- Introduction

- What is Pine Protocol?

- Pine Ecosystem

- Market Analysis

- Tokenomics

- Team

- Roadmap

- Partnerships

- Conclusion

Introduction

With multiple NFTs selling for great prices, the NFT market picked pace during the crypto rally of 2021. Most NFTs do not provide any passive income opportunities and lie dormant in the wallet. The capital invested in these digital assets is confined. This might lead to missed financially profitable opportunities. Pine Protocol is building a 2-sided NFT-backed loan protocol for NFT holders to gain access to liquidity and for cryptocurrency holders to earn yield.

What is Pine Protocol?

Pine is a decentralized two-sided NFT-backed loan protocol.

The design is pool-to-borrower (“P2B”) where on one end, lenders create pools of cryptocurrencies Pine allows users to take a loan with their NFT as collateral without the risk of losing ownership. It will enable customers to buy premium NFTs with the “Pine Now Pay Later” feature.

Pine users receive not just instant loans but also perks associated with those NFTs.

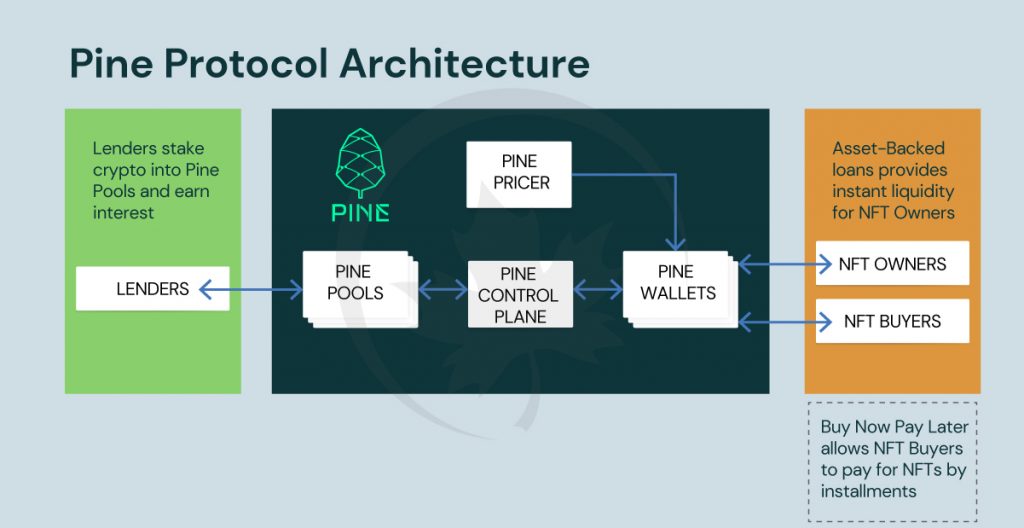

Pine Ecosystem

Pine Wallet

The Pine wallet is created for borrowers during their first loan transaction on the Pine platform. It is a collection of smart contracts made to hold NFT assets when they are used as collateral for loans and placed on loans. The borrower will not be permitted to transfer or authorize the transfer of the NFT asset while it is loaned.

Pine Pricer

An NFT pricing oracle overseen by the PineDAO, Pine Pricer offers a fair and transparent price feed for the value of NFT collaterals for all loan obligations. Only lenders with access to a live price feed from the Pine Pricer may open lending pools for NFT collections. No new loan obligation can be formed for an NFT collection after the pricing for that NFT collection becomes unavailable.

Pine Pools

Lenders stake their crypto in the Pine pool and earn interest in exchange for providing liquidity. A single institutional investor sets up each Pine lending pool.

Borrowing

A borrower places his collateral NFT and receives $ETH from the Pine pool per the terms and conditions.

When the borrower can repay with the accepted terms, the obligation is fulfilled, and they retain full ownership of their NFT. If the borrower fails to repay according to the agreed conditions or when the Loan-to-Value (LTV) exceeds liquidation LTV, the lender gains full access to that NFT in their Pine wallet.

Pine Now Pay Later (PNPL)

This feature helps users get a mortgage for buying a blue-chip NFT from the open market if PNPL supports the marketplace and the NFT collection. After the terms are agreed upon, the NFT is transferred using the funds from the wallet and PNPL loan. This NFT is kept as collateral until the loan is fully repaid.

Market Analysis

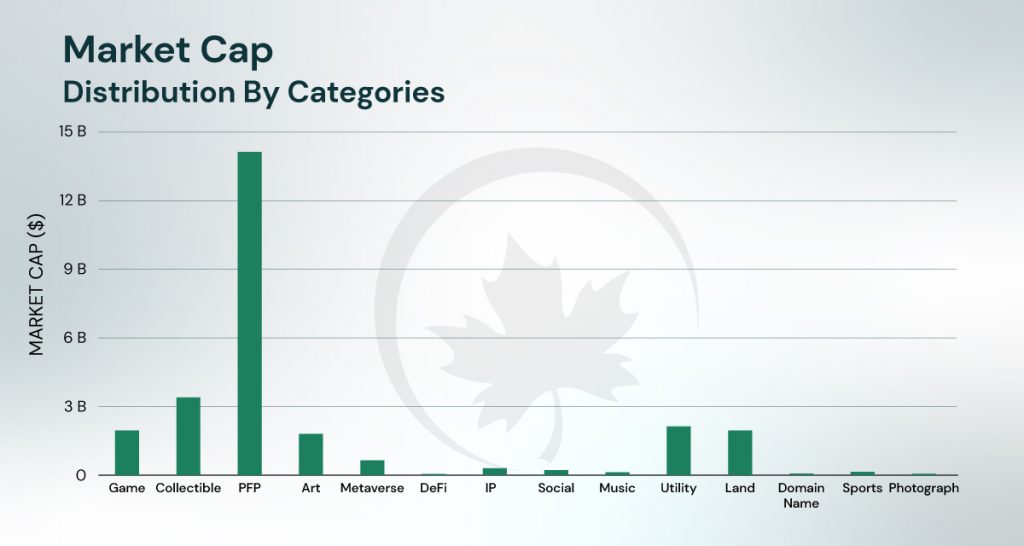

From a long-term perspective, the NFT market cap is seen to be on an uptrend and has the potential to continue the same trend in the future. The industry witnessed over $17 Billion of transactional volume in 2021, registering YoY growth of 21,350%, while the secondary market brought $5.4 Billion in profit.

NFTs have gathered a significant audience towards PFPs, a trend started by CryptoPunks. These PFPs serve no utility and are kept as a status symbol or prospective NFT flip for future appreciation of its price.

Categorized distribution of capital inflow in NFTs

PFPs can unlock a new utility with the help of NFT lending platforms by giving them access to their invested capital and not miss any profit-making opportunities.

Competitors

Several firms intend to offer products with only some functionalities of the Pine ecosystem and thus are not strictly comparable with the firm’s services. Pine is the progenitor of a very niche market in the complex NFT landscape.

Tokenomics

$PINE is the native protocol token for Pine.

Utility of $PINE

- Governance

- Access token

- Economic incentive

Token Distribution

Team

Alex (Product) is as “crypto-native” as anyone can be. He started to mine cryptocurrencies at the age of 14 and began to code smart contracts in Solidity when he was 18. Before co-founding Pine, he worked in the crypto industry writing automated maker-making and custodial wallet smart contracts for companies ranging from financial institutions to fast-growing startups. He is a true “degen” who loves to trade NFTs and maximize yield in different DeFi protocols.

Sharon (Growth & Operations) is an ex-Wall Street banker and a serial entrepreneur. She was previously a credit and FX trader at State Street Bank and ICBC where she gained vast experience in pricing and trading illiquid assets. She also has experience working at a central banking institution in one of Asia’s financial hubs.

TGEN (Business & Strategy) comes from many years of true FinTech experience. He started his career as a software developer at one of the big four accounting firms and eventually became a quant trader at investment banks and hedge funds. He also brings entrepreneurial and digital asset experience to the team. He is a true connoisseur of NFTs and collects a wide range of NFTs from PFPs to generative art.

Demu (Engineering) is a seasoned full-stack developer and project manager with many years of experience building software and managing engineering teams at one of the largest gaming companies in the world.

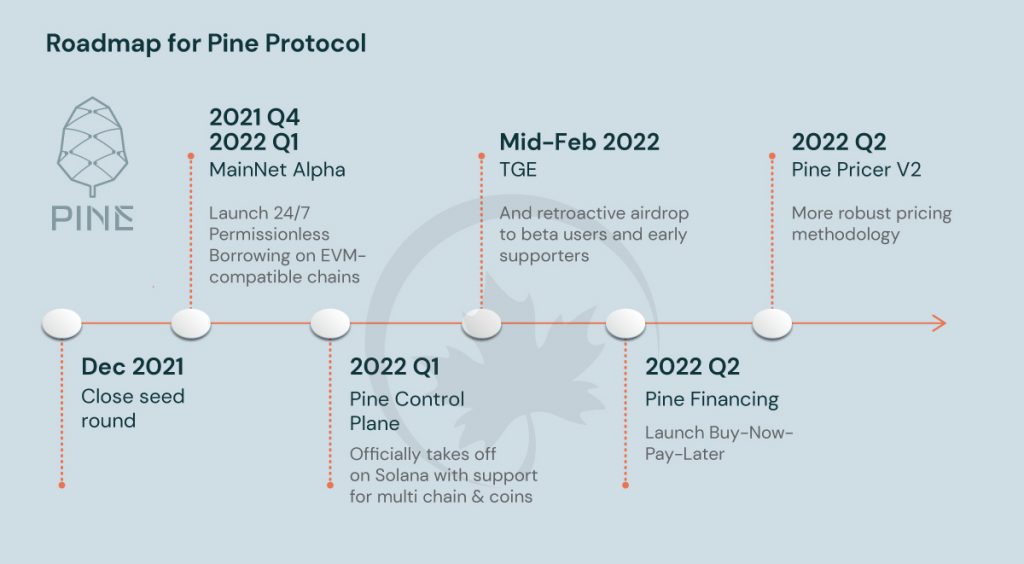

Roadmap

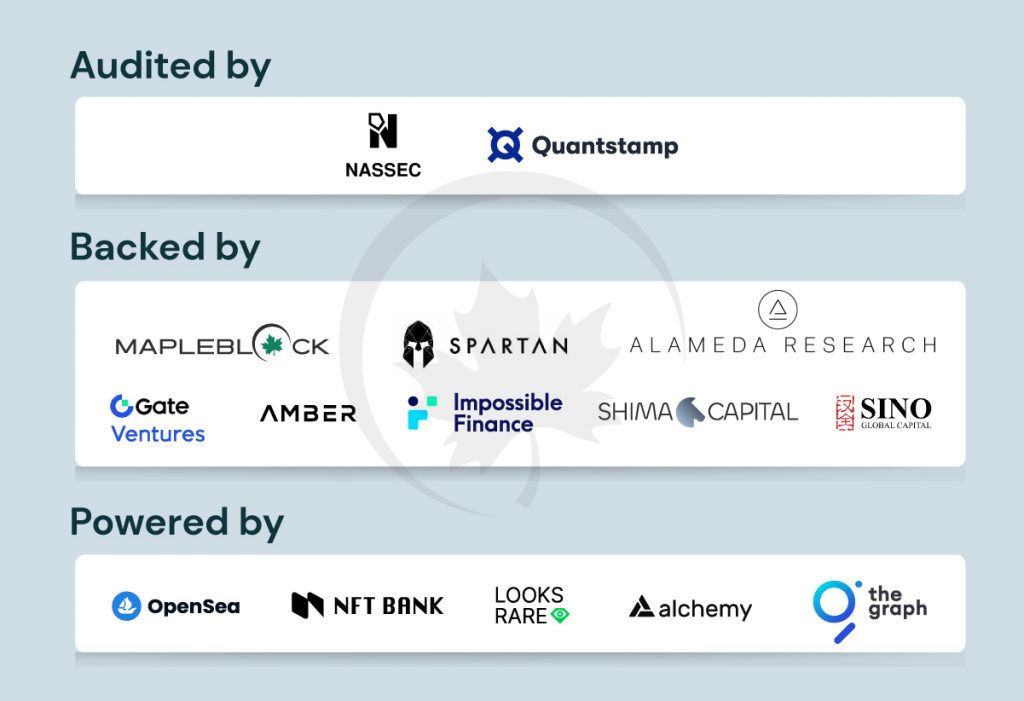

Partnerships

Conclusion

We are glad to back Pine Protocol in its mission to enable smooth liquidity and additional financing opportunities for the NFT space. The future looks bright because of possible future DeFi explorations. Pine Protocol has onboarded 33 NFT collections along with their partnership with top NFT marketplaces: OpenSea and Looks Rare.