The last month showed positive growth and signs of a resuming bull cycle in the digital asset market. The launch of ProShares Bitcoin Strategy ETF(BITO) marked new highs for the price of Bitcoin. BTC reached a peak of $66,930 on 20th October 2021 marking another ATH, the day after the Pro-Shares Bitcoin Strategy ETF was opened for trading. Quickly to follow up were Valkyrie Investments along with VanEck Associates Corp. to be the next in line for their Bitcoin ETF approval. SEC’s approval indicates positive sentiment towards the larger market from the regulators. In this month’s newsletter we go over these developments and what they mean for the future of the cryptocurrency space.

What is a Bitcoin ETF?

An ETF(Exchange-Traded Fund) is an investment fund that tracks the price of an underlying asset. In the case of Bitcoin ETFs, the underlying asset is Bitcoin. The major advantage of an ETF is that they are regulated products and are tradeable on traditional markets. The introduction of a Bitcoin ETF helps bridge the gap between the traditional market and the larger crypto ecosystem. The BTC ETF provides exposure of cryptocurrency to the investors without the hassle of going through the process of directly buying the coins and custodying them.

Proshare’s Bitcoin Strategy ETF (BITO)

BITO was made live on the 19th of October, 2021, after the inaction of the SEC allowing the deadline of 75 days to lapse for providing comments on the ETF proposal. The pushback on the previous BTC ETFs by the SEC was due to the volatile conditions and possibilities of market manipulation owing to the unregulated nature of the cryptocurrency markets. The BITO does not rely on the spot price of BTC, instead, it relies on the data of the bitcoin futures contracts trading on the Chicago Mercantile Exchange(CME). The CME is overseen by Commodity Futures Trading Corp. which is an institution approved by the regulators.

CME calculates a Bitcoin Reference Rate (BRR) based on the data acquired from the trade flows on major spot exchanges during a one-hour window. With the help of this, BITO can determine the prices of its ETF. The expense ratio of the ETF is 0.95%.

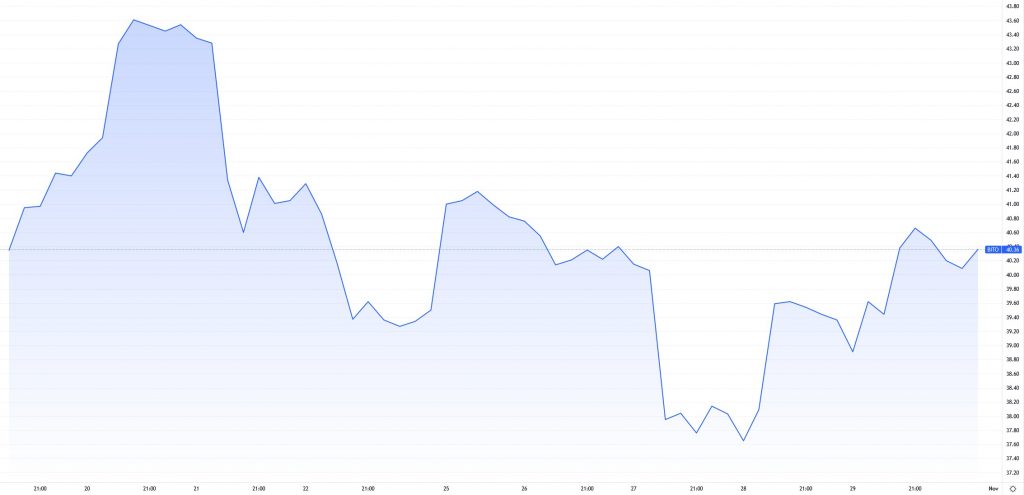

This means that Bitcoin is essentially being treated as a commodity by the regulators. BITO opened its first trading session at $40.88 and made a high of $43.95 the next day. Here are the prices of the ETF since its launch in late October:

Alternatives to BTC ETFs

Apart from Bitcoin ETFs, some other ways to gain exposure to cryptomarkets are:

Grayscale Bitcoin Trust(GBTC)

GBTC allows exposure to cryptocurrency via the traded shares of GBTC. This provides similar exposure to BTC as ETFs. Grayscale had applied for an ETF in the year 2017 but it was rejected by the SEC.

The volatility of BTC plays a role in the price disparity between the GBTC price and the spot price of BTC leading to discounted or premium prices. During the bull run of 2017, investors had to pay higher premiums for owning GBTC shares than the actual spot price of BTC.

On October 19th, 2021, Grayscale announced a partnership with NYSE Arca to file Form 19b-4 with the SEC to convert the Grayscale Bitcoin Trust Fund(GBTC) into a Bitcoin Spot ETF. 19b-4 is used by Self Regulatory Organizations (SROs) to record a rule change with the SEC. It is intended to provide the necessary information on the rule change for an informed comment to be made on it.

Blockchain ETFs

There are many Blockchain ETFs that track the stock prices of companies invested in blockchain technology.

Few of the blockchain ETFs:

- Siren Nasdaq NexGen Economy ETF (2.27% Coinbase, 2.05% Square Inc, 1.85% Microstrategy Inc )

- Amplify Transformational Data Sharing ETF

(Holdings of the company involved in Blockchain: 5.76% MARATHON DIGITAL HOLDINGS INC COM, 5.43% HUT 8 MNG CORP NEW COM, 5.06% Microstrategy Inc, 4.71% Coinbase Inc, 4.36% Galaxy Digital Holdings LTD) - VanEck Vectors Digital Transformation ETF(9.33% Coinbase Inc, 9.07% Marathon Digital Holdings Inc, 7.68% Square Inc)

Closing thoughts

The green signal given by the SEC to the BITO ETF delivered its impact to the cryptocurrency markets, specifically to Bitcoin resulting in another ATH. There is an ongoing debate on various disadvantages of a Futures Contract-based ETF, and a spot ETF is being discussed to be deployed in the coming year. BITO is still a major milestone towards mainstream adoption of digital assets, and is an attractive investment vessel for pension and retirement funds. It will also invite a massive influx of capital into the crypto ecosystem from traditional markets. Apart from this, SECs newly appointed Chairman Gary Gensler is a former professor of Blockchain Technology at MIT. These events and trends are indicative of a growing acceptance of the digital asset space and are making new investors become more confident .

Mapleblock research

DeFi Land Investment Thesis

We wrote our investment thesis for DeFi Land, highlighting the need for better DeFi management tools in the ecosystem. DeFi land is a multi-chain gamified asset management layer for decentralized finance. The project seeks to unlock mass adoption of DeFi through a friendly user experience & onboarding process. Read how they are accomplishing this mission here.

All about Polkadot and Kusama parachain auctions

On 13th October 2021, the Polkadot founders Gavin Wood and Robert Habermeier announced that the network had reached the technical capability to support its first ever cohort of parachains. This was followed by a motion submitted to the Polkadot Council to open the network’s first parachain auction beginning from 11th November, 2021. We at Mapleblock Capital support multiple projects in the Polkadot ecosystem, and share the multichain vision of the Polkadot team. In this article we give an in-depth look at parachains, the auction mechanism, and look back at the Kusama parachain auctions that happened this year.

Market News

- Facebook rebranded itself to ‘Meta’, signalling its focus to the development of Metaverse technologies. The existing apps and platforms will continue to operate as such, including the flagship Facebook app and website.

- Facebook’s announcement resulted in a massive rally for crypto tokens in the gaming, metaverse and virtual world space with some projects such as Decentraland seeing a 300% rise.

- We also saw another meme coin frenzy with Shiba inu coin gaining over 700% and entering into the top 10 largest cryptocurrencies by market cap. This led to many similar dog themed tokens also posting large gains of over 100% in a day.

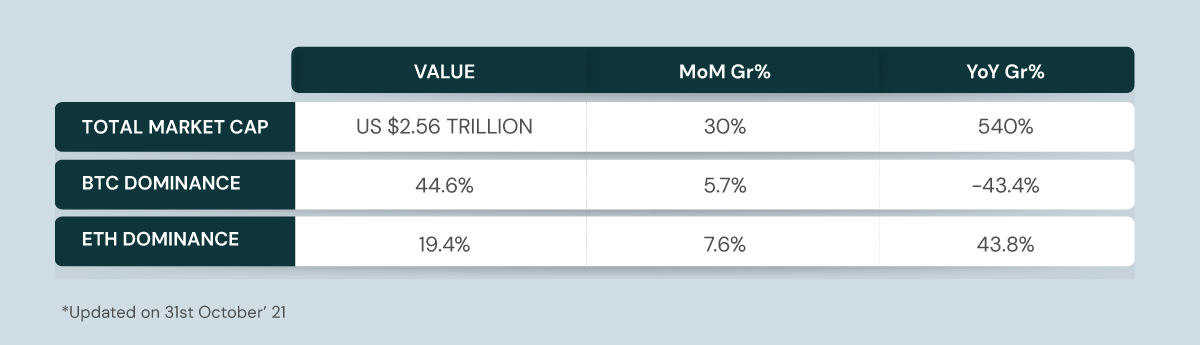

Market Dashboard

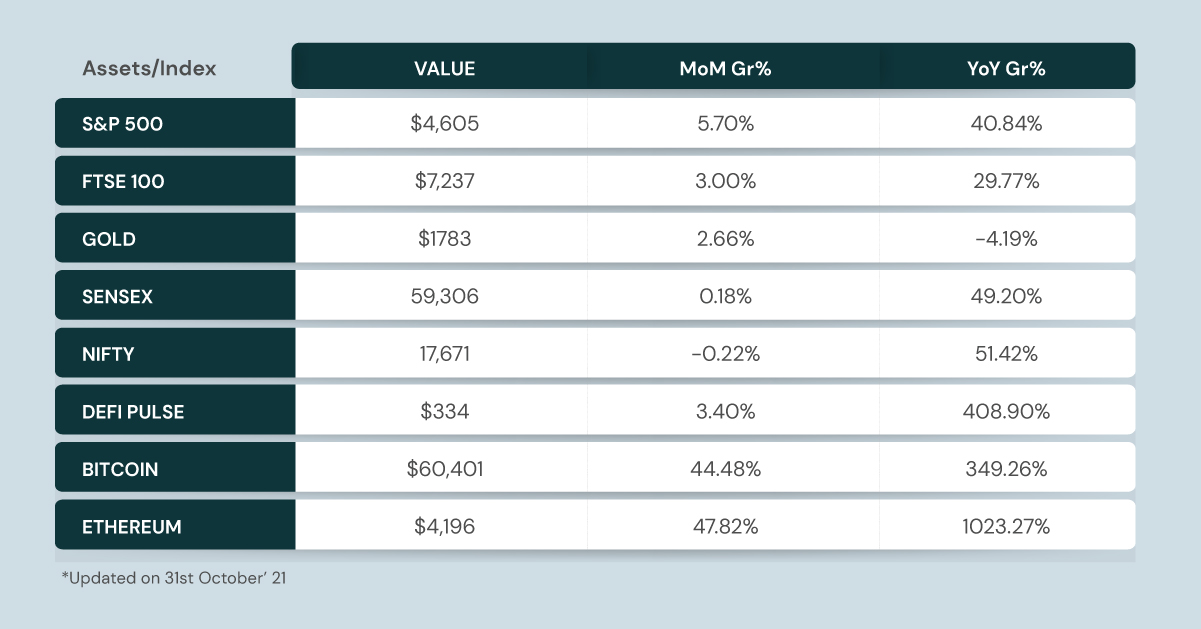

Performance of Key market Indexes

Disclaimer: This article is a summary of the writers opinions and research. Digital assets are a volatile asset class and readers should be aware of the potential risks of investing in blockchain projects. This is not investment advice & we will not accept liability for any loss or damage that may arise directly or indirectly from any such investments.