. Ethereum has now successfully transitioned from Proof-of-work consensus mechanism to Proof-of-stake. Post this transition, the two biggest blockchains in the crypto market are governed by different consensus mechanisms.

It is highly controversial to even consider the ETH merge as a move in the right direction for the overall crypto community. Highlighting the essence of this merge and its various implications, one can say, the miners of Ethereum are now redundant and the control of the network has now shifted to the committed holders of ETH who will validate the network’s transactions. Whether this move away from the ideal of true decentralization optimizing for performance and energy consumption is the right direction for the crypto community to progress towards is to be seen.

- Widespread technology adoption

Web3 is the next stage of the internet, and it is being built and adopted at a rapid pace across different industries. The growing recessions and the increased centralization by big tech giants are the major reasons behind this revolution. Many new technologies and business models have come up which will reshape the way we do business everyday. Some metrics that highlight the potential of Web3 are – the global blockchain revenue is expected to reach $23Bn by 2028. According to McCann Worldgroup, by 2026, about 2 billion people worldwide “will spend at least one hour a day in the metaverse to work, shop, attend school, socialize or consume entertainment”. In the same year, the total value of the virtual goods market in the metaverse is expected to reach as high as $200Bn.

Challenges

- Terra crash

The dual crash of TerraUSD’s UST stablecoin and LUNA saw a never before seen $40Bn crypto market cap meltdown. UST was an algorithmic stablecoin that promised an unsustainable 20% yield through its Anchor protocol. This high interest rate made retail investors crowd in to hold UST, and the high interest rate was funded by institutional funds like Three Arrows Capital. Terra’s stablecoin, Anchor Protocol, was steadily reducing its rates, leading to a mass exit of UST holders. To exit UST, holders can use Terra’s burn-and-mint mechanism, which lets them swap 1 UST for $1 of LUNA, creating an arbitrage opportunity. UST depegged by a little less than $0.02 due to the burn-and-mint exit, which caused the supply of UST to cratered and the supply of LUNA to the moon. The Luna Foundation Guard (LFG) stepped in to help UST find its peg, but it was too late as the market capitalization of UST had already overtaken LUNA’s, creating a death spiral.

- FTX collapse

FTX and Alameda Research had a close relationship, with Alameda Research holding assets and funds from the customer base of FTX, and FTX using FTT tokens as collateral to borrow billions. The FTX mess began when Bankman-Fried extended a lifeline to struggling cryptocurrency companies, relying on high-risk bets from Alameda Research and using FTT tokens as collateral. Concerns grew when Binance announced it would offload all its FTT holdings. Binance refused to acquire FTX due to mishandling of customer funds and pending investigations, leading to a liquidity crisis and bankruptcy.

- Unfavorable macroeconomy

The most important factors in global macro markets in 2022 are global inflation and responsive monetary tightening policies, i.e., interest rate hikes, by central banks of each country. In the US, inflation has reached its highest level since 1980 and the benchmark interest rate is expected to be raised until the second quarter of 2023. This has led to a substantial decline in stock markets, currencies, and treasuries across the globe, and the cryptocurrency industry is particularly vulnerable due to its high leverage ratio and deleveraging process. The contraction of liquidity by interest rate hikes of the Federal Reserve would have become the one to blame when viewing critical events in crypto in 2022 retrospectively in the future.

- Strict regulatory norms

Regulators are responding to the rapid expansion of the cryptocurrency markets, but crypto exchanges need to incorporate surveillance to ensure market integrity. Regulators are working to create a legal framework that is modern and accommodative, but also prudent, and large institutional investors are adopting cryptocurrencies.

The European Markets in Crypto Assets bill is the most important regulatory event of 2022, with a transparent licensing regime, higher legal responsibility for crypto influencers, and a moderate approach to investor protection. The Responsible Financial Innovation Act (RFIA) and Digital Asset Anti-Money Laundering Act have been introduced in the US, while Russia has taken a more moderate approach. Brazil legalizes crypto as a payment method, leading to a trend of crypto-friendly moves in Latin America.

- Struggle for consumer use cases

Cryptocurrency has evolved beyond just paying for goods and services, with five use cases that demonstrate the extent of the fintech revolution. Smart contracts and collateral lending are key applications of the decentralized finance (DeFi) movement. On-chain voting is an effective way to ensure provable voter turnout, while non-fungible tokens (NFTs) represent unique digital assets.

However, the real challenge has just started and it will be interesting to see how exactly the crypto ecosystem will onboard the next billion users. The next bull run will be driven by mass adoption alone. The crypto ecosystem is efficient, has greater transparency, and better security and privacy than the current version of the internet. However, these efficiencies need to be reflected in the end products and services that the user will be exposed to. Mass adoption will happen via gaming and metaverse expansion into the next generation of users.