- Introduction

- What is Primex Finance?

- Market Dynamics

- Architecture and Features

- Market Competition

- Tokenomics

- Roadmap

- Team

- Conclusion

Introduction

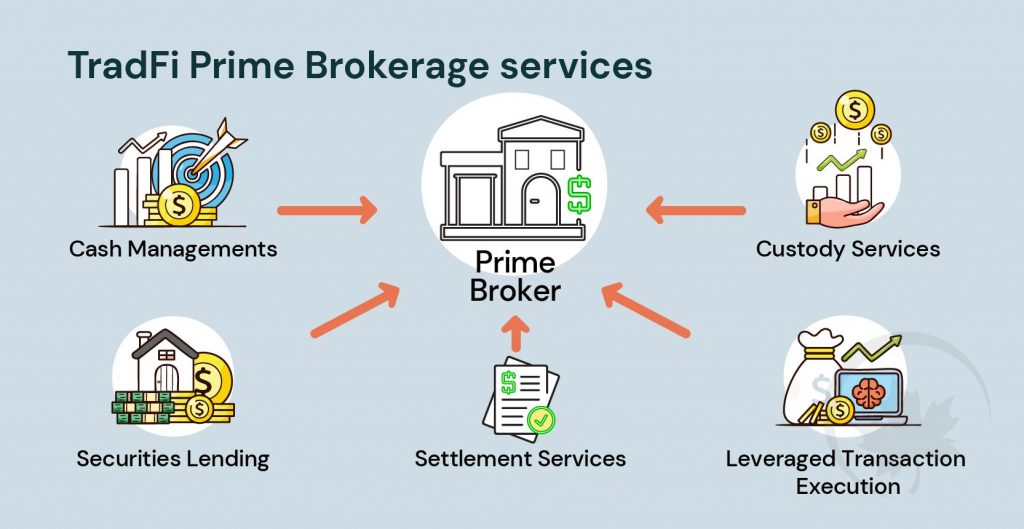

In the traditional finance ecosystem, prime brokerage is essentially a group of services offered by Investment banks, wealth management funds, and other security dealers to hedge funds and other similar clients. These services were principally concerned with facilitating the lending and borrowing of securities and cash along with peripheral services to concerned financial businesses that aimed to achieve better returns. As the DeFi ecosystem evolved, several protocols emerged to replicate distinct functionalities of various types of financial institutions within the crypto space. TradFi had exchanges like Nasdaq, while DeFi offered DEXs like Uniswap or PancakeSwap. One could lend or borrow fiat currencies at a bank and do the same with cryptocurrencies through lending protocols such as AAVE or Compound. But the DeFi space falls behind TradFi when it comes to facilities requisite to assist leverage or margin trading. Primex is a new prime brokerage protocol that intends to fill this gap.

What is Primex Finance?

Primex is a new prime brokerage liquidity protocol for margin trading on DEXs with trader scoring mechanisms. Primex provides a platform through which lenders can provide liquidity to margin pools which traders then utilize to perform leveraged trading. Lenders can obtain better yields than conventional lending protocols through the interest levied on the liquidity provided based on margin fees.

Market Dynamics

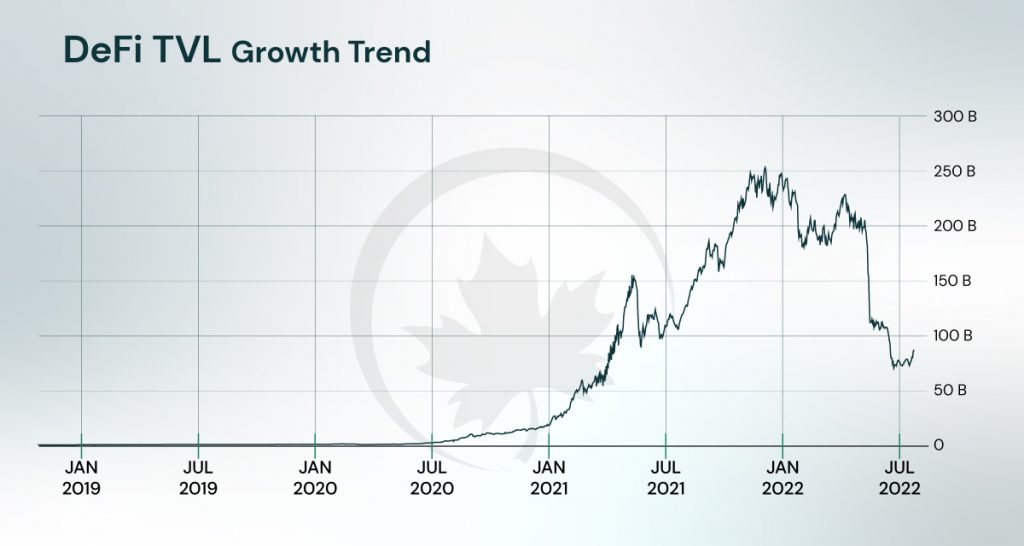

DeFi has witnessed tremendous growth in recent years. The explosion in adoption has catapulted the global user base count to 4.5 Million distributed across several subsectors of the DeFi ecosystem with an equally impressive growth trend. Some of the best-performing protocols within the DeFi space are lending protocols with the likes of AAVE and Compound, boasting billions in total value locked (TVL). DeFi TVL peaked in December 2021 with a gross value of over $250 Billion. With the current value of around $90 Billion, the figure has fallen considerably, but this can be primarily attributed to the global economic conditions. Investment in risky securities has decreased in general as users seek safe-haven assets.

Architecture and Features

How does Primex work?

Primex works in tandem with multiple protocols and parties to facilitate leverage or margin trading across multiple DEXs. Multiple stakeholders play vital roles in conducting the process:

Lenders, through Primex, provide liquidity to a particular type of liquidity pool called credit buckets and expect returns proportionate to their contributions. Credit buckets are almost identical in functionality compared to the liquidity pools used by conventional lending protocols, except it enforces an additional restriction stating the liquidity enclosed can only be used for limited sets of actions, primarily trading, on special terms determined by the risk profile attached to the bucket. This also allows lenders to manage their risk.

Notaries are responsible for risk evaluation based on the stability of profits that credit buckets provide to Lenders. Notaries are nominated by a community of Delegators through staking and are given a commensurate reward for their efforts.

There are two types of notaries:

Bucket Notaries are human and machine-based financial experts that propose and evaluate credit buckets with specific risk frameworks. The creation of new credit buckets is decided on by voting, where notaries who voted for profitable buckets get better rewards.

Trader Efficiency Notaries – evaluate traders who utilized the credit buckets through AI-based mechanisms, neural networks, and complex data science procedures. This feature is expected to be released with Primex v2.

Traders finally utilize tokens in credit buckets to conduct trading on various DEXs.

Primex Features

Primex plans to provide several unique features through its v1 and v2 release.

Trading across DEXs with Cross-margin: The platform’s technique is not restricted to any one DEX. Traders can open leveraged positions on different DEXs, and depending on a number of variables, including the amount of liquidity in the particular pair, the trade may be extended on one DEX and closed on another.

Risk management for digital assets, trading pairs, and traders: Lenders can spread their risk among various investments, particular traders, and credit buckets.

Yield farming supported by successful margin trading: Profitable trading nets in substantially more significant returns, allowing participants to pay higher protocol costs through profit sharing. As a result, lenders make more money than they would under standard lending protocols.

AI-based trader scoring: An decentralized network of ML-based nodes regularly evaluates traders. The rating establishes the risky and accessible buckets for traders. Significant-scoring traders will be able to endure high volatility and maintain their positions even during adverse market conditions.

Zero collateral required to establish a position: Trading only necessitates locking the deposit to create a leveraged position. In the event of liquidation, the locked assets are transferred to the protocol TVL, and no monies are ever transmitted to external wallets. Instead of interacting with DEXes using their personal wallets, traders employ the protocol’s smart contracts.

Fixed interest rate for LPs: Lenders have the option to set their interest by locking in tokens for a predetermined amount of time. Trading fees support the fixed interest.

Market Competition

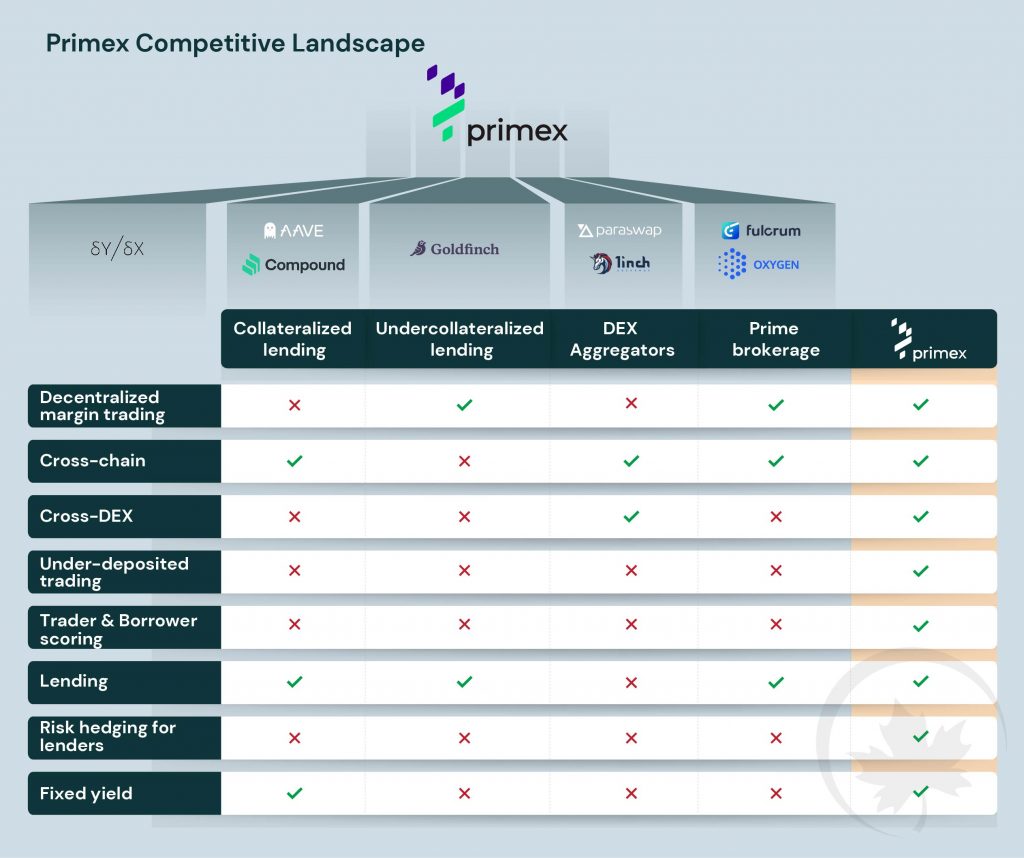

Primex offerings, albeit in diluted forms, are present across numerous protocols in different subfields setting up a complex competitive landscape.

Tokenomics

The $PMX token will be chiefly used for hosting staking-based voting systems to elect notaries. Notaries’ deposits are locked when they perform their duties and can be slashed for misbehavior. Notaries will also be rewarded in terms of tokens depending on the efficiency of the credit buckets.

Roadmap

Team

The Primex team is a group of individuals experienced in the field of finance, cryptography and blockchain led by Vlad Kostanda.

Vlad Kostanda (Co-Founder, CEO) is a Blockchain Engineer and Consultant, CEO of Adoriasoft. He’s an expert in computer science with a deep focus on cryptography and steganography. His high-level knowledge lends itself perfectly to distributed ledger technology. He’s got hands-on experience as an engineer and consultant but also gets the business side of software development.

Dmitry Tolok (Co-Founder, VP of Growth) has worked in business development for three leading IT companies in Ukraine and was a business analyst at UniCredit Europe before that. His track record in B2B sales gives him skills in communicating technical knowledge to the market. His three years working as head of business development and operations in the DLT and blockchain spaces add to his expertise and led him to co-found Primex Finance and working as the VP of growth.

Alex Marukhenko (Blockchain Lead) knows about business systems and processes and also has a deep and broad knowledge of cryptology, cyber security, blockchain, and networks. Along with his commercial work, he’s still interested in the academic side of computer science, with academic publications to his name, along with titles from All-Ukraine Cybersecurity Contests.

Conclusion

Primex will enable crypto traders to explore untouched avenues while lenders obtain a platform where they get to extend loans in line with their risk appetite. As the DeFi industry matures, all pieces which form a financial economy fall in their place, working in tandem to create an alternative capable of competing with traditional finance, and Primex, with a highly polished offering with several unique features, is well-positioned to become DeFi’s prime prime brokerage protocol.